Opendoor (OPEN) Stock: Explodes as Former Shopify Executive Named as New CEO

TLDR

- Opendoor Technologies stock jumped 78% after appointing former Shopify executive Kaz Nejatian as CEO

- Co-founder Keith Rabois returns as chairman following investor pressure campaign led by Eric Jackson

- Stock hits 52-week high with over 500% year-to-date gains despite challenging housing market

- Company adopts “founder mode” strategy with original leadership team returning to guide operations

- New CEO promises AI integration to transform home buying and selling process

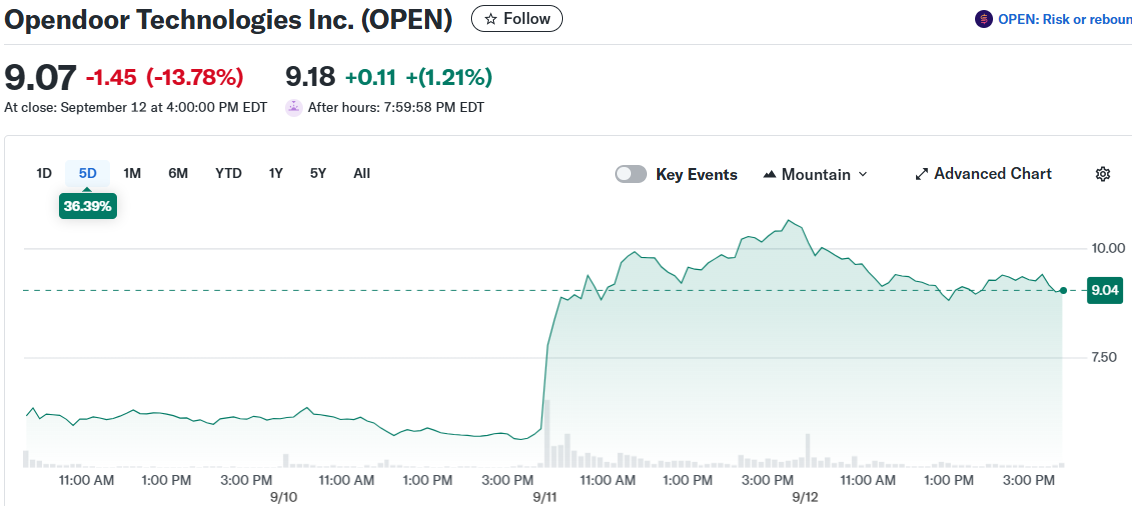

Opendoor Technologies stock exploded Thursday after the company named Kaz Nejatian as its new CEO. The former Shopify executive’s appointment sent shares soaring 78% in a single session.

Opendoor Technologies Inc. (OPEN)

Opendoor Technologies Inc. (OPEN)

The leadership shake-up also brings back co-founder Keith Rabois as chairman of the board. This move represents a complete turnaround for the real estate technology company after months of investor pressure.

Former CEO Carrie Wheeler resigned in August following a vocal campaign. Hedge fund manager Eric Jackson and Rabois himself led the push for new leadership.

Shares hit a 52-week high and extended the stock’s remarkable 2025 run. Opendoor has gained over 500% year-to-date, making it one of the market’s biggest winners.

The stock had traded below $1 earlier this year before its dramatic recovery. This performance has established Opendoor as a favorite among meme stock traders.

Founder Mode Strategy Takes Hold

The company announced it’s entering “founder mode” by bringing back its original leadership team. Eric Wu, who served as Opendoor’s first CEO before stepping down in 2023, also rejoined the board of directors.

This strategic shift comes as the company faces major operational challenges. Rising mortgage rates have frozen the housing market, making Opendoor’s iBuying business model extremely difficult to execute profitably.

Nejatian brings extensive e-commerce and technology experience from his executive role at Shopify. The new CEO has promised to use artificial intelligence to make home transactions “radically simpler, faster and more certain.”

The leadership overhaul reflects investor demands for change after the company struggled with declining home purchases. Revenue increased 34% in Q2, but home acquisitions dropped 63% year-over-year.

Jackson built a massive following on social media after his successful Carvana investment. His endorsement sparked intense retail investor interest that pushed shares from penny stock territory to over $10.

New Business Model Emerges

The company recently launched an agent partnership program that showed promising early results. The pilot program generated double the customers ready for cash offers compared to the traditional direct-to-consumer model.

This capital-light approach could provide new revenue streams without requiring massive inventory investments. Opendoor has expanded the pilot to all regions and is training real estate agents to participate.

Nejatian’s appointment signals a potential strategic pivot toward technology solutions rather than traditional home buying. His Shopify background suggests Opendoor may develop new platforms to facilitate real estate transactions.

The Federal Reserve has signaled upcoming interest rate cuts, which could help revive the housing market. Lower rates would make it easier for homeowners to sell properties and purchase new homes.

The company ended Q2 with $1.5 billion in inventory representing 4,538 homes. This was down 32% from the first quarter as management worked to reduce holdings during the challenging market environment.

The post Opendoor (OPEN) Stock: Explodes as Former Shopify Executive Named as New CEO appeared first on CoinCentral.

You May Also Like

The Stark Reality Of Post-Airdrop Market Dynamics

Headwind Helps Best Wallet Token