Native Markets To Test USDH Stablecoin Within Days After Winning Hyperliquid Vote

Native Markets will test Hyperliquid’s USDH stablecoin within days after a community vote chose it over rivals including Paxos and Frax.

“We will be deploying both the USDH HIP-1 and corresponding ERC-20 within days,” said founder Max Fiege in a post on X.

The win came after Ethena withdrew from the contest last week, giving Native Markets a clear path to selection.

After initial deployment in the coming days, Native Markets will kick off the testing phase for mints and redeems for the USDH stablecoin. Feige said that the dollar amounts per transaction will initially be capped at $800, and this testing phase will only include “an initial group.”

Once that testing stage is complete, Native Markets will then open up “the USDH/USD spot order book as well as uncapped mints & redeems,” the project’s founder added.

He said anyone trading large volumes on Hyperliquid who wants to test the API during this early phase can reach out to the team directly.

Native Markets Secures Vote Amid Backlash From Crypto Community

Native Markets is a relatively new entity that was founded by Feige, who is a Hyperliquid investor and adviser.

In its proposal, the project positioned itself as a “Hyperliquid-native” option. It also highlighted that Native Markets is already deeply aligned with the Hyperliquid ecosystem, governance and technical stack.

Leading up to the final stages of the voting process, there were some in the crypto community that claimed the process was rigged from the get-go.

Those critics argued that validators had predisposed in favor of Native Markets, adding that the process had been tilted to favor Native Markets while other bidders barely had a fair amount of time to submit their own proposals.

Other critics focused on how short the voting window was. This put projects that weren’t already connected to the Hyperliquid ecosystem at a disadvantage, because they didn’t have enough time to show the community why they would be a good fit for the Hyperliquid stablecoin, the critics argued.

Other analysts and community members also expressed concerns around Native Markets having no prior experience of issuing a stablecoin. Although the project has partnered with known players like Stripe, Bridge, BlackRock, and others, some community members still feel the lack of direct stablecoin experience presents a risk.

USDH Enters Competitive Stablecoin Market

Regardless of the controversy around the USDH voting process, Feige has already said that the Native Markets team aims to prove itself to the community.

USDH will enter a competitive market, especially after more players entered the stablecoin space following US President Donald Trump’s signing of the GENIUS Act in July.

The bill is the first legislation on the federal level that establishes rules for both domestic and offshore stablecoin issuers looking to issue their tokens in the US.

Currently dominated by the likes of Tether (USDT) and Circle’s USD Coin (USDC), the stablecoin market has seen its capitalization enter a gradual climb after the GENIUS Act signing.

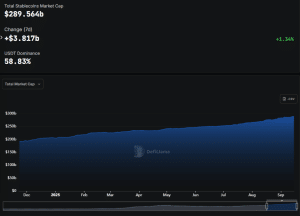

DefiLlama data shows that since the middle of July, the stablecoin market cap has risen from around $259.905 billion to $289.564 billion today. This is after the capitalization for these tokens soared more than $3.81 billion in just the last week.

Stablecoin market cap (Source: DefiLlama)

USDT is the dominant stablecoin in the space, with a 58.83% share of the market and a capitalization of roughly $170.29 billion. The next-biggest stablecoin is USDC, with a market cap of about $73.1 billion.

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

Bitcoin ETFs Surge with 20,685 BTC Inflows, Marking Strongest Week