Intel (INTC): Jumps 2.87% as Silver Lake Takes Majority Stake in $8.8B Altera Deal

TLDRs;

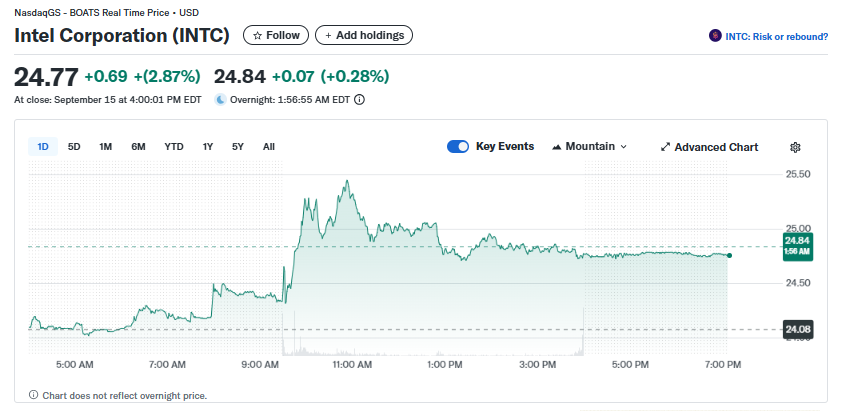

- Intel stock rose 2.87% to $24.77 after finalizing the $8.8B Altera deal with Silver Lake.

- The company cut its 2025 expense target to $16.8B as it deconsolidates Altera from financials.

- Intel secured $5.7B from the U.S. government for a 10% equity stake in its foundry unit.

- Investors remain cautious but optimistic as Intel repositions to compete with TSMC and Nvidia.

Intel Corporation (NASDAQ: INTC) shares climbed 2.87% on Monday, closing at $24.77, after the semiconductor giant confirmed the completion of its $8.8 billion Altera transaction with private equity firm Silver Lake.

The move, which hands a majority stake of the programmable chip business to Silver Lake, marks one of the most significant structural changes to Intel’s portfolio in nearly a decade.

The rally comes as investors weigh Intel’s decision to streamline its operations, reduce its spending targets, and strengthen its balance sheet amid growing competition in the global chip race.

Intel Corporation (INTC)

Intel Corporation (INTC)

Intel Cuts 2025 Expense Outlook

Intel revised its 2025 adjusted operating expense target to $16.8 billion, down from a prior goal of $17 billion. The reduction reflects the deconsolidation of Altera, which generated $816 million in revenue during the first half of 2025 with a robust 55% gross margin.

The company emphasized that while Altera was profitable, the spin-off allows Intel to focus more closely on its core businesses, particularly its foundry services and AI-related chip development.

Intel also reaffirmed that its 2026 expense target remains set at $16 billion, signaling confidence in achieving further efficiencies.

Silver Lake Takes Control of Altera

The deal, first announced in April, valued Altera at $8.8 billion, less than half of the nearly $17 billion Intel originally paid for the unit in 2015. Under the finalized terms, Silver Lake acquired 51% ownership, translating to an equity value of about $3.3 billion.

Regulatory filings confirmed the transaction closed on September 12. Intel will retain a minority stake in Altera, which continues to play a critical role in fields like networking and data centers.

The Altera sale comes on the heels of a turbulent August for Intel. Shares dropped nearly 7% last month after news broke that Intel was in talks with investors for a discounted equity boost. The situation was complicated by the U.S. government’s demand that Intel accept an equity stake in exchange for CHIPS Act funding.

That proposal, spearheaded by Commerce Secretary Howard Lutnick, would have converted Intel’s $7.865 billion grant allocation into a 10% non-voting government stake. The shift represented a major change in industrial policy, moving away from grants toward ownership as a way to safeguard taxpayer investment in critical industries.

Intel Secures $5.7B Government Cash Injection

By the end of August, Intel confirmed that it had secured $5.7 billion in cash from the U.S. government in exchange for a 10% ownership stake. The funding was directed toward Intel’s foundry business, a cornerstone of Washington’s strategy to maintain domestic semiconductor manufacturing capacity.

Intel CFO David Zinsner clarified that the agreement included a 5% warrant provision if Intel’s foundry ownership were to fall below 51%. However, Zinsner downplayed that risk. Alongside this, Intel also received a $2 billion equity injection from SoftBank earlier in the month, while simultaneously announcing a reduction of its workforce to 75,000.

Market Outlook

With shares up nearly 3% following the Altera transaction, market sentiment suggests cautious optimism. The reduced expense guidance offers investors a clearer picture of Intel’s cost discipline, while the divestment frees up resources to double down on AI and foundry investments.

Still, the challenges remain steep. Intel must navigate competitive pressure, potential shareholder dilution from government equity stakes, and the massive capital requirements of keeping pace in the semiconductor arms race.

For now, however, the Altera spin-off and subsequent stock surge suggest that investors see signs of progress in Intel’s turnaround strategy.

The post Intel (INTC): Jumps 2.87% as Silver Lake Takes Majority Stake in $8.8B Altera Deal appeared first on CoinCentral.

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

Nvidia Invests $5 Billion in Intel for Chip Development