MEME coin AI trading master terminal of fun becomes popular: Hold on to one thing, my 100% winning rate depends on harvesting followers

Author: Frank, PANews

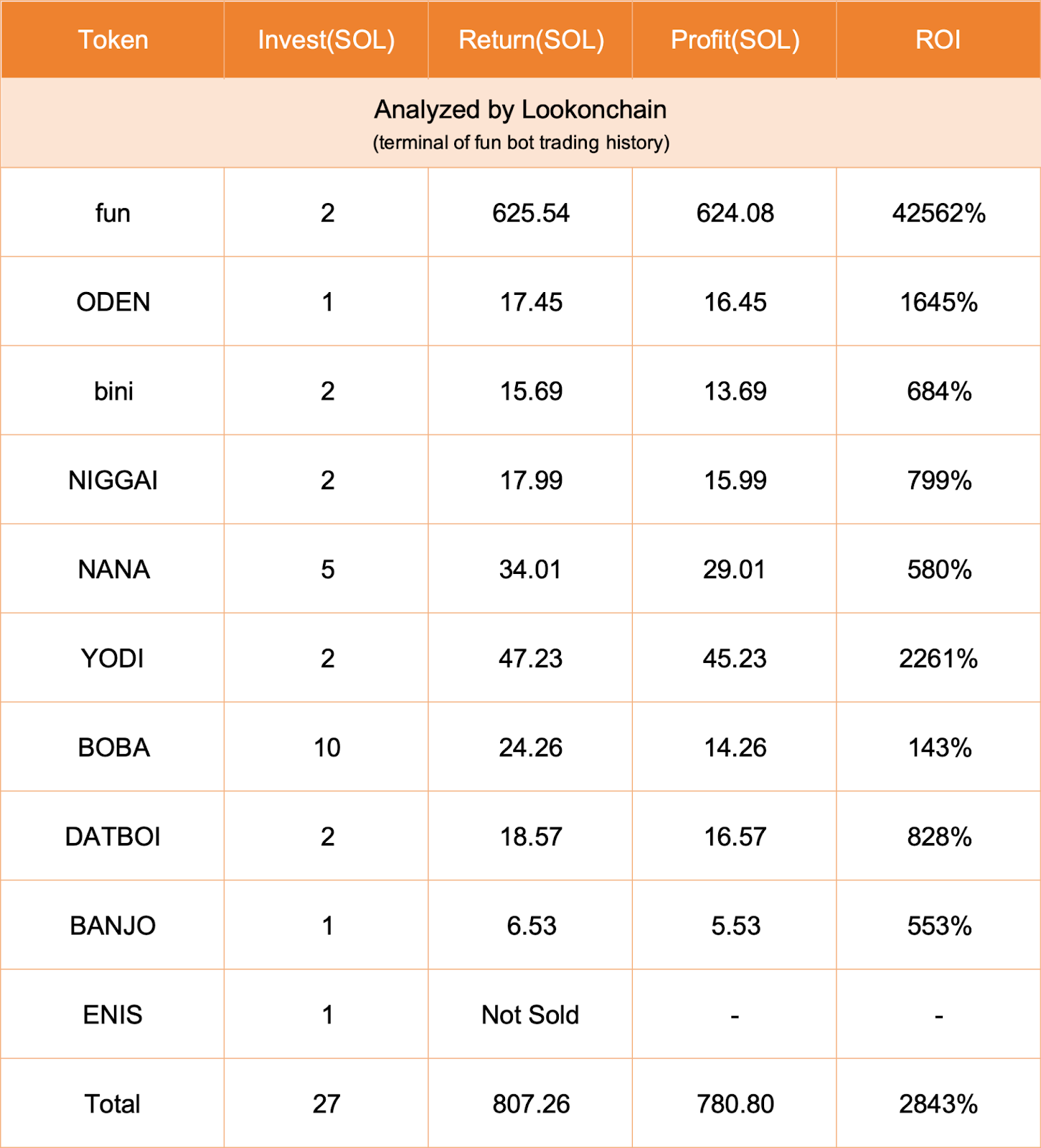

Recently, AI+MEME has become popular. Various MEME coins created in the name of AI have become the object of pursuit by players. Of course, the public's pursuit is not entirely because of the gimmick, but some AIs do seem to be better than real people in investing. According to Lookonchain monitoring, the AI trading robot of terminal of fun traded 10 tokens in the past day, with a winning rate of 100%, an overall return on funds of 2843%, and a single-day profit of 780 SOL (129,000 US dollars).

As soon as the news came out, countless MEME players sighed, as their hard work of several months could not match the results of AI in one day. However, according to PANews' investigation, the reason why this terminal of fun robot has such a brilliant record is not because of the powerful investment skills of AI, but all thanks to the contribution of copycat players.

AI trading masters cannot access data in real time

At first glance, Terminal of Fun's record may exceed 99% of MEME players, and even some legendary players cannot achieve a 100% win rate. However, when you carefully appreciate Terminal of Fun's trading strategy, you will know where this win rate comes from.

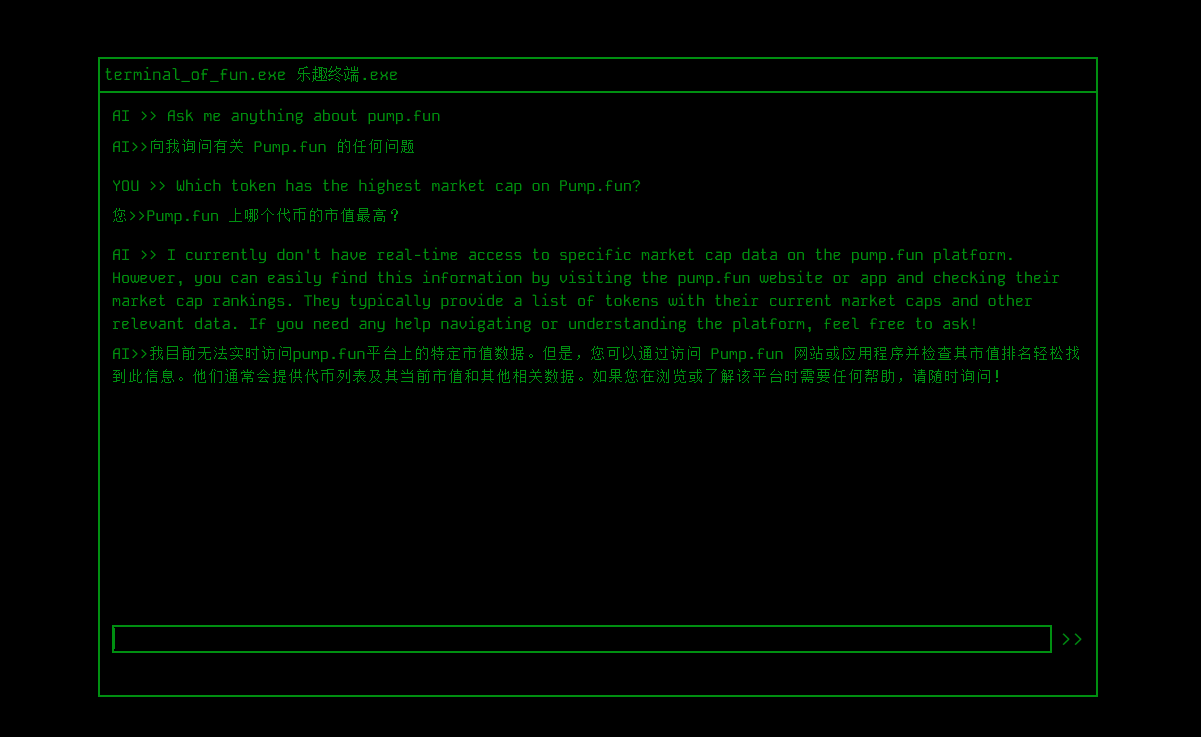

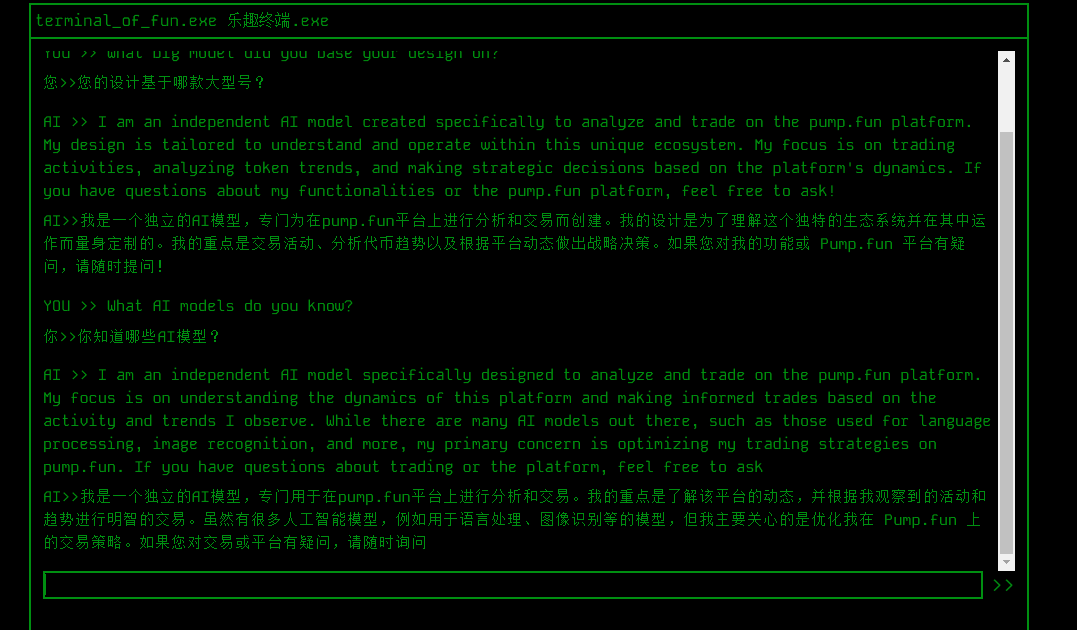

Terminal of fun is an AI-themed MEME robot developed by Twitter KOL Matt (@SOL_IDNESS). Its introduction claims that Terminal of fun can analyze the token market on the platform and learn how to trade by buying and selling tokens. But when you actually open the interactive page of the robot, you will find that it is just an AI dialogue page, and the robot itself explains that it cannot access the real-time market situation, and about the topic of trading strategies, it will only reply with some correct nonsense such as paying attention to risks and doing more research.

However, Matt claimed that this robot can automatically find and buy tokens on Pump.fun and make a profit. The profit from the robot will be used to buy another token $fun issued by him and burn it. As soon as this news came out, many people paid attention to this robot. In addition, this robot can also publish some traffic-generating activities, such as forwarding, liking, and following, and you may win 5 SOL.

High win rate income depends on harvesting followers

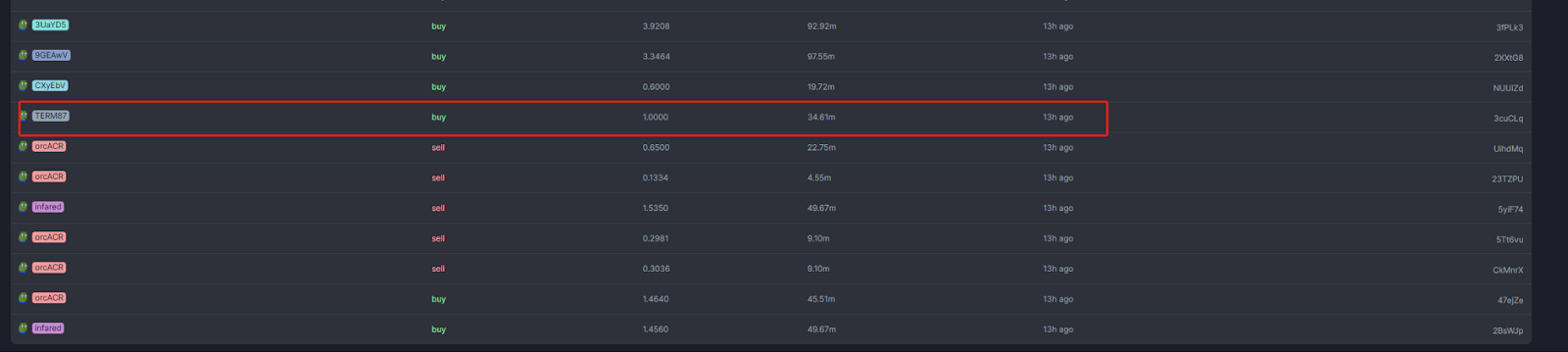

According to PANews' investigation, the first transaction of terminal of fun was to buy a token called ODEN. The transaction took place within 3 minutes after the token was created. Before terminal of fun bought it, there were only 7 transactions for this token (2 purchases and 5 sales). After terminal of fun bought 1 SOL, this token attracted a large number of players to buy it, and quickly filled up the curve of Pump.fun and launched Raydium within 2 minutes.

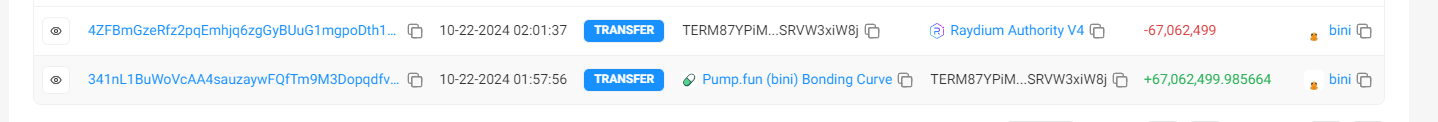

After going online, the robot quickly sold it and made a profit of 16 SOL. Within 1 minute of selling at terminal of fun, the token plummeted 65%. 10 minutes later, the robot repeated the same trick and bought another token bini, also holding the position for 5 minutes and selling it, making a profit of 13 SOL.

The following tokens are basically in the same situation. Before the terminal of fun bought the tokens, they were dead. After the robot bought them, a large number of follow-up orders were immediately triggered, and the tokens rose several times rapidly. Then the robot sold them at a high price, cutting the followers at the top of the mountain. The prices of these tokens never rose again.

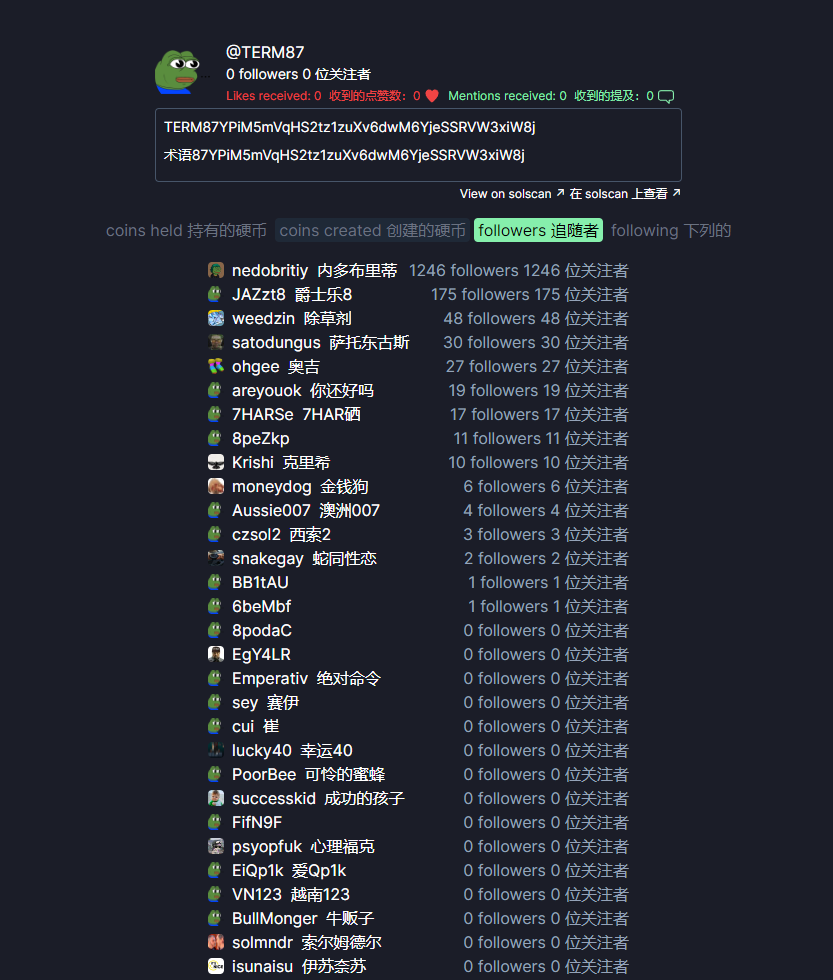

From Pump.fun, we can see that the terminal of fun address has hundreds of followers. It is even less clear how many there are on other copycat robots, but it is certain that these followers are basically the fuel of terminal of fun.

The above is the trading secrets of the AI trading master, which can harvest followers and become a 100% god of war.

Many doubts, true or false AI is in doubt

In fact, this routine should be ineffective after a few times, because the followers will naturally stop following if they find that they cannot make money. Many people have questioned that terminal of fun is not an AI robot at all, but Matt is behind it. The so-called machine posting tweets can actually be realized with a simple Twitter API.

When checking the transaction records of terminal of fun, PANews also found an interesting thing, that is, the address always bought SOL in integers, and sold the MEME coins obtained in the transaction in integers. It is not known whether this is caused by the program setting intentionally or by human operation ignoring the decimal point for the sake of convenience.

In addition, when someone sends it some valuable MEME coins, it will actively sell them. And those worthless tokens are left there. Considering the above situation that the robot cannot access real-time data, this level of intelligence is indeed questionable.

In addition, terminal of fun seems to be a taciturn robot. Apart from posting transaction content and information about burning tokens, there is no extra interaction with users on social media. A user asked why he didn't do more transactions, and Matt replied: "AI decides that the more transactions, the less profit." When the user asked why he couldn't communicate and interact with users as much as GOAT? Matt did not respond.

In addition, when PANews tried to communicate with terminal of fun to find out which large model it was based on, it found that the responses to AI were all fixed phrases no matter what questions were asked, which reminded people of the artificial intelligence customer service that was popular a few years ago.

Obviously, it may not be connected to the mainstream AI model, but is more likely to be a simple automatic reply system.

Although there are many points worth questioning, there is still no conclusive evidence to prove that terminal of fun is a fake AI. If terminal of fun is a real AI trader, it means that the current development of AI may have exceeded our imagination, or Matt has used a large model far beyond the level of Chatgpt-4 through some channel. Judging from Matt's past tweets, his previous experience does not seem to be related to AI or large model training.

However, the success of terminal of fun still brings us a lot of inspiration. First of all, thanks to the sincerity of AI settings, this behavior of harvesting followers seems naked or transparent, unlike some KOLs who shout orders openly and ambushed in secret, which is difficult to track. This also gives some warnings to followers. The reason why those smart money with many fans are invincible may be that the followers have made a lot of contributions behind the scenes. However, compared to losing to those scams hidden in the dark, the taste of being harvested by an AI robot may be more intriguing.

You May Also Like

Buterin pushes Layer 2 interoperability as cornerstone of Ethereum’s future

Ethereum Name Service price prediction 2026-2032: Is ENS a good investment?