Hong Kong's new crypto regulations are here: CRP-1 and its impact on the market

Let’s take a closer look at the new requirements of CRP-1, compare them with the regulatory policies of other countries and regions, and then discuss the impact these changes will have on us cryptocurrency players.

Written by Xiao Sa Legal Team

Driven by a wave of technological innovation, the global cryptoasset market has expanded rapidly. This has, however, also exposed a range of risks, including price volatility and money laundering, making the need for effective regulation even more urgent. In September 2025, the Hong Kong Monetary Authority (HKMA) issued a draft of the new module CRP-1, "Cryptoasset Classification," of the Banking Supervisory Policy Manual (SPM), to the local banking industry for public comment. This draft aims to align with international regulatory standards and establish a regulatory framework that balances innovation and risk prevention, providing clear guidance for banks involved in cryptoasset-related businesses.

Next, the Sajie team will take a closer look at the new requirements of CRP-1, compare them with the regulatory policies of other countries and regions, and discuss the impact these changes will have on our cryptocurrency players.

01 Interpretation of the core content of the new Hong Kong CRP-1 regulations

(I) Basic Definition: Scope of Supervision and Applicable Objects

The new CRP-1 regulation clearly defines the scope of cryptoasset regulation, laying a solid foundation for subsequent implementation. Specifically, the new regulation defines cryptoassets as those primarily relying on cryptography and distributed ledger technology (DLT), or similar technologies, that can be used for payment or investment purposes, or to acquire goods or services. However, it explicitly excludes central bank-issued digital currencies from this scope. This approach provides a precise definition of cryptoassets while distinguishing them from legal tender digital currencies, preventing overly broad regulation.

The new regulations will apply to all licensed financial institutions in Hong Kong, including regular banks, restricted license banks, and deposit-taking companies. These institutions are an important part of Hong Kong's financial system, and the crypto businesses they conduct directly impact financial stability. Bringing them under regulation will help control risks at the source.

In terms of risk management, the new regulations adopt a comprehensive approach. Risks arising from banks' own holdings of crypto assets, the safekeeping and trading of crypto assets for clients, and indirect exposure to crypto assets through financial derivatives must all be managed. This prevents financial institutions from exploiting loopholes to evade regulation, ensuring that all crypto-related risks are rigorously managed.

(2) Core categories

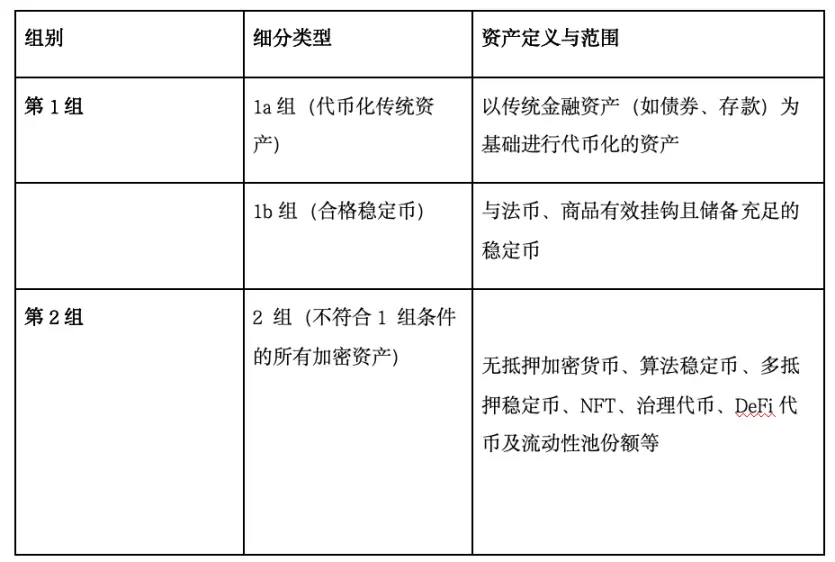

Risk grading is the core logic of the new CRP-1 regulations. The new regulations divide crypto assets into Group 1 (low risk) and Group 2 (high risk) based on their risk mitigation capabilities. The table below provides a clear overview of these core categories.

02. Connection and Differences between CRP-1 and International Rules (BCBS Standards)

(1) BCBS Standard Core Logic

The Basel Committee on Banking Supervision (BCBS), as the core institution of global banking supervision, issued the "Prudent Treatment of Crypto-Asset Risk Exposures" in December 2022 and launched the "Revision of Crypto-Asset Standards" in July 2024, building a global unified crypto-asset regulatory framework. Its core logic can be summarized as "risk classification and prudent control."

The BCBS standards focus on "preventing and controlling cryptoasset risks and ensuring adequate bank capitalization" to prevent the transmission of cryptoasset risks to the traditional banking system and maintain global financial stability. Within the core framework, the BCBS classifies cryptoassets into "Group 1" and "Group 2" based on risk, setting strict capital requirements for high-risk assets while also promoting global regulatory coordination to prevent regulatory arbitrage.

The launch of the BCBS standard stems from the rapid development and risk accumulation of the global crypto asset market. It aims to provide a unified regulatory benchmark for internationally active banks, balance "financial stability" and "responsible innovation", and provide a reference framework for regulators in various countries.

(2) Integration of CRP-1 and BCBS

The new CRP-1 regulations and BCBS standards are consistent in many key areas, demonstrating Hong Kong's commitment as an international financial center to keeping pace with global regulation.

In terms of asset classification, CRP-1 divides crypto assets into "Group 1" and "Group 2," while BCBS divides them into "Group 1" and "Group 2." The core criterion for both classifications is the ability of an asset to manage risk. For example, relatively low-risk and reliable assets like compliant stablecoins fall into "Group 1" under BCBS and "Group 1" under CRP-1. Both require clear legal regulations for such assets and effective risk management. For higher-risk assets, both sides implement strict regulations on the amount of capital that financial institutions must maintain to manage risk, fully embodying the principle of "the greater the risk, the stricter the management."

In terms of fund supervision requirements, CRP-1 largely continues the BCBS's approach to prudent management. The BCBS stipulates that for certain high-risk crypto assets, financial institutions must maintain a reserve of funds equivalent to 1250% of the asset's value to mitigate risk. CRP-1 also applies this standard to Group 2b assets. For highly liquid crypto assets, the BCBS requires trading on regulated exchanges and achieving a certain market size. CRP-1 also imposes similar requirements on Group 2a assets, requiring trading on regulated exchanges and setting market capitalization and trading volume thresholds to ensure that the funds invested align with the asset's risk.

In addition, both CRP-1 and BCBS place particular emphasis on comprehensive supervision. Whether it is the crypto assets held by the bank itself, the assets involved in providing services to customers, or even indirectly related risks, all must be included in the regulatory scope to avoid the emergence of "gray areas" where no one is in charge and to achieve the goal of global unified supervision.

03 CRP-1 Specific Impact of the New Regulations on Crypto Asset Users

After the implementation of the new CRP-1 regulations, banks’ crypto business has undergone major adjustments, which directly affects our friends’ trading, custody, and use of crypto assets.

Let's start with trading options. The new regulations have tightened trading restrictions on both assets and channels. High-risk Category 2b assets, like some NFTs and governance tokens, are no longer permitted by banks, forcing users to switch to other platforms, which can be less reliable. While Category 1 compliant assets are safe, the selection is narrower. Category 2a assets must be traded on licensed exchanges, which require stricter account opening procedures and higher thresholds. Regarding asset security, the new regulations do make asset custody safer, providing priority for recovering funds even if a platform fails. However, the stringent anti-money laundering requirements reduce personal privacy, and the price fluctuations of different assets vary.

For those holding Category 2b NFTs and governance tokens, the Sajie team recommends prioritizing platforms regulated by the Hong Kong Monetary Authority or with international compliance qualifications, and avoiding storing all assets in one place. Those who prefer Category 1 compliant assets can seek the security of a bank, but must accept that they can purchase fewer items. For those trading Category 2a assets, remember to prepare a complete set of documents, including your ID and bank card, in advance to prepare for the exchange's rigorous review. Regardless of the type of asset you hold, you'll need to restructure your portfolio and monitor changes in bank fees. You need to balance the security provided by the new regulations with privacy protection and operational convenience.

Final Thoughts

In summary, the new Hong Kong CRP-1 regulation demonstrates significant foresight in the field of crypto asset regulation, providing new ideas and directions for industry development and risk prevention and control.

Sister Sa recognizes that Hong Kong's cryptoasset regulation will enter a phase of dynamic optimization and deepening practice. Going forward, regulators must closely follow international trends and strengthen cross-border regulatory coordination. Industry participants should establish regular compliance communication mechanisms. I hope Hong Kong will use CRP-1 as an opportunity to improve regulatory technology, balance investor protection and innovation, and set a global regulatory precedent.

You May Also Like

Crypto News: Donald Trump-Aligned Fed Governor To Speed Up Fed Rate Cuts?

What Is Ripple Doing at Davos — and Who’s With Them?