The Ongoing Privacy Battle Between Blockchain Stakeholders and Governments

The cryptocurrency sector in Europe is bracing for significant changes as the European Union prepares to implement strict Anti-Money Laundering (AML) rules that will target privacy coins and anonymous crypto accounts starting in 2027.

Under the new Anti-Money Laundering Regulation (AMLR), banks, financial firms, and crypto asset service providers (CASPs) will be prohibited from offering anonymous accounts or supporting privacy-focused cryptocurrencies. This measure reflects the EU’s wider efforts to tighten oversight of the blockchain industry and address risks tied to money laundering and illicit activity.

Anja Blaj, a legal consultant and policy expert at the European Crypto Initiative, described the struggle to preserve access to privacy coins such as Monero (XMR) as an ongoing challenge between regulators and the crypto community. “Governments want control. They want to know who is transacting with whom,” Blaj explained during a live discussion on Sept. 3.

Her remarks come as the EU continues expanding its regulatory framework for crypto markets, building on the Markets in Crypto-Assets Regulation (MiCA), which already set new standards for exchanges, stablecoins, and digital asset issuers.

Room for negotiation remains

Although the AMLR is finalized, experts believe there is still room for dialogue with regulators before the measures take effect in 2027. “Policymaking is a continuous conversation,” Blaj said, emphasizing that enforcement details and interpretations may still evolve.

She noted, however, that rules targeting privacy-preserving cryptocurrencies are likely to remain strict because they conflict with state interests and regulatory priorities.

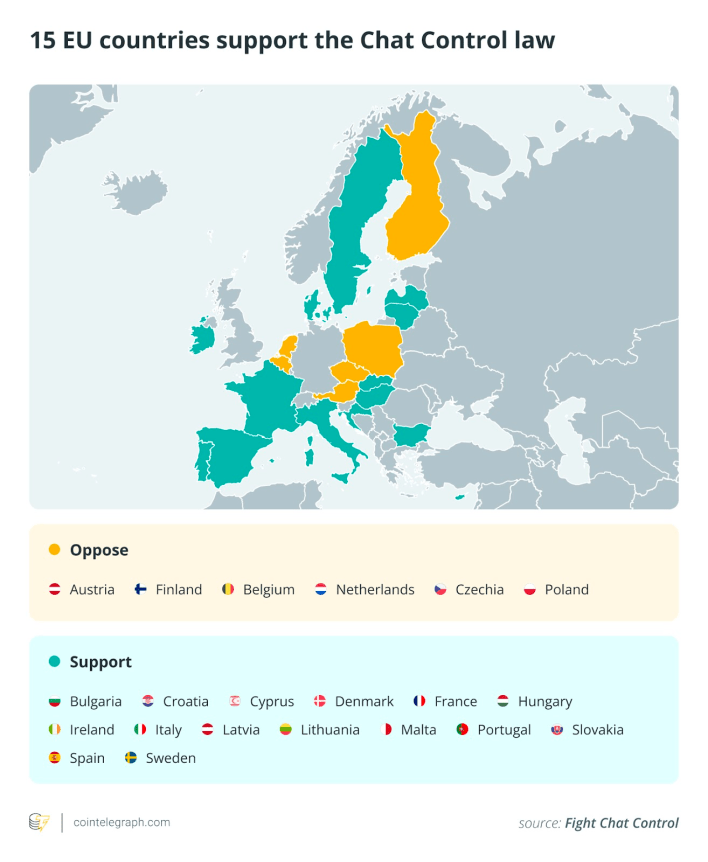

The crackdown on crypto privacy is also unfolding alongside another controversial EU initiative known as “Chat Control.”

Source: Flight Chat Control

Source: Flight Chat Control

The proposal would require messaging platforms like WhatsApp and Telegram to scan user content, including encrypted messages, for potential illegal activity. While 15 member states currently support the measure, they do not represent the 65% of the EU population required for adoption. Germany’s stance could ultimately determine the outcome.

These developments highlight growing tension between digital privacy rights and state regulation. As the EU’s new frameworks take shape, their impact on cryptocurrencies, decentralized finance (DeFi), and the wider blockchain ecosystem is set to be profound.

This article was originally published as The Ongoing Privacy Battle Between Blockchain Stakeholders and Governments on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Crypto News: Donald Trump-Aligned Fed Governor To Speed Up Fed Rate Cuts?

What Is Ripple Doing at Davos — and Who’s With Them?