Bitcoin Plummets Under $100K: Is the Bottom Near or More Losses Ahead

TLDR

- Bitcoin’s Fear & Greed index has dropped to 10, the lowest level since February, signaling extreme market fear.

- The price of Bitcoin has fallen below both the 7-day and 30-day moving averages, indicating weak market momentum.

- Over the past week, Bitcoin has lost 6.7%, dropping under $100,000 as large holders, or “whales,” continue to sell.

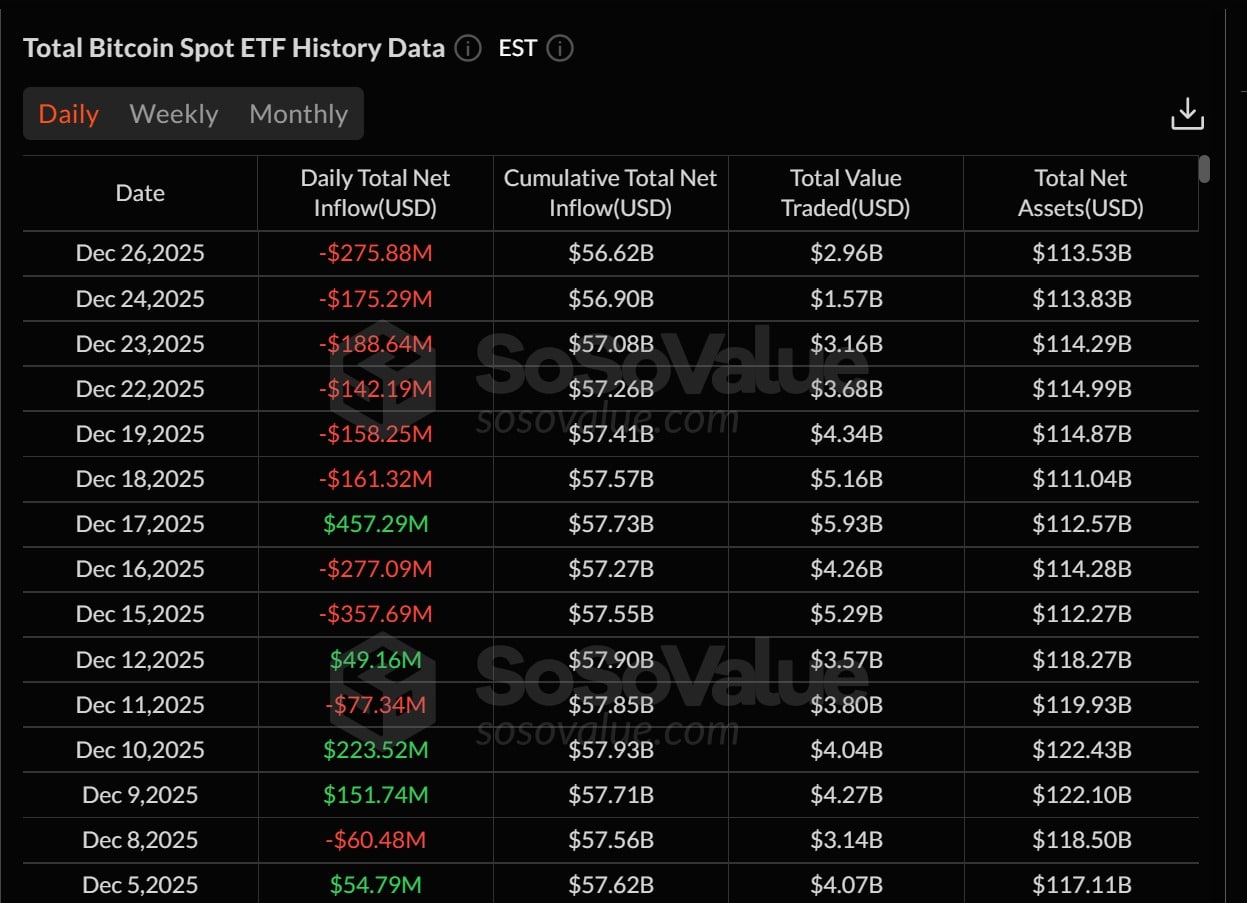

- U.S. spot Bitcoin ETFs have experienced significant outflows, showing reduced institutional interest in Bitcoin.

- Bitcoin’s persistent negative correlation with the Nasdaq 100 means it tends to drop sharply during tech sell-offs.

Bitcoin’s Fear & Greed index has dropped to 10, marking the lowest level since February. This dramatic fall reflects deepening market pessimism, with Bitcoin trading below both its 7-day and 30-day moving averages. The sharp decline has resulted in a 6.7% drop over the past week, pushing Bitcoin below $100,000.

Weak Momentum and Whale Activity Drive Decline

According to 10x Research, Bitcoin’s weak short-term and medium-term momentum is evident. The cryptocurrency’s price movements have been consistently below the 7-day and 30-day moving averages. This trend indicates a lack of buying momentum in the market, contributing to the ongoing sell-off.

Large Bitcoin holders, often referred to as “whales,” have also been contributing to the market’s downward pressure. These significant sell-offs by whales have added to the price decline. As whales unload their holdings, the market becomes more vulnerable to further losses.

Institutional Interest Wanes Amid Market Volatility

U.S. spot Bitcoin ETFs have experienced notable outflows, reflecting declining institutional interest in Bitcoin. These outflows suggest that large institutional investors are hesitant to engage with Bitcoin during its current market volatility. Bitcoin’s ongoing negative correlation with the Nasdaq 100 is another factor, as the cryptocurrency tends to drop more sharply during tech sell-offs.

The price of Bitcoin fell below $95,000 on Friday, triggering a surge in discussions around the cryptocurrency. According to Santiment, this spike in Bitcoin conversation reached a four-month high. This sharp rise in social media activity is a clear signal of fear, uncertainty, and doubt (FUD) among retail investors.

Death Cross Forms as Bitcoin Faces Uncertainty

Bitcoin has recently formed a “death cross,” a technical indicator often associated with declining market conditions. Despite its ominous name, the death cross is seen as a lagging indicator. Analyst Benjamin Cowen notes that previous death crosses have often coincided with local market bottoms, indicating potential reversals.

However, Cowen warns that if the current market cycle is nearing its end, any potential bounce could fail. He emphasizes that a clear sign of recovery should emerge within the next week. If Bitcoin does not show signs of a rebound soon, the market could experience further downside before any significant recovery.

The post Bitcoin Plummets Under $100K: Is the Bottom Near or More Losses Ahead appeared first on CoinCentral.

You May Also Like

Bitcoin Needs 6% Rally to Close 2025 in Green, Analyst Warns

Bitcoin Price Gains 1% Despite US-listed Spot ETFs Seeing $782 Million In Outflows During Christmas Week