Bitcoin Spot ETF Records $51M Outflow Snaps 7-Day Inflow Streak as ETH Bleeds Again

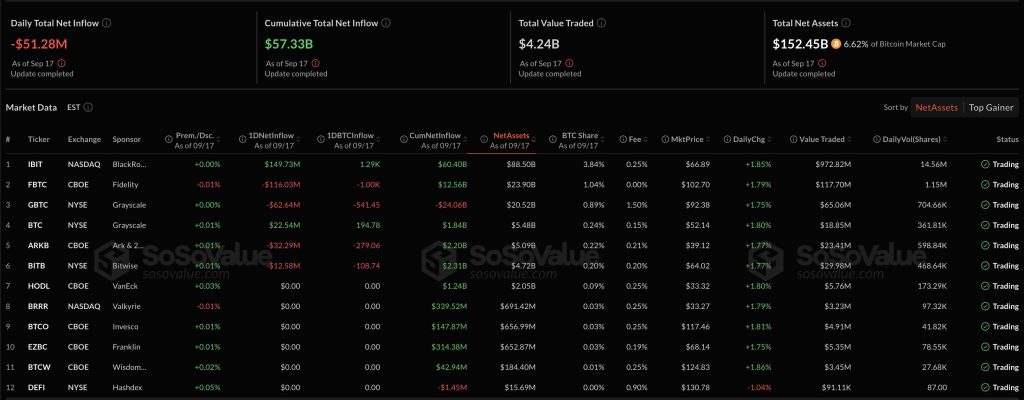

Bitcoin spot exchange-traded funds (ETFs) in the United States recorded their first significant outflow in over a week, with $51.28 million leaving the market on September 17, according to data from SoSoValue.

The reversal came after seven consecutive sessions of inflows that had fueled optimism among institutional investors. The retreat came just one day after U.S. Bitcoin ETFs recorded $292.27 million in net inflows on September 16.

Bitcoin Spot ETF Loses Momentum While Ethereum Funds Struggle With Persistent Outflows

The sudden shift reflects rapid repositioning across major issuers. Fidelity’s FBTC was the hardest hit, posting $116.03 million in daily outflows, despite holding a historical net inflow of $12.56 billion.

Grayscale’s flagship GBTC also logged heavy losses, with $62.64 million withdrawn, while Ark and 21Shares’ ARKB shed $32.29 million. Smaller declines were seen at Bitwise’s BITB, which lost $12.58 million.

Bitcoin ETFs Flow September 17 Source: SoSoValue

Bitcoin ETFs Flow September 17 Source: SoSoValue

Not all funds recorded redemptions, however. BlackRock’s iShares Bitcoin Trust (IBIT) continued to attract capital, pulling in $149.73 million on the day.

Grayscale’s lower-fee Bitcoin Mini Trust ($BTC) also posted $22.54 million in inflows, raising its lifetime tally to $1.84 billion.

The net outflows left the total assets under management for Bitcoin spot ETFs at $152.45 billion, equivalent to 6.62% of Bitcoin’s market capitalization.

Cumulative net inflows across all products since launch stand at $57.33 billion. Prices tracked lower alongside the shift in flows, with many ETFs ending the day down just over 1%.

Ethereum ETFs, meanwhile, remain under pressure. On September 17, Ether products saw $1.89 million in net outflows, extending a streak of withdrawals that has persisted since early September.

Fidelity’s FETH was the largest loser, with $29.19 million in redemptions. Bitwise’s ETHW also saw $9.67 million exit the fund.

Inflows at BlackRock’s ETHA, which added $25.86 million, and smaller gains at Grayscale’s products were not enough to offset the broader weakness.

Total assets under management for Ether ETFs now stand at $29.72 billion, or 5.47% of Ethereum’s market capitalization. Cumulative inflows are reported at $13.66 billion.

The figures follow a period of heavy selling earlier this month, when Ether ETFs lost more than $1 billion over six consecutive sessions, including a $446.7 million single-day withdrawal on September 9.

By contrast, Bitcoin ETFs have shown stronger resilience. Earlier in September, funds added more than $1.7 billion in inflows over four days, reversing weakness from late August when Bitcoin ETFs posted their first weekly outflows since June.

Ether funds continue to bleed assets after a brief rebound mid-month, raising questions about institutional conviction in Ethereum compared to Bitcoin.

SEC Approves New Listing Standards, Paving Way for More Crypto Spot ETFs

The ETF market has seen renewed institutional interest. A fresh wave of cryptocurrency ETF filings has landed at the U.S. Securities and Exchange Commission (SEC), showing the industry’s push beyond traditional Bitcoin and Ether products.

On Tuesday, five applications were submitted, ranging from Bitwise’s proposed spot Avalanche ETF to Tuttle’s “Income Blast” funds targeting Bonk, Litecoin, and Sui.

Defiance also filed for ETFs built around Bitcoin and Ethereum basis trades, while T-Rex submitted paperwork for a leveraged 2x Orbs ETF.

ETF Institute co-founder Nate Geraci noted that the industry should brace for “what’s coming over the next few months,” as the number of active applications climbs past 92, with many facing autumn deadlines.

The filings arrive just as REX-Osprey prepares to launch XRP and Dogecoin ETFs on Thursday through the faster 40 Act structure, which bypasses traditional SEC approval bottlenecks.

Momentum picked up further on Wednesday when the SEC approved new listing rules for major exchanges, including Nasdaq, Cboe BZX, and NYSE Arca.

The decision allows generic listing standards for commodity-based trust shares, clearing the way for spot ETFs tied to a wider range of cryptocurrencies.

Bloomberg analyst James Seyffart described the move as the “crypto ETP framework we’ve been waiting for,” predicting Solana and XRP could be first in line.

In a separate development, the regulator cleared Grayscale’s Digital Large Cap Fund, the first multi-asset crypto ETP in the U.S., providing investors exposure to Bitcoin, Ether, XRP, Solana, and Cardano.

Crypto Steadies as Fed Trims Rates 25 Bps, Bitcoin Eyes $118K Resistance

Bitcoin held above $117,000 on Thursday after the Federal Reserve delivered its first interest rate cut since December, trimming the federal funds rate by 25 basis points to a range of 4.00%–4.25%.

The cryptocurrency was last trading at $117,173, up 1% over 24 hours and 5.7% in the past two weeks. Ethereum followed with stronger momentum, climbing 1.8% on the day to $4,568, extending gains to 6.2% over 30 days.

The Fed cited weaker job growth and a softer economic outlook for the decision, noting that 911,000 fewer jobs were created in the past year than previously reported.

Inflation remains at 2.9%, above the bank’s 2% target. Chair Jerome Powell said future cuts would remain data-dependent, while President Donald Trump has pressed for deeper reductions.

Market reaction was immediate. More than $105 million in crypto positions were liquidated within an hour of Powell’s remarks, with longs bearing the brunt.

The global crypto market cap briefly fell 0.9% to $4.08 trillion, while Bitcoin dipped to $115,089 before recovering.

On-chain data points to easing sell pressure. Bitcoin exchange inflows dropped to a yearly low, with the 7-day moving average falling to 25,000 BTC, down from 51,000 in July.

Average BTC deposits have halved since mid-summer. Ethereum showed similar trends, with inflows sliding to a two-month low of 783,000 ETH.

Traders are now focused on the $118,000 resistance level. Analysts say a break above could open the door to retesting Bitcoin’s record high near $124,000.

You May Also Like

Coinbase Data Breach Fallout: Former Employee Arrest in India Over Customer Data Case Raises Bitcoin Security Concerns

Burmese war amputees get free 3D-printed prostheses, thanks to Thailand-based group