Bitcoin’s Surge Past $106K Liquidates James Wynn 12 Times in 12 Hours

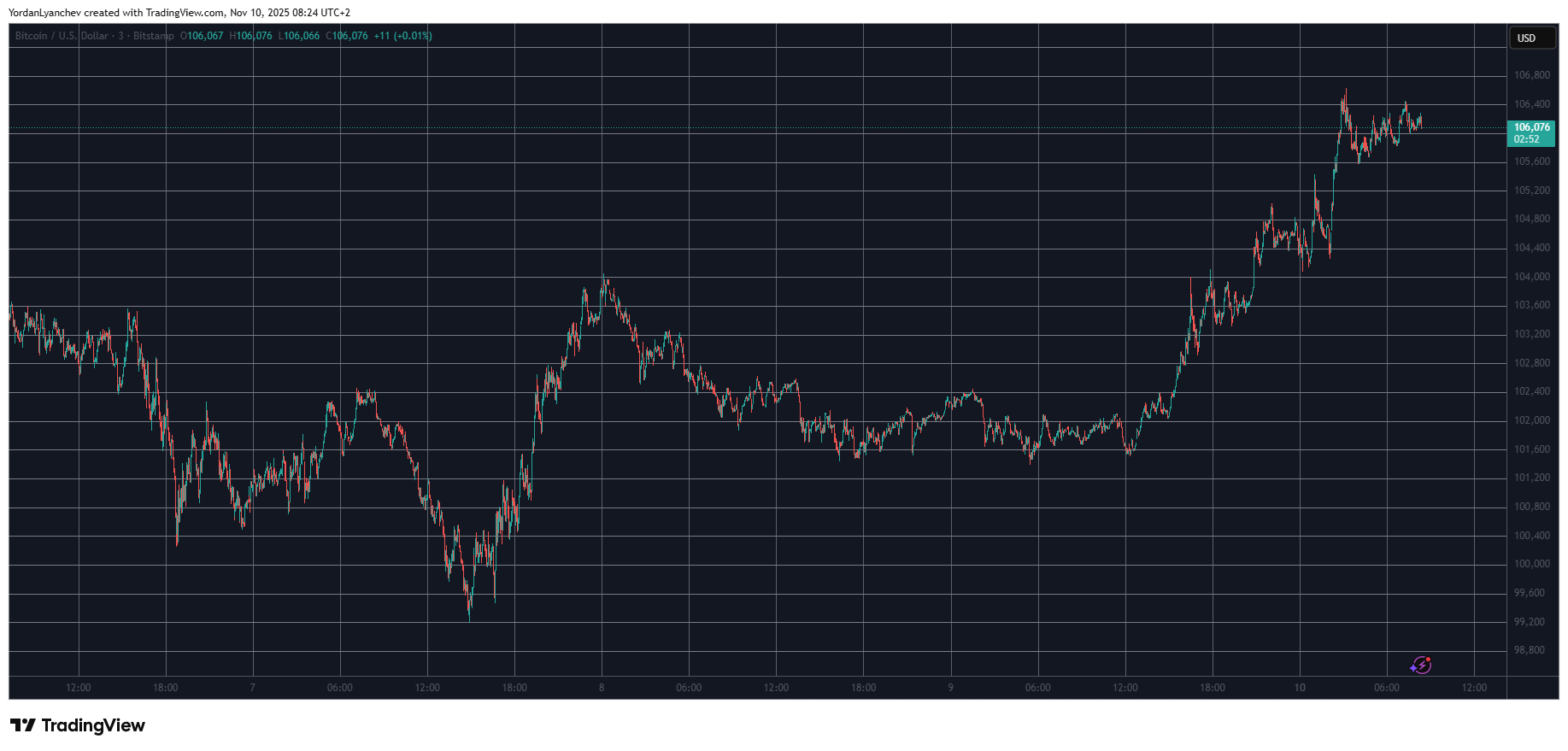

Bitcoin ended the calendar week with a price resurgance that only intensified as the new one began, and the asset jumped to almost $107,000 for the first time since last Tuesday.

Naturally, this explosive month north has harmed certain over-leveraged traders. The popular account going under the name James Wynn made the headlines again by suffering a dozen liquidations in the span of just 12 hours, according to data from Lookonchain.

The analytics platform continues to track Wynn’s performance in recent months and noted that they had been wrecked 45 times in the last 60 days. They finally had a “one winning trade,” but chose to keep shorting bitcoin during the weekend, which turned sour.

In the span of just half a day, Wynn was wrecked for a total of over $85,410, and their account is left with just $6,010.

This liquidation came as BTC jumped from under $102,000 to a multi-day peak of almost $107,000 on the heels of an interesting promise by the US President. Yesterday, Trump said numerous Americans, aside from high-income people, will receive dividends of at least $2,000, which history suggests could be linked to fresh money poured into crypto.

The altcoins followed suit with some impressive gains, such as WLFI, which has soared by nearly 30%, followed by PUMP (16%), ZEC (16%), and UNI (14%).

The total liquidations for the past day are up to $360 million, according to CoinGlass, with more than $260 of the total coming from shorts. The number of wrecked traders is close to 120,000.

BTCUSD. Source: TradingView

BTCUSD. Source: TradingView

The post Bitcoin’s Surge Past $106K Liquidates James Wynn 12 Times in 12 Hours appeared first on CryptoPotato.

You May Also Like

Ripple (XRP) Pushes Upwards While One New Crypto Explodes in Popularity

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets