DeFiLlama’s founder 0xngmi has accused Blockworks of reselling DeFiLlama’s free data

DeFiLlama founder 0xngmi publicly accused Blockworks of reselling DeFiLlama’s free data on a paid analytics platform priced at $4,500 per year on X, leading to immediate and wide community reaction.

The accusation was made on the same day Blockworks co-founder Jason Yanowitz published a long announcement stating that Blockworks will shut down its news division and fully transition into a software and data organization.

Jason Yanowitz posted a statement explaining the company’s direction. He said that when he and Michael Ippolito founded Blockworks in 2017, they wanted to address what he called “the information problem,” during a period when crypto was expanding quickly and lacked reliable industry reporting.

Jason wrote that Blockworks built events, podcasts, research products, data dashboards, and eventually a newsroom. He said the company had record revenues in 2025 and expected another record year in 2026, pointing to especially fast growth in its data division.

Jason wrote that both investors and crypto protocols rely on Blockworks data daily, and that he and Michael view the data business as the company’s strongest opportunity since its founding.

The Blockworks CEO then confirmed that Blockworks will exit news, saying that crypto media has matured and users now look primarily to data dashboards rather than traditional articles.

Jason thanked the reporters on the news team and invited other organizations to hire them, then mentioned that Blockworks will continue to run newsletters, podcasts, and events, and that the DAS conference will take place next year in Abu Dhabi.

DeFiLlama challenges Blockworks over paid data dashboards

Shortly after Jason’s announcement, 0xngmi quoted the post and said:

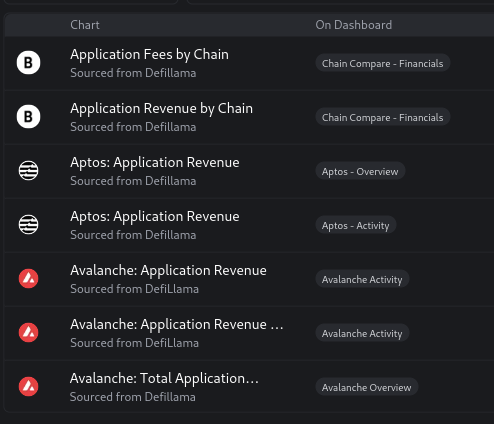

The attached screenshot displayed a chart that appeared to be generated from DeFiLlama’s data within a Blockworks paywalled dashboard. Check it out below:-

Source: 0xngmi/X

Source: 0xngmi/X

Then Dan Smith, the head of data at Blockworks, replied under the tweet, saying:

0xngmi responded by calling Dan a liar, and adding that the ‘application revenue by chain’ chart showed in his screenshot worked and returned DeFiLlama data.

Dan then replied, “Yeah, not updated since July, like my last DM said. No reason to not have followed up there like ‘Hey, there must be a bug’.”

0xngmi pointed out that:-

After that, Dan stopped replying. Engagement under the thread shows 0xngmi’s replies receiving more likes than Dan’s, a pattern commonly recognized on X as being ratioed, meaning the community is on DeFiLlama’s side on this one.

The conversation continued circulating widely, with users sharing screenshots and commentary about Terms of Service compliance and platform transparency.

Community responds to Blockworks laying off its newsroom

At the same time, the decision to remove the news staff drew its own backlash.

Many in the community are angry that Jason’s statement began by highlighting record revenue, and only after several paragraphs mentioned that the journalists who contributed to Blockworks’ visibility would be departing.

Critics said the tone framed layoffs as an afterthought.

Martyna MBL, Senior Director at Serotonin, commented that:

Other users echoed this sentiment, arguing that the Blockworks newsroom helped build the brand’s recognition inside the industry during market cycles when clear reporting was necessary.

Some also pointed out that the timing of the data resale allegation amplified the reaction, since the company was positioning itself as a trusted data provider on the same day it was accused of misusing another project’s data.

Claim your free seat in an exclusive crypto trading community - limited to 1,000 members.

You May Also Like

Lucid to begin full Saudi manufacturing in 2026

Exploring Market Buzz: Unique Opportunities in Cryptocurrencies