Institutions Buying Bitcoin Are Fueling a Scalability Arms Race, And One L2 Is Leading the Pack

Quick Facts:

The market is seeing a major institutional rotation as long-term Bitcoin holders sell to new institutional players like traditional finance funds and ETFs.

The market is seeing a major institutional rotation as long-term Bitcoin holders sell to new institutional players like traditional finance funds and ETFs. Institutional buying is driving the demand for a faster Bitcoin execution layer, proving the “old cycle theory” is obsolete due to strong new liquidity.

Institutional buying is driving the demand for a faster Bitcoin execution layer, proving the “old cycle theory” is obsolete due to strong new liquidity. Bitcoin Hyper ($HYPER) is a Layer 2 built using SVM technology to give Bitcoin sub-second transactions and low gas fees for dApps and utility.

Bitcoin Hyper ($HYPER) is a Layer 2 built using SVM technology to give Bitcoin sub-second transactions and low gas fees for dApps and utility. Bitcoin maintains its role as the secure base layer, while Bitcoin Hyper transforms it from a ‘store of value’ to a high-speed playground for DeFi and general use.

Bitcoin maintains its role as the secure base layer, while Bitcoin Hyper transforms it from a ‘store of value’ to a high-speed playground for DeFi and general use.

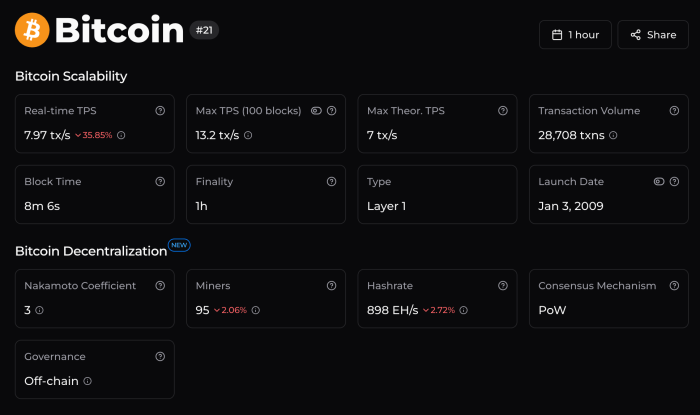

For years, Bitcoin has been the heavyweight champ of security but the slowest runner on the track. Everyone trusted it, everyone bought it, but nobody could pretend it was fast.

Meme coins? Impossible. Cheap transactions? Forget it. dApps? Developers laughed and walked away. And with Bitcoin’s tiny throughput and poor scalability, the chain was basically a digital gold bar that sat still and looked pretty.

Now the market is shifting. Institutions are buying Bitcoin in size, and even OG Bitcoiners are cashing out to them. That alone shows Bitcoin is far from dead.

The current dip is a perfect illustration of this changing market structure. CryptoQuant founder and CEO, Ki Young Ju, posted on X that the selling is merely a rotation from original long-term holders to new institutional players like traditional finance funds and ETFs, with strong liquidity inflows from these new channels signaling that the old cycle theory is obsolete.

Bitcoin has simply reached the point where the next evolution needs more speed, more utility, and more tech than the base chain can offer. And that is exactly where Bitcoin Hyper ($HYPER) steps in.

With this new crypto project, the old chain feels like it just got a full makeover. A proper facelift. Bitcoin Hyper arrives as a Layer 2 built on the SVM, one of the fastest blockchain engines in the world.

Suddenly, Bitcoin unlocks sub-second transactions and tiny gas fees.

Developers, builders, and degens finally get what they always wanted but never had: high-speed action on Bitcoin itself.Bitcoin is no longer limited to being a store of value. Payments feel instant again. Apps can live on-chain instead of being pushed elsewhere. Bitcoin stays as the trusted, solid base layer, while Bitcoin Hyper becomes the playground where everything actually happens.

And it is built for builders, for degens, and for the culture. Tooling, support, and incentives are all baked in, with enough raw speed to make the entire crypto world blink twice.

Bitcoin Hyper ($HYPER) – Bridging Bitcoin’s Past to a High-Speed Future

Bitcoin earned its reputation by being the safest and most trusted base layer in crypto. It locks in value, keeps the chain secure, and does not break. But that strength came with a price.

Bitcoin never had the speed or flexibility needed for modern applications. Bitcoin Hyper ($HYPER) changes that by building a modular Layer 2 on top of Bitcoin’s settlement layer.

Bitcoin stays the rock. $HYPER becomes the engine.

Execution moves off-chain, using the Solana Virtual Machine (SVM), where transactions fire almost instantly and cost next to nothing.

The SVM is the key that unlocks all of this. Developers can use Rust and build smart contracts that actually feel modern. We go into further detail in our ‘What is Bitcoin Hyper‘ guide.

Suddenly, Bitcoin can support DeFi, lending, trading platforms, and even complex on-chain products that were never possible before.

Movement between layers stays smooth thanks to a built-in Canonical Bridge that lets $BTC flow into Hyper’s ecosystem with no hassle.This architecture gives users everything they were missing: fast payments, cheap transfers, NFT marketplaces, gaming, and real room for builders.

Instead of watching other chains run ahead, Bitcoin finally gets its own high-speed playground. Bitcoin Hyper takes Bitcoin’s secure past and connects it to the kind of future people have been asking for.

Join the $HYPER presale today.

Why Buy $HYPER Now

Investors see a clear trend. Institutional money is pouring into Bitcoin after ETF approvals, but the base chain still cannot support modern financial tools.

That gap created demand for a real execution layer. Bitcoin Hyper fills that gap with speed, cheap transactions, and cross-chain features that Bitcoin always needed.

Buyers are getting early access to the ecosystem that will run everything on $HYPER.

With over $27.8M raised, the market already showed strong belief in the Layer 2 future of Bitcoin.

Institutions are now looking for scale, smart contracts, and real utility on top of Bitcoin. Bitcoin Hyper delivers all of that while letting Bitcoin remain the trusted, secure base layer underneath. Want in but not sure how? Check out our ‘How to Buy Bitcoin Hyper‘ guide.

If Bitcoin is leveling up, $HYPER is the ticket that gets you inside the upgrade.Bitcoin Hyper brings Bitcoin into the high-speed era. Fast payments, cheap transactions, DeFi, meme coins, and full cross-chain movement all live under one system.

If Bitcoin needed an execution layer, Bitcoin Hyper built it. And $HYPER lets you take part in that future.

Buy $HYPER today for $0.013295.

Remember, this is not intended as financial advic,e and you should always do your own research before investing.

Authored by Bogdan Patru, Bitcoinist — https://bitcoinist.com/institutions-buying-bitcoin-fuel-demand-for-bitcoin-hyper-l2

You May Also Like

CME Group to Launch Solana and XRP Futures Options

The best IPO stocks to watch in 2026