Private Shielded Zcash Purchases ‘Shipping Next Week’ on Zashi

Shielded Zcash ZEC $569.6 24h volatility: 18.5% Market cap: $9.30 B Vol. 24h: $2.31 B decentralized purchases are coming to Zashi Wallet, powered by NEAR Intents, according to Electric Coin Capital CEO Josh Swihart. This is a long-awaited feature that will allow users and investors to swap from other coins into fully private shielded ZEC, as the leading privacy coin surges in price.

The announcement came as a teasing post on Nov. 14, with Swihart’s promise of “shipping next week.” In the image, we can see a swap simulation of 1 BTC, valued at $96,432, for 170.30 ZEC, at the same nominal value, and a crossed shield next to Zcash’s logo.

Zashi implemented the “swap to ZEC via NEAR Intents” feature in the wallet app on Oct. 1, which uses the NEAR Protocol chain abstraction stack and Intents protocol to allow decentralized purchases of Zcash using a transparent address. Before that, the leading wallet had natively implemented NEAR Intents for the opposing route: swapping from shielded ZEC to other supported blockchains like NEAR, Solana, Bitcoin, Ethereum, and more.

Interestingly, the cross-pay feature was highlighted but also partially criticized by the prominent onchain investigator ZachXBT. “Zashi is an enjoyable wallet experience for privacy and fixes several UI/UX complaints I had for Monero,” Zach said, while also warning of potential information leakage due to the use of Zcash transparent addresses for refunds—the same used for the ZEC purchases.

Both Josh Swihart and Illia Polosukhin commented on the matter, saying additional shielded Zcash features were on the roadmap for both Zashi and NEAR Intents to fix these potential leaks.

ZEC Price Analysis Amid Crypto Crash

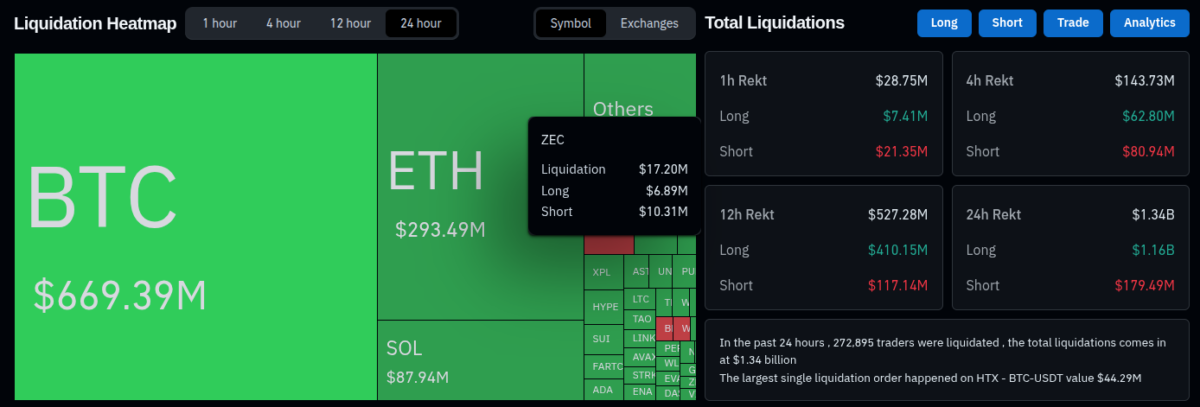

Nov. 14 started with a significant market crash that liquidated more than $1.34 billion in less than 24 hours, according to data from Coinglass. ZEC was among the largest liquidations, but, differently from everything else, Zcash had a larger liquidation from short positions—registering notable gains while other cryptocurrencies were crashing and liquidating a majority of longs.

In total, $17.20 million in ZEC were liquidated, with $10.3 million being from short positions. On the other hand, $1.16 billion of the $1.34 billion liquidations were from long positions, a pattern replicated by BTC, ETH, SOL, and most, if not all, of the other cryptocurrencies.

Liquidation heatmap and total liquidations in 24 hours, as of Nov. 14, 2025 | Source: Coinglass

As of this writing, Zcash is trading at $572.88 and has a $9.34 billion market capitalization, ranked in the 14th position on CoinMarketCap and is currently the leading privacy coin by market cap. ZEC has accumulated 16.55% gains in the last 24 hours and 1,436% gains year-over-year, attracting support from different industry players as it crossed the 10x-gain mark.

Zcash (ZEC) price and market data as of Nov. 14, 2025 | Source: CoinMarketCap

Zcash’s rally has been mostly attributed to its superior privacy features and improved user experience thanks to Zashi. Moreover, NEAR Intents has also been mentioned as a core contributor to ZEC’s success as a “universal liquidity layer” that allows people to easily buy and spend their coins privately—being praised by figures from different ecosystems, similarly to what happened to Zcash pre-rally, as Coinspeaker reported.

nextThe post Private Shielded Zcash Purchases ‘Shipping Next Week’ on Zashi appeared first on Coinspeaker.

You May Also Like

CME Group to launch options on XRP and SOL futures

Why losing THIS support could drag XRP toward $1