Simple, Battle-Tested Algorithms Still Outperform AI

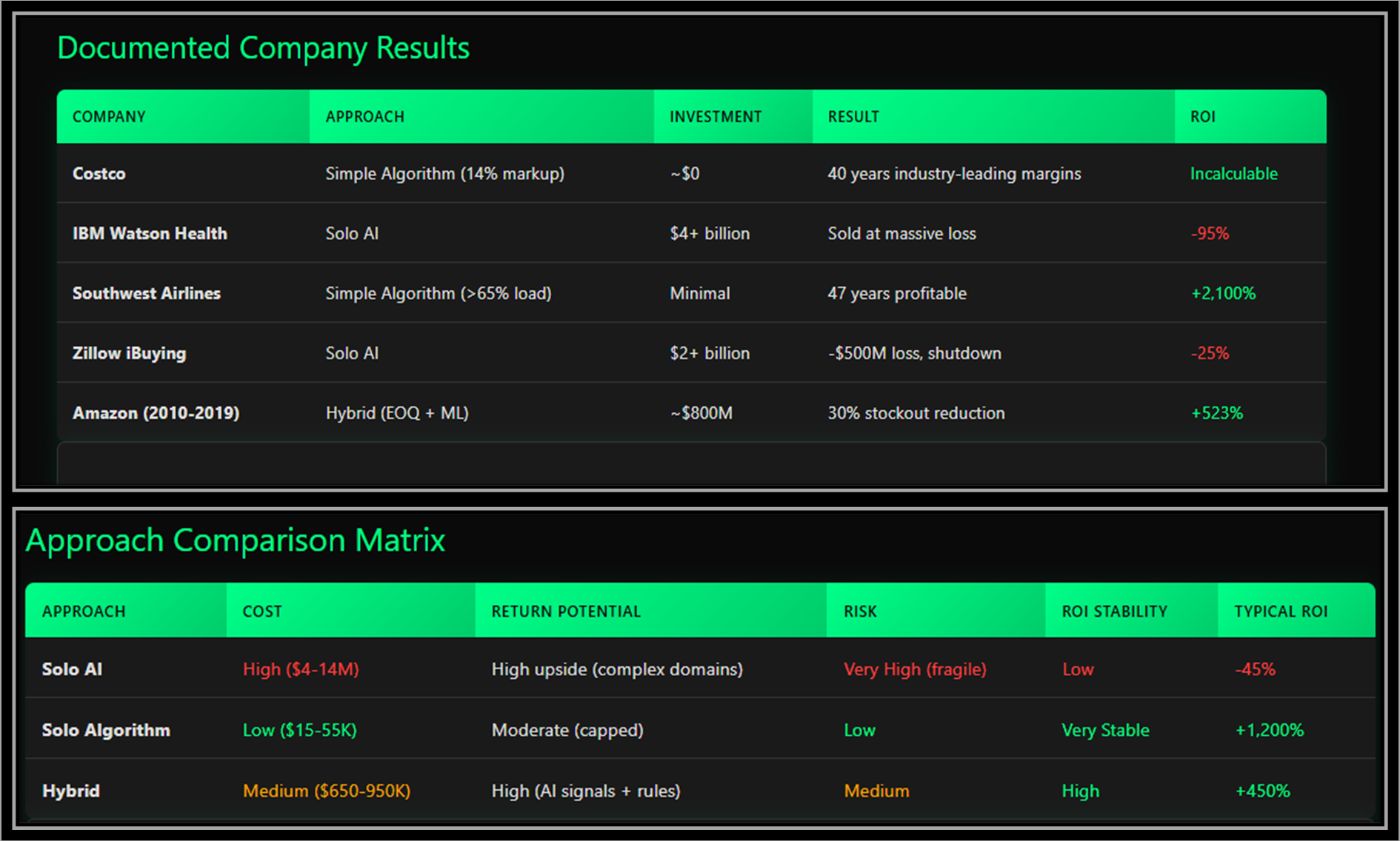

==Let’s put numbers to the AI overhype. Companies are burning more than $200 billion every year by choosing AI over simple, proven algorithms. That’s not an opinion. That’s math. (See the chart below if you’re still rubbing your eyes in disbelief.)==

But here’s the question: Is AI the villain - or are CEOs burning money on systems they barely understand?

The truth is more brutal than either narrative. AI isn’t the disaster — it’s the excuse for the disaster.

Look at the chart below. This is your American Horror Story in three acts:

Act I: The Promise Solo AI vendors promise revolutionary decision-making. Fortune 500 CEOs, hypnotized by NVIDIA’s stock price and OpenAI’s demos, write checks their companies can’t cash.

Act II: The Bloodbath That red line? That’s $500 billion annually achieving -45% ROI (Return on Investment — how much you get back compared to what you spend). Not a typo. Negative forty-five percent. Companies are paying premium prices to make worse decisions slower. It’s like hiring McKinsey to tell you what you already know, except McKinsey occasionally delivers positive value.

Act III: The Coverup Nobody admits failure. The AI system becomes “strategic infrastructure.” The losses get buried in “digital transformation.” The vendors — Anthropic, OpenAI, the whole choir — keep singing about the future while cashing checks in the present.

Remember the California Gold Rush from the history books? You know who got rich in 1849. Not the miners. The pickaxe sellers.

==Today’s pickaxe merchants sell GPU clusters and API tokens to CEOs panning for digital gold.== They whisper sweet promises: “AI will revolutionize your business.” What they don’t mention is that graph showing AI never achieves positive ROI for operational decisions.

Instead they boast about having more billion parameters than the competition’s AI monster. Of course theirs is bigger, more insanely convoluted — an expanding minefield of compounding errors, Types I through IV, each cascade multiplying the disaster.

Meanwhile, see that green line in the chart above — simple algorithms from 1913 — keeps printing money at 1200% ROI. But nobody’s selling conferences about the Economic Order Quantity formula. There’s no TED talk about Little’s Law and the other older algorithms.

Yep, unfortunately you can’t raise billions in funding rounds by selling an algorithm that fits on a napkin from that expensive restaurant where you’re shaking hands with investors interested in a bigger AI beast.🤔

The tragedy is more nuanced than AI sellers admit — and more complex than CEOs with their broken quarterly-profit-maximization algorithms want to hear.

==First, you need to understand your business== ==from the molecular level to the stratosphere — every intricacy of your model, what you’re actually selling versus what you think you’re selling, where costs hide, where value emerges. These insights come from human minds. AI won’t solve what you can’t articulate, despite the sales pitch.==

==Second, you need to hire and respect professional====s who combine programming excellence with mathematical rigor and the rare ability to translate both into business value. But your AI recruiting system will never surface these people.== It’s optimized for commodities, not talent — screening for keywords, not capability.

Here’s the brutal reality with a massively failed AI that most companies are facing right now:

Look at the carnage in the table below (Chart 3) . This isn’t speculation — it’s documented history:

- Costco: Running on a decision that fits on an index card. Investment: approximately zero. Return: Industry dominance for four decades.

- IBM Watson Health: The crown jewel of AI healthcare. Investment: $4 billion. Return: Sold for parts at a 95% loss.

- Southwest Airlines: One simple rule about load factors. Still the only major US airline to avoid bankruptcy.

- Zillow iBuying: Cutting-edge AI pricing models. Burned $500 million in one quarter before shutting down entirely.

\

The only success story with AI? Amazon’s hybrid approach — yup, not pure AI, it’s old-school EOQ with some ML sprinkled on top when absolutely necessary. Even then, the ROI is a fraction of what simple algorithms achieve alone.

But let’s be honest here, let’s not throw the baby out with the bathwater: when your business complexity genuinely grows — meaning the actual number of variables you must account for — you need more flexibility. That might be AI/ML, or more likely, it’s just good programmers who understand your business and can architect the math you actually need.

Here’s what 20 years in the trenches taught most of us: around 90% of “complex” business problems can be solved by a competent programmer with decent math skills and simple algorithms, properly wired together.

Occam’s Razor still cuts: The simplest solution that works is usually right.

==But simplicity doesn’t sell conference tickets. Simplicity doesn’t raise Series B funding. Simplicity doesn’t get you on the cover of Wired. 😂==

So instead, companies take the lazy, prestigious route: throw their problems at whatever AI the vendors are pushing this quarter. It’s like hiring a top surgeon to apply a Band-Aid — expensive, unnecessary, and probably going to make things worse.

The real tragedy? That competent programmer with the simple solution costs $150K/year. The AI system that fails costs $15M. But the programmer doesn’t come with a sales team, a PowerPoint deck, or a promise to “transform your digital future.”

Guess which one the board approves.

The Seven Heroes of Business History

Our position shouldn’t surprise you by now, dear reader. We’re betting on what’s worked brilliantly for decades through every crisis, disaster, and market shift while delivering massive profits: the algorithm way.

The formula is simple: Hire, value, and respect your best asset — skilled programmers with solid math foundations who convert business problems into algorithmic solutions. Add modern cloud infrastructure and, when genuinely appropriate (maybe 5–10% of cases), deploy the hybrid Algorithm + AI/ML approach.

But let’s be clear: forget the magic they’re selling — the fantasy of throwing data at AI and getting perfect solutions every time. That’s not happening.

Yes, LLMs are useful as search tools, data navigators, even coding assistants. But they’re far from autonomous. In non-trivial cases, you need spend lot of time cross-referencing to catch their false positives and, worse, the errors nobody notices — Type III and IV errors that spaghettify and collide concepts into dangerous nonsense.

Meet the Magnificent Seven

More than 500 years of combined service. Trillions in value created. Under 1K lines of code total.

Look at this table (Chart 4). These seven algorithms have never failed. For decades — in some cases over a century — they’ve consistently delivered business value to most of mankind. The epitome of simplicity.

\ Each one is a specialist with embarrassingly simple code:

- EOQ (1913): The inventory gunslinger - Square root of (2 × demand × order cost / holding cost). One line. Tells you exactly how much to order.

- DuPont (1920): The financial sharpshooter - ROE = Profit Margin × Asset Turnover × Leverage. Three numbers multiplied. Instant diagnosis of what’s broken.

- Newsvendor (1950s): The perishables ranger - Order up to the point where the chance of selling out matches the cost of running short vs. overstocking. A single threshold for “how much to make.”

- Kelly (1956): The risk-sizing marshal - Bet a fraction of your bankroll based on edge and odds — when your advantage is bigger, size up; when it’s small, size down. Never overbet.

- CPM (1957): The project management tracker - Find the longest path through your network. That’s your deadline. Everything else can slip; this can’t.

- Little’s Law (1961): The operations enforcer - Items in system = arrival rate × time in system. It’s physics, not statistics. Works for everything.

- PageRank (1998): The young gun who built an empire - A page’s importance is the sum of votes from important pages, each vote split by their outlinks, with a small random-jump factor to keep it stable. Keep iterating. Built Google.

The AI hype has its place — pattern finding, searching, identifying. But it needs years of improvement to correct its statistical errors from Type I through IV. Even then, algorithms in the hands of competent developers remain irreplaceable and far from commodities.

The bottom line: While everyone chases AI complexity, these seven simple formulas keep generating thousands of percent returns. They don’t need updates. They don’t hallucinate. They just work.

That’s not outdated. That’s immortal. Let’s keep programming with algorithms while the true researchers work on fixing AI errors with better math.

You May Also Like

The Channel Factories We’ve Been Waiting For

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight