Solana chops sideways; Market eyes new payments player Digitap

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

As Solana struggles, the market’s next big narrative has shifted, stablecoins and payments are now the prize, and Digitap is leading the charge.

- Fed Governor Waller’s proposed “skinny” Fed accounts could let institutions and stablecoin issuers bank directly with the Fed, putting payments in the spotlight.

- Solana faces resistance below $200, while stablecoin-focused projects are drawing major investor attention as the next growth wave.

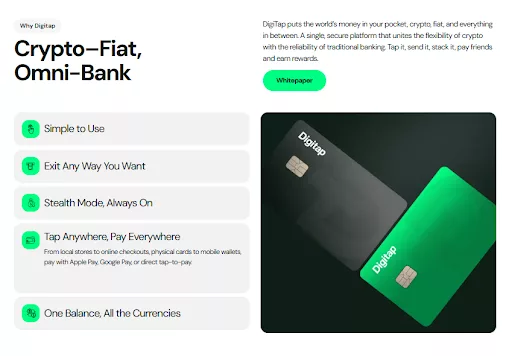

- Digitap unites banking, stablecoins, and crypto in one consumer app, using AI routing and a Visa card to make digital payments seamless and accessible.

Solana has stalled under $200, and the game is changing. Whales have been slurping enormous amounts of BTC via ETFs, and now the entire world is focused on payments and stablecoins following Fed Governor Waller proposing a new ‘skinny’ account that would allow institutions and stablecoins issuers to bank directly with the Fed.

Stablecoins are where the next growth leg is happening, and timing matters in crypto. Right now, the market is paying a massive premium for projects that make stablecoins simple for regular people. And that’s precisely what Digitap (TAP) does, quickly becoming the leader of the payments race.

Solana: Don’t bet against the king

Solana continues to chop sideways and languishes below the important psychological price of $200 mark. Analysts point to a possible double-bottom near the mid-$170s, but even if SOL returns to its prior ATH, upside is limited here.

Trading at a valuation in excess of $100 billion caps upside. Even with ETF hopes brewing and increased institutional curiosity, it would take an obscene amount of capital to push SOL meaningfully upwards. SOL currently trades below the 200-day moving average, signaling the beginning of a prolonged bearish trend.

While betting against SOL has proven a poor move in the past. The difference between backing an underdog at a multiple-million-dollar valuation and a hundred-billion-dollar valuation is a different game. SOL needs to break upwards convincingly before it will be attractive again.

Payments are the prize in 2025

The smartest builders are all aiming at the same target: stablecoins and payments. Stablecoins settle fast, can move across borders, and can be programmed, allowing for greater optionality and expression within transactions.

Policy is supportive, and the winning product that nails distribution will feel like normal spending with smarter rails underneath. Demand for consumer-first projects is booming, and that’s why Digitap is enjoying record-breaking inflows into its presale.

Digitap’s consumer-first stack

Digitap is a universal application for money. Bank funds, stablecoins, and crypto all come together in a single dashboard. As well as supporting all types of value, Digitap is a more intelligent system than regular banks.

When a salary goes out, a remittance crosses a border, or a card is tapped at a store, the AI-enhanced routing system optimizes to find the best possible corridor. Sometimes a blockchain and sometimes a banking corridor.

Users can instantly swap fiat for crypto in the app, available for download today, and use the Visa card to spend crypto like regular fiat. Conversion happens at the moment of payment, and the routing engine always finds the lowest slippage route.

The interface looks like a modern finance app because that is the point: everyday tasks in one place, without forcing anyone to learn which rail the payment travels on. Abstract away the complexities of blockchain while delivering the performance upgrades.

Why Digitap is beating the competition

Legacy banks have trust, familiarity, and fiat rails. But they are slow. Blockchains are fast but can be complicated for the average user. Neobank front-ends simplify accounts, yet do not integrate blockchains. And that’s why Digitap is way out ahead.

As the world’s first omni-bank, it is a consumer app that feels like a bank, has a connected Visa card, and routes value across both banking corridors and blockchains. Digitap is transitioning stablecoins from a useful product to mainstream money.

TAP is available today for $0.0194, and the presale is rapidly closing in on a million dollars. In the next round, TAP’s price will jump by 38% to $0.0268, rewarding early adopters. And with 50% of platform profits used to reduce supply and reward stakers, it presents one of the better value accrual designs on the market.

With payments and stablecoins occupying the center of gravity and institutions rushing to join the party, Digitap is pulling ahead as the payments leader. And TAP is easily one of the leading cryptos to buy now before mania kicks off in Q4.

To learn more about Digitap, visit the presale, website, and socials.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

You May Also Like

Will US Banks Soon Accept Stablecoin Interest?

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse