The Fed Cuts Rates by 25bps, Bitcoin Steady For Now

A Labor Department revision revealed 911,000 fewer jobs were created over the past year than previously reported—basically a statistical gut punch to the “strong labor market” narrative. Combine that with sluggish growth signals and a creeping sense of slowdown, and the Fed was boxed in. “Uncertainty about the economic outlook remains elevated,” the central bank conceded in its statement—bureaucratic-speak for we’re worried.

Inflation vs. Jobs: The Balancing Act

Cutting rates with inflation at 2.9% (still above the Fed’s sacred 2% target) is no small gamble. But the central bank’s dual mandate—stable prices and maximum employment—forced its hand. Interestingly, newly installed governor Stephen Miran, Trump’s pick, dissented, calling for a 0.50% cut. His view? Go bigger, faster. Other hawkish members like Michelle Bowman and Christopher Waller, who previously opposed cuts, begrudgingly agreed that a quarter-point was “enough for now.”

Bitcoin, Ethereum, and the “Priced In” Trade

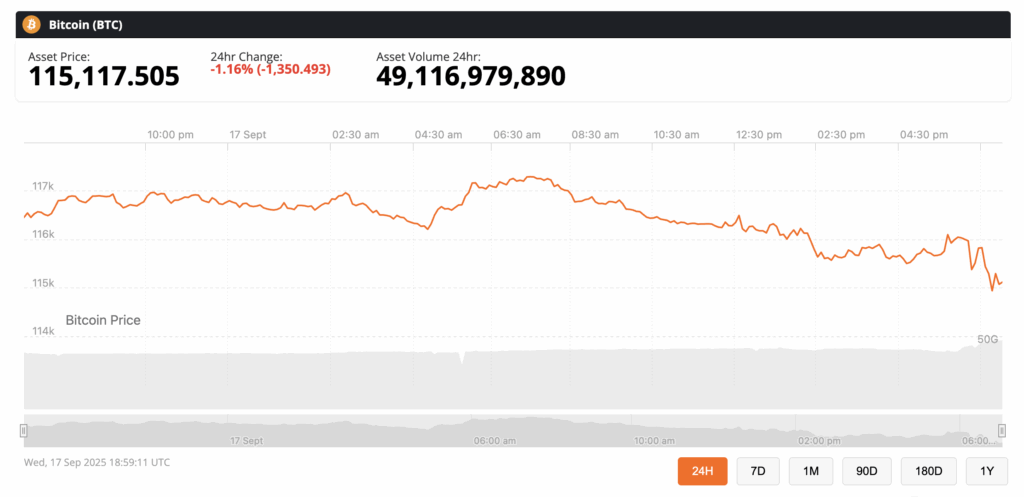

Crypto markets barely twitched. Bitcoin traded just north of $116,000, a rounding-error move of 0.2% over the previous hours, according to CoinGecko. Ethereum sat flat around $4,501. That’s because markets had already priced in this cut weeks ago—the CME’s FedWatch tool put the odds of a reduction at 96% heading into the meeting. Traders were more interested in the tea leaves of Powell’s press conference and the Fed’s updated economic projections, which now signal two more cuts possible before year’s end.

Bitcoin briefly topped $117,000 before pulling back, Source: BNC

Politics, Power Plays, and Gold at Record Highs

The rate cut didn’t happen in a vacuum. Trump has been at war with Powell’s Fed for months, accusing it of dragging its feet and threatening to replace governors with his own dovish loyalists. He just installed Miran to finish out a short term, and even tried (unsuccessfully) to oust Governor Lisa Cook—who, ironically, isn’t considered especially hawkish. A federal appeals court blocked that move, underscoring how messy the White House-Fed relationship has become.

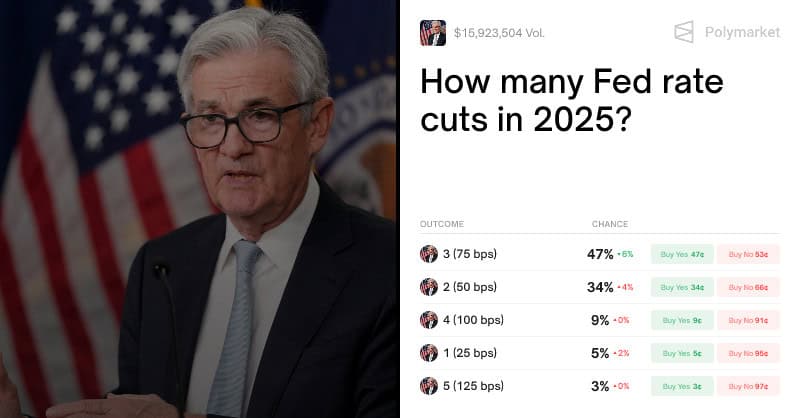

Polymarket is now predicting further rate cuts to come this year.

Two more rates cuts are predicted this year, Source: Polymarket

Meanwhile, safe-haven buyers are voting with their wallets. Gold surged to a record $3,730 this week, up more than 10% in a month as investors hedge against both inflation and Trump-era chaos. If Bitcoin is supposed to be “digital gold,” it’s not showing it—at least not yet.

This cut was expected, priced in, and, frankly, underwhelming in immediate market terms. The real drama lies ahead: whether Powell signals further easing, whether Trump keeps meddling, and whether investors decide Bitcoin deserves to trade more like gold in this uncertain environment.

You May Also Like

Gold edges higher as Fed easing outlook cushions downside

Flare Mainnet Launches FXRP, Bringing XRP Into DeFi