With Bitcoin on a Rollercoaster Ride, Bitcoin Hyper Could be the Next Crypto to Explode, with $24.5M Raised

KEY POINTS:

Bitcoin is still struggling to recover after US President Donald Trump’s China tariff threat continues to loom over the crypto market.

Bitcoin is still struggling to recover after US President Donald Trump’s China tariff threat continues to loom over the crypto market.

Some Bitcoin-related projects continue to thrive despite the current market downturn.

Some Bitcoin-related projects continue to thrive despite the current market downturn.

The Bitcoin Hyper presale has raised over $24.5M, positioning it as potentially the next crypto to explode.

The Bitcoin Hyper presale has raised over $24.5M, positioning it as potentially the next crypto to explode.

However, not everything across the entire Bitcoin ecosystem is down right now. The fact is, there are projects that continue to pump despite the market downturn. One of these is the Bitcoin Hyper ($HYPER) presale, which has raised over $24.5M to date.

As it stands, Bitcoin Hyper has all the makings of the next crypto to explode. But what is the Bitcoin Hyper project all about, and why are more and more investors being drawn to it? Read on to find out more.

The Bitcoin Blockchain: Great But Not Perfect

The Bitcoin blockchain was developed over a decade ago, yet it still offers remarkable performance – especially when it comes to security. This is thanks to its simplified code, which helps prevent security attacks on its network.

But this security comes at the cost of scalability. As such, you can’t do much with your $BTC other than use it as a store of value, unlike coins on other chains such as Ethereum and Solana. Modifying the code won’t solve this, as it would compromise Bitcoin’s robust security.

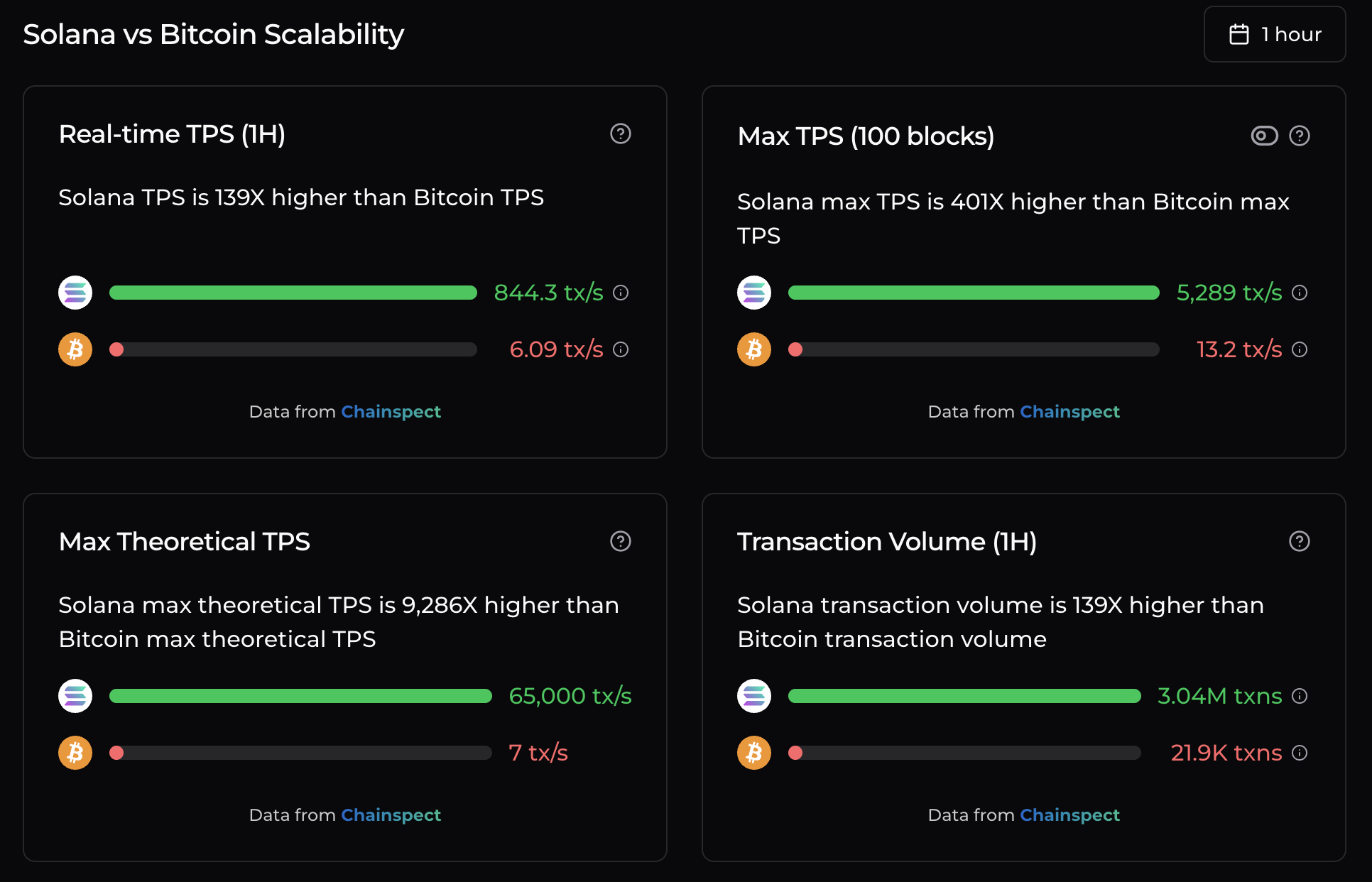

Then there’s its transaction speed. Theoretically, Bitcoin can handle up to seven transactions per second (TPS). This pales in comparison to more modern chains like Solana, which has a maximum theoretical TPS of 65K.

Source: Chainspect

As Bitcoin can process only a handful of transactions per second, the result is network congestion. This then drives up the cost of transactions on the Bitcoin blockchain.

Bitcoin Hyper to the Rescue

Since limited scalability, as well as slow and expensive transactions, have been a part of Bitcoin since day one, various projects have cropped up to help address these challenges.

At its core is its Layer-2 (L2) network, which is currently under development. It will integrate the Solana Virtual Machine (SVM), which will make it possible for the L2 to handle more transactions per second than the base Bitcoin blockchain can.

Now, with faster transactions come lower fees. Both are important, considering the next element that Bitcoin Hyper will bring to the table.

There will also be a Canonical Bridge, which will enable you to send your $BTC from the main blockchain to the L2. Here, you’ll be able to use your Bitcoin for a wide variety of applications, including staking, trading, and interacting with dApps. Thanks to the SVM, all these advanced applications will run at lightning speed.

Here’s a quick look at how the L2 will work:

Time to Grab $HYPER Tokens

Powering the project is its native $HYPER token. When the L2 launches, you’ll be able to use your token to pay for transaction fees.

Aside from that, holding $HYPER will also give you extra perks, like governance rights and access to exclusive features on the platform.

Considering Bitcoin Hyper’s strong use case and attractive holder benefits, it’s little wonder that the project’s presale has seen a healthy amount of whale activity. Whale buys of $379.9K, $274K, and $180.6K are among the big-ticket purchases that have contributed to the presale’s $24.5M+ tally.

Considering Bitcoin Hyper’s strong use case and attractive holder benefits, it’s little wonder that the project’s presale has seen a healthy amount of whale activity. Whale buys of $379.9K, $274K, and $180.6K are among the big-ticket purchases that have contributed to the presale’s $24.5M+ tally.

Right now, you can purchase your $HYPER tokens through the official Bitcoin Hyper presale website. Each one costs $0.013155, which is a good deal considering what you’ll get for holding the token.

And if $HYPER’s Layer-2 lives up to its promises, which it’s looking set to do, investing at today’s price could see impressive long-term gains. According to our Bitcoin Hyper price prediction, $HYPER has the potential to end the year at $0.20 – and reach $1.20 by 2030. That would mean a 1,420% and 9,023% ROI respectively.

If you prefer, however, you can also stake your $HYPER tokens and enjoy staking rewards at 48% p.a. Take note, though: the APY will drop as more investors lock their tokens in the staking pool.

Our guide on how to buy Bitcoin Hyper offers step-by-step instructions on getting your hands on $HYPER tokens.

Our guide on how to buy Bitcoin Hyper offers step-by-step instructions on getting your hands on $HYPER tokens.

Time is running out, though, as the next price increase is set to take place later on tomorrow. So, if you want to buy $HYPER at its current price, the sooner you act, the better.

Don’t delay – join the Bitcoin Hyper ($HYPER) presale today.

You May Also Like

Trading time: Tonight, the US GDP and the upcoming non-farm data will become the market focus. Institutions are bullish on BTC to $120,000 in the second quarter.

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse