What is Multi-Asset Mode?

1. What Is Multi-Asset Mode?

1.1 Features of Multi-Asset Mode

1.2 Limitations of Multi-Assets Mode

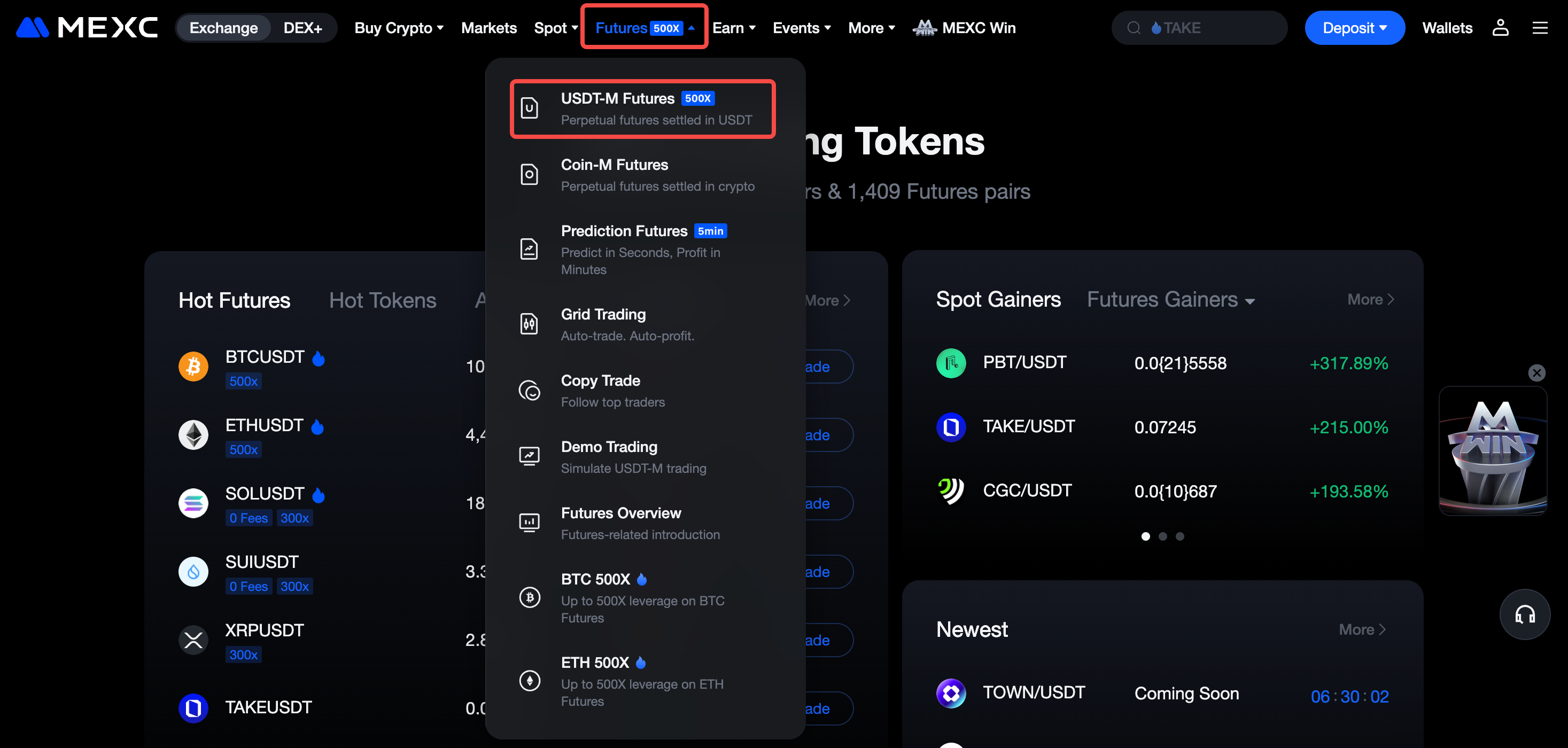

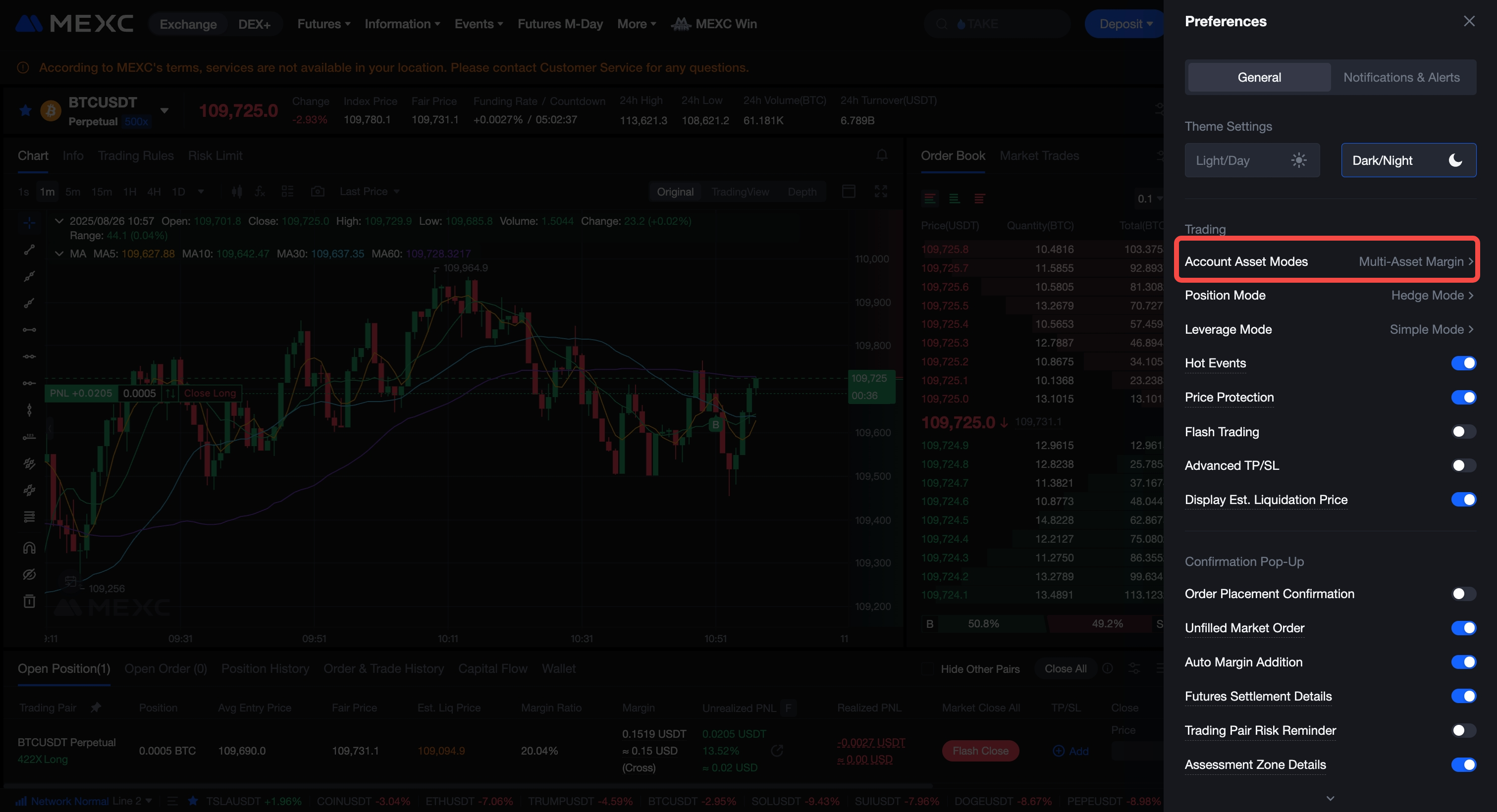

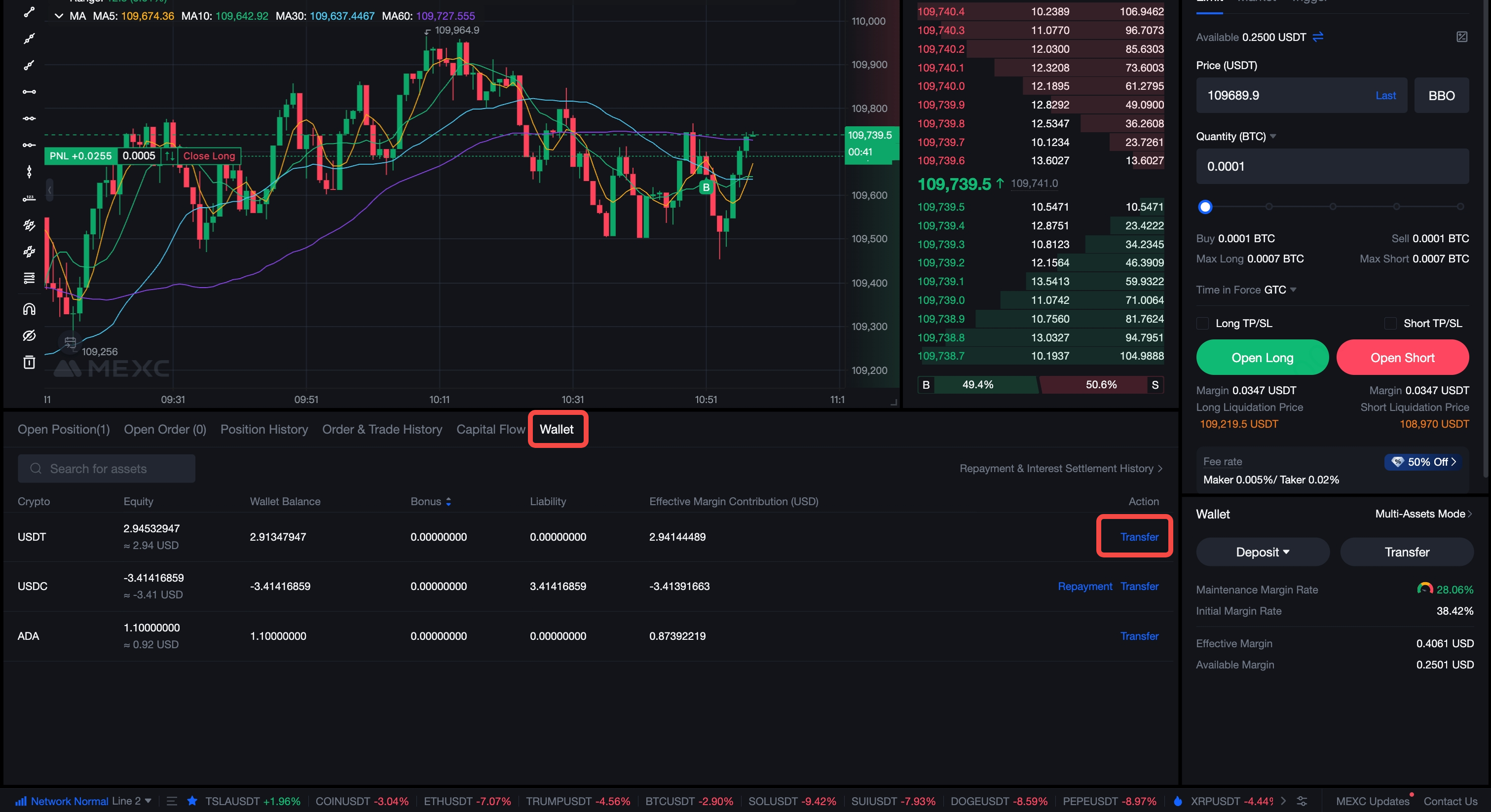

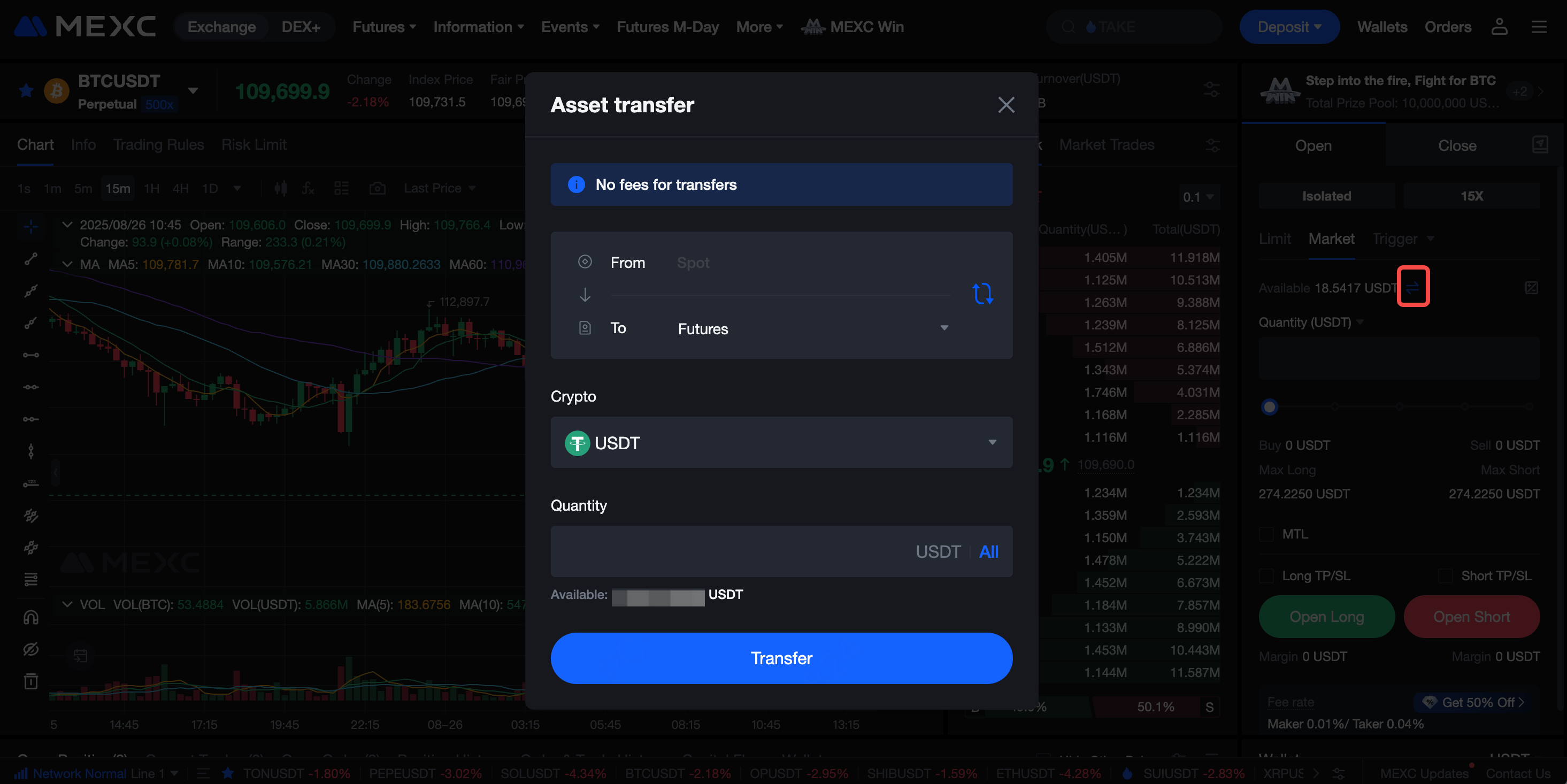

2. How to Enable Multi-Assets Mode

2.1 On the Web

2.2 On the App

3. What Is a Tiered Collateral Rate?

- Stablecoins (USDC, USDT): Collateral rate = 100%, with no limit on the amount that can be collaterialized.

- Non-stablecoin assets: Use a tiered collateral rate and have a maximum collateral limit. Any amount exceeding this limit will not count as effective margin.

- If an asset’s equity is negative, its collateral rate will not be considered when calculating effective margin.

Token | Staked Amount | Collateral Rate |

ETH | ≤ 100 | 90% |

≤ 200 | 80% | |

≤ 300 | 70% | |

≤ 400 | 60% | |

MX | ≤ 10,000 | 95% |

≤ 20,000 | 80% | |

≤ 30,000 | 70% |

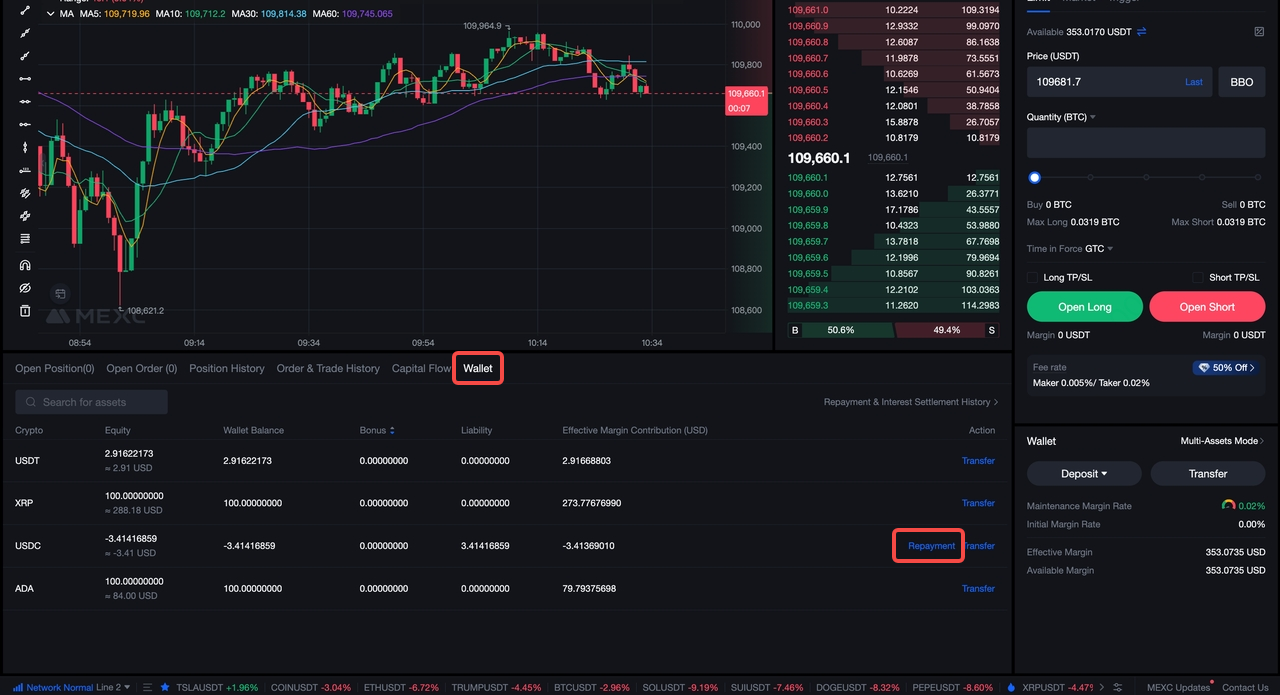

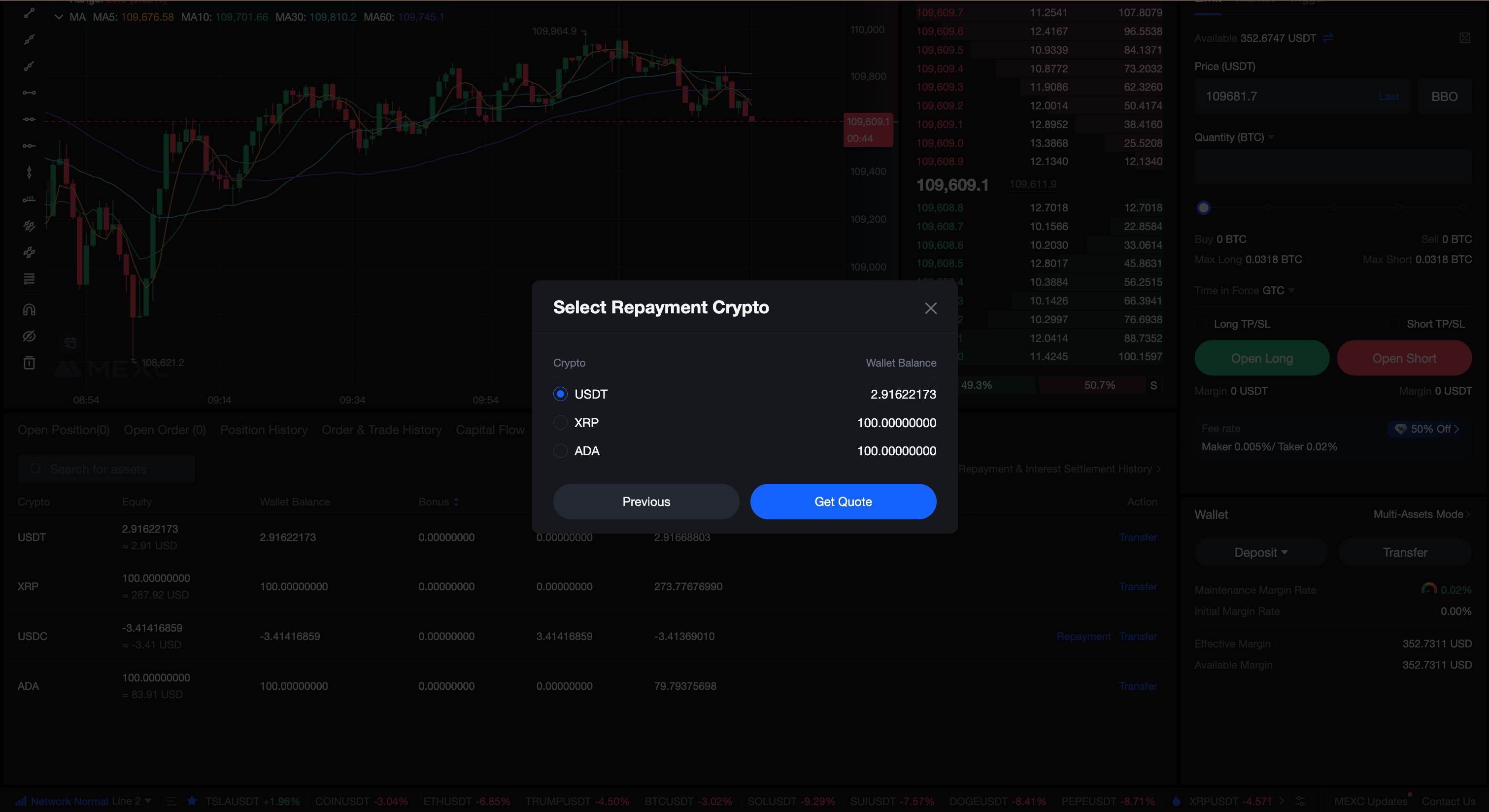

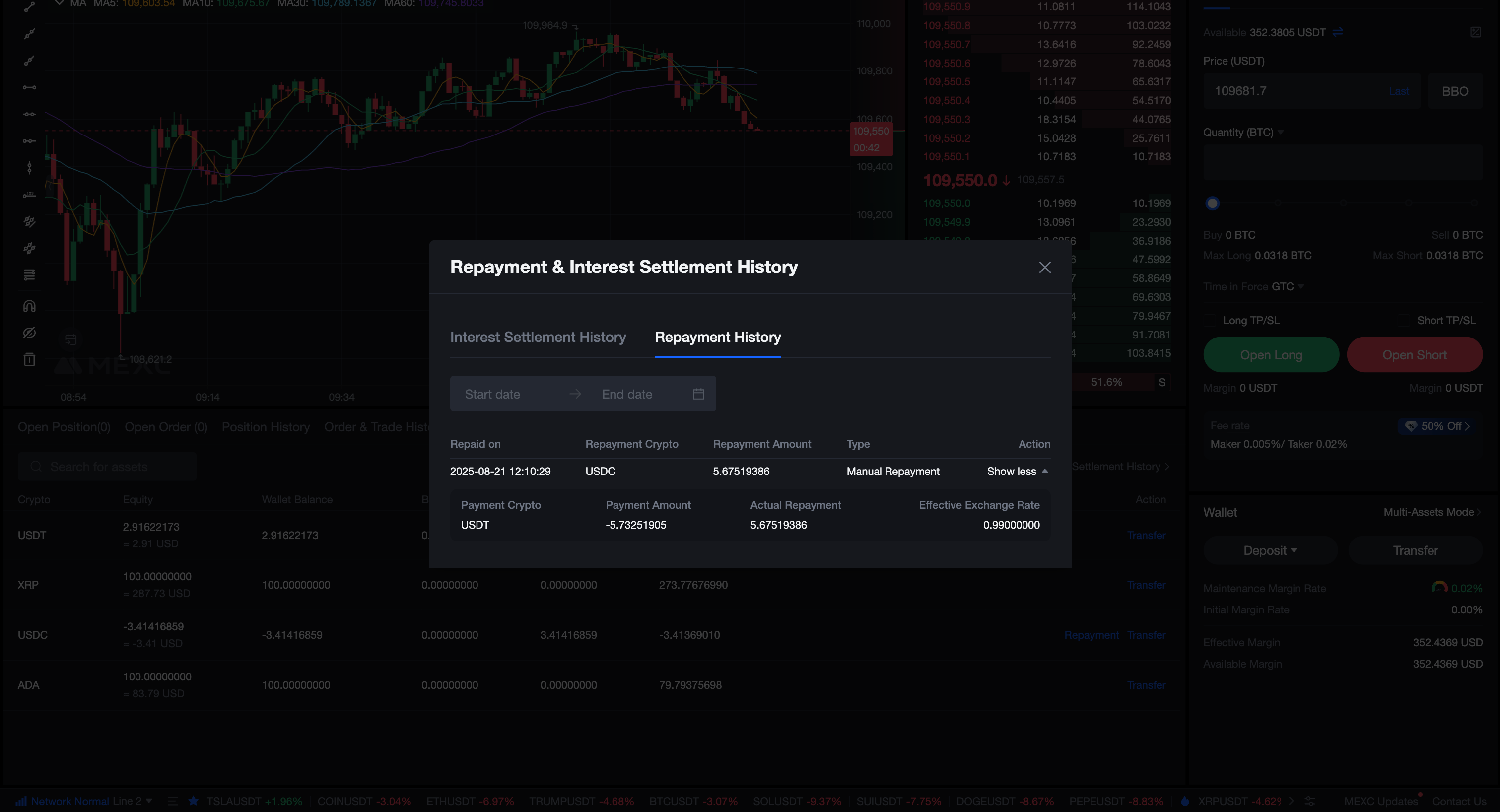

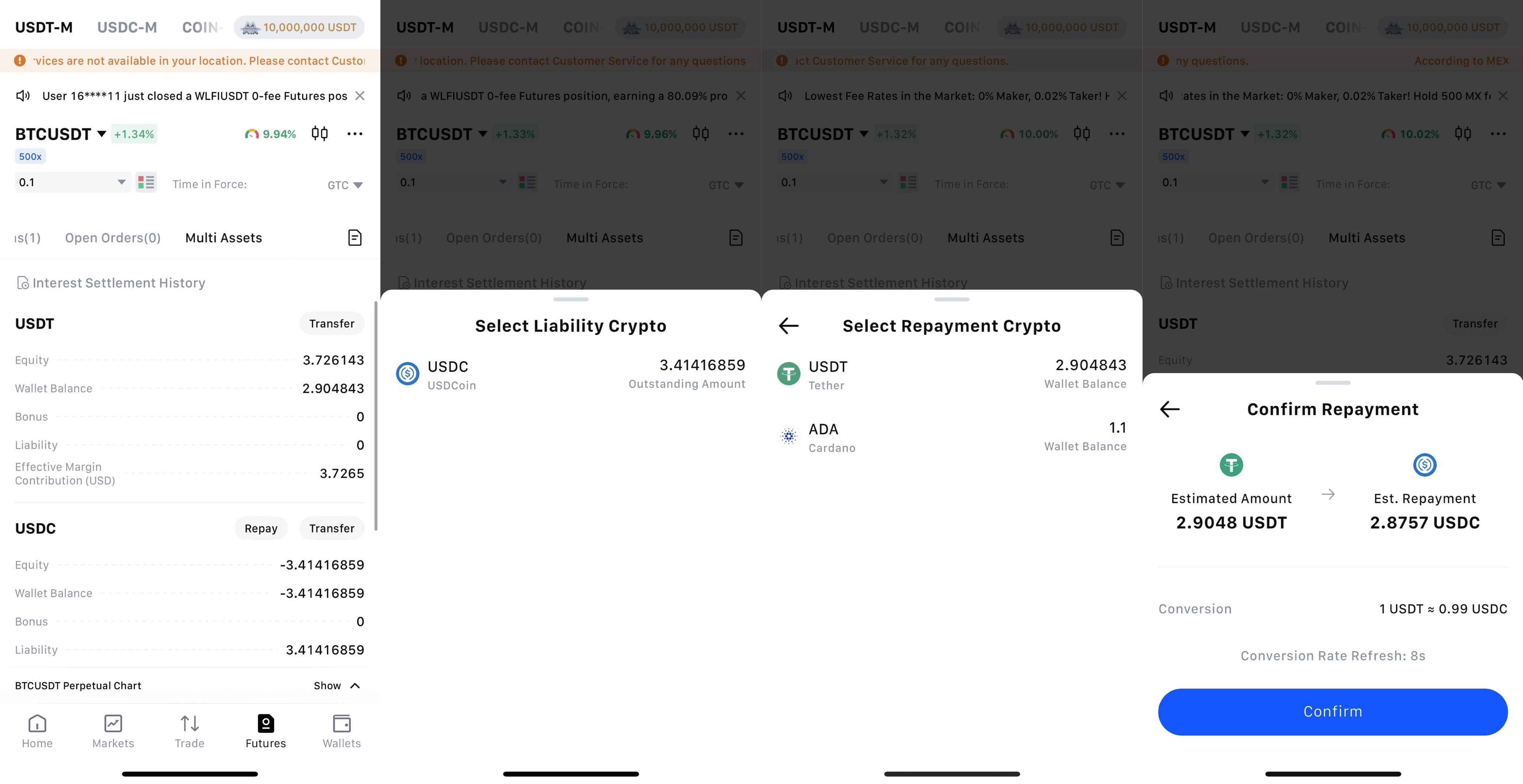

4. Repayment Process

4.1 On the Web

4.2 On the App

Popular Articles

When Will Bitcoin Go Back Up? Expert Analysis and Price Predictions

Bitcoin has pulled back from its recent highs, leaving investors wondering when the recovery will begin. This article examines short-term price signals, historical recovery patterns, and expert predic

What is Mog Coin (MOG)? Complete Guide to Mog Crypto Price, Price Prediction, News & Investment

In the dynamic world of cryptocurrency, meme coins continue to capture global attention through viral culture and community-driven movements. Mog Coin (MOG) stands as a revolutionary example of how in

What Shiba Inu (SHIB)? A Complete Guide: Ecosystem, Shibarium & Tokenomics Explained

Shiba Inu (SHIB) is a decentralized cryptocurrency originally known as a meme coin but has evolved into a full DeFi ecosystem with a Layer-2 blockchain (Shibarium) and multiple tokens including SHIB,

How to Stake SHIB on ShibaSwap: Complete Bury & Dig Guide to Earn Rewards

ShibaSwap is the decentralized exchange (DEX) for the Shiba Inu ecosystem, allowing users to swap tokens, provide liquidity (Dig), and stake assets (Bury) to earn rewards like BONE. Burying SHIB, LEAS

Hot Crypto Updates

View More

Bitcoin Price Crash in January 2026 Revealed: Complete BTC Bottom-Fishing Guide & Optimal Buying Strategy

Bitcoin's price plunge in January 2026 triggered market panic. This in-depth analysis reveals BTC decline causes, technical analysis, bottom-fishing timing, and practical strategies for accumulating

Gold Price Hits Historic $5,600 High! Tokenized Gold XAUT Trading Volume Surges – How to Seize Investment Opportunities?

Gold prices reach historic high above $5,600, driving massive XAUT trading volume surge past BTC. In-depth analysis of XAUT investment value, market data, and why MEXC is the best platform for

Bitcoin (BTC) 7-day Price Change

The latest Bitcoin (BTC) price has shown significant movement over the past week. In this article, we'll examine its current Bitcoin price today, 7-day Bitcoin price performance, and the key market

Bitcoin (BTC) Short-Term Price Prediction

Introduction to Bitcoin Short-Term Price Predictions In the fast-paced world of cryptocurrency, short-term Bitcoin predictions can help traders identify opportunities in daily, weekly, and monthly

Trending News

View More

QCP Capital: Bitcoin Remains Under Pressure Amid Geopolitical Tensions

Financial markets have shifted into risk-off mode amid rising geopolitical tensions. The current situation is also weighing on bitcoin, said QCP Capital analysts

New VirtuousAI Research: Mid-Market CEOs See AI’s Value, But Most Remain Stuck in Pilot Mode

New report finds mid-market CEOs see AI’s value, while expertise and integration gaps slow execution SILICON VALLEY, Calif., Jan. 21, 2026 /PRNewswire/ — Virtuous

Rising JGB Yields and Tariff Tensions Push Bitcoin into Defensive Mode, Says Analyst

Bitcoin declined more than 6% over the past week as Japanese government bond yields climbed to 2.29%, the highest since 1999, while escalating U.S.–Europe trade

Mood Sours From Greed To Extreme Fear In Days

The post Mood Sours From Greed To Extreme Fear In Days appeared on BitcoinEthereumNews.com. Keshav is currently a senior writer at NewsBTC and has been attached

Related Articles

Copy Trading Guide For Lead Traders

Copy Trading is an innovative cryptocurrency investment strategy that enables investors to automatically replicate the trades of experienced traders. For beginners lacking professional knowledge or tr

Setting Take-Profit and Stop-Loss for Futures Trading

In the cryptocurrency markets, price movements can be extremely volatile, and profits or losses can occur in an instant. For Futures traders, take-profit and stop-loss orders are not only essential to

How to Trade Futures on MEXC App: Complete Beginner's Guide

MEXC Futures trading offers MEXCers an advanced way to trade cryptocurrencies. Unlike Spot trading, Futures trading has its own unique logic and order-opening mechanisms. This article is designed to h

Spot Trading vs. Futures Trading: A Beginner's Guide to Determining Which is Right for You

As the cryptocurrency market continues to mature, the diversification of trading tools has become a key factor in building robust investment strategies. Among global mainstream crypto exchanges, MEXC