Ethena Teams Up with Flowdesk as USDe Soars Past $14B in Value

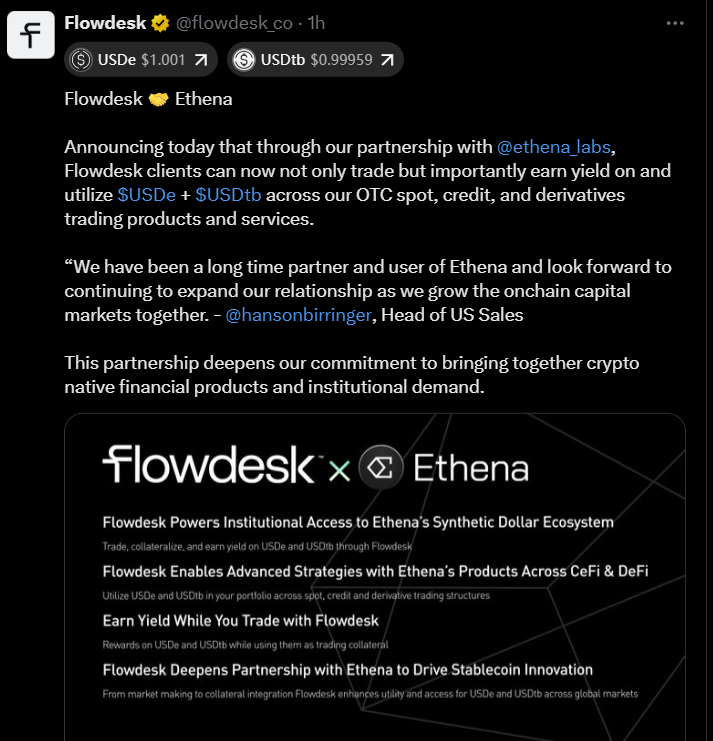

The Ethena stablecoin ecosystem continues to accelerate its expansion, with Ethena Labs announcing a strategic partnership with Flowdesk, an institutional OTC desk. This collaboration aims to enhance trading accessibility for Ethena’s two primary stablecoins—USDe and USDtb, supporting broader institutional participation in the growing DeFi landscape.

Flowdesk, catering to token issuers, hedge funds, and exchanges, will now facilitate trading and implement reward programs for both stablecoins, further integrating Ethena’s ecosystem into the broader crypto markets.

Source: Flowdesk

Source: Flowdesk

USDe is a synthetic dollar token from Ethena, primarily backed by cryptocurrencies and maintained through a delta-neutral hedging strategy designed to keep its valuation pegged at $1. Meanwhile, USDtb is collateralized by real-world assets, including BlackRock’s tokenized money market fund, BUIDL, as well as other stablecoins, aligning its risk profile closely with fiat-backed stablecoins like USDC and USDT.

The new partnership amplifies USDe’s status, which recently surpassed $14 billion in market capitalization, according to data from CoinMarketCap. Its circulating supply has increased by 21% over the past month, positioning USDe as the third-largest stablecoin by market cap, behind USDT and USDC.

The circulating supply of USDe has grown significantly in recent weeks. Source: CoinMarketCap

The circulating supply of USDe has grown significantly in recent weeks. Source: CoinMarketCap

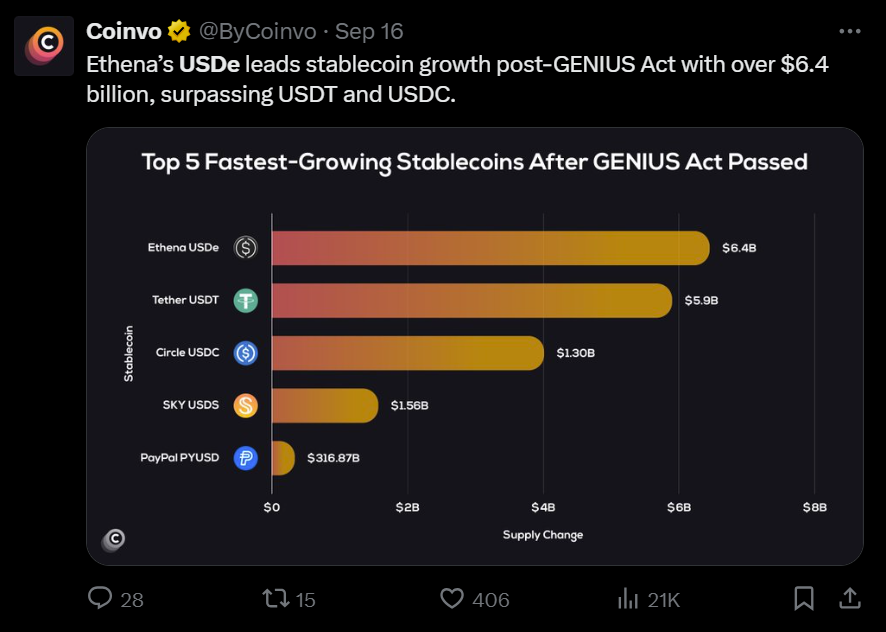

Growth and Interest in Ethena

Ethena’s rise can be attributed to USDe’s yield generation capabilities, which allow holders to earn returns while providing robust collateral for DeFi applications. This yield model has garnered the attention of major market players, including Mega Matrix, which recently filed for a $2 billion shelf registration to acquire Ethena’s governance token, ENA—a move that would enable participation in protocol governance and revenue sharing from USDe.

Additionally, Ethena’s revenue surpassed $500 million in August, bringing it closer to activating its planned “fee-switch” mechanism, distributing protocol profits to ENA token holders. Even more, two public companies—StablecoinX and TLGY Acquisition—have secured $890 million in merger funding, with intentions to acquire digital assets such as ENA.

Source: Coinvo

Source: Coinvo

Despite its rapid growth, some market participants approach Ethena’s synthetic stablecoin model with caution. Experts highlight risks tied to derivatives-backed stablecoins, such as funding rate volatility, counterparty exposure, and reliance on USDT-margined contracts. There is ongoing debate about whether synthetic dollars can withstand extended periods of market stress or negative funding environments.

For now, USDe’s demand remains strong, with users seemingly willing to accept the associated risks for yield opportunities, illustrating ongoing confidence in Ethena’s innovative blockchain-based stablecoins.

Related: ‘Ethena has 6x upside to Circle’: Mega Matrix doubling down on ENA ecosystem

This article was originally published as Ethena Teams Up with Flowdesk as USDe Soars Past $14B in Value on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

MAXI DOGE Holders Diversify into $GGs for Fast-Growth 2025 Crypto Presale Opportunities

UK crypto holders brace for FCA’s expanded regulatory reach