Crypto.com Addresses Secret User Data Leak Rumors

Crypto exchange Crypto.com has denied allegations that it concealed the details of a 2023 data breach from regulators or the public. The company maintains it acted swiftly to address the incident, which involved a targeted phishing campaign aimed at one of its employees.

According to a Bloomberg report published Friday, Noah Urban, affiliated with the hacking group Scattered Spider, claimed responsibility for phishing into a Crypto.com employee’s account early last year. This breach allegedly exposed a limited subset of personal information belonging to a small number of users.

Blockchain investigator ZachXBT subsequently suggested that Crypto.com might have attempted to cover up the breach, asserting that the platform had been breached multiple times and had not fully disclosed these incidents. Privacy concerns among cryptocurrency users have heightened following recent security issues at major exchanges like Coinbase, which experienced a significant data leak earlier this year.

Crypto.com’s official response emphasized their proactive measures. A spokesperson told Cointelegraph they filed a “Notice of Data Security incident” with the U.S. Nationwide Multistate Licensing System and submitted reports with relevant regulators amid the investigation. The company described the breach as limited, stating that the phishing attack only involved exposure of personal identifiable information of a few affected users.

The spokesperson added, “The incident was contained within hours of detection, and no customer funds were accessed or put at risk.” However, it remains unclear whether those impacted were directly notified or if the filings were made publicly accessible. Crypto.com has yet to comment further on the matter.

Crypto.com affirms that impact was minimal

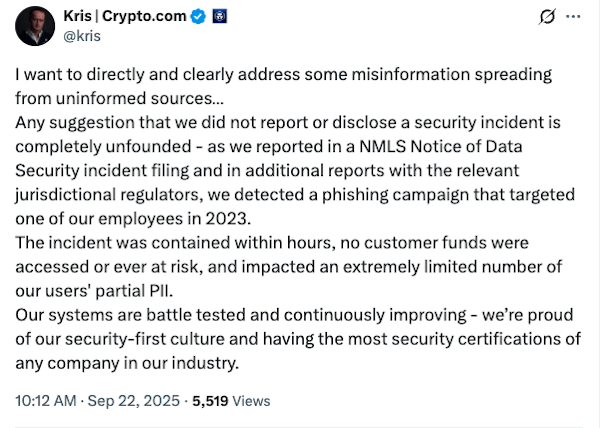

Crypto.com CEO Kris Marszalek addressed the issue on X, asserting that misinformation was circulating from uninformed sources. He emphasized, “Any suggestion that we did not report or disclose a security incident is completely unfounded,” and reiterated that the breach was reported promptly to U.S. regulators and relevant authorities.

Source: Kris Marszalek

Source: Kris Marszalek

Earlier in September, Crypto.com’s ties with broader industry developments included a strategic partnership with Trump Media & Technology Group to establish a CRO treasury, indicating ongoing collaboration between the crypto sector and major US political and media initiatives.

As the crypto markets continue to evolve, user data security remains a critical concern, with regulators scrutinizing how exchanges manage and disclose breaches to protect investor confidence. While Crypto.com asserts its incident was limited and promptly addressed, the broader industry continues to face challenges related to transparency and comprehensive security measures in the fast-changing landscape of cryptocurrency and DeFi.

This article was originally published as Crypto.com Addresses Secret User Data Leak Rumors on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Why It Could Outperform Pepe Coin And Tron With Over $7m Already Raised

U.Today Crypto Review: Ethereum (ETH) Loses 30-Day Progress, Shiba Inu’s (SHIB) End of Bears; Bitcoin’s (BTC) Last Recovery Chance