Why Vitalik Thinks Low-Risk DeFi Could Be Ethereum’s Secret Weapon

TLDR

- Vitalik Buterin believes low-risk DeFi could serve as Ethereum’s stable revenue source, similar to how Google Search funds Google’s other ventures

- He sees low-risk protocols like stablecoin lending as a way to balance profit generation with Ethereum’s founding values

- Current stablecoin lending yields around 5% for blue-chip assets, providing reliable returns without high speculation

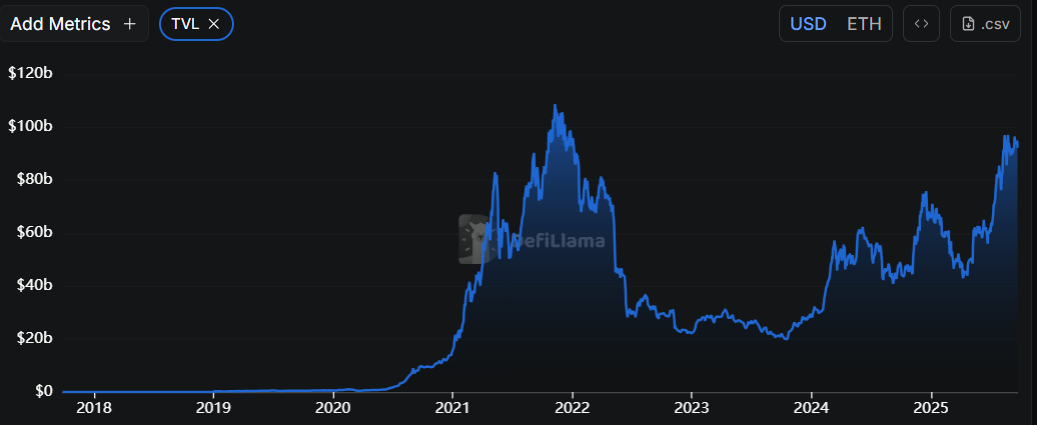

- Ethereum’s DeFi ecosystem has rebounded with total value locked crossing $100 billion for the first time since early 2022

- Buterin also promotes basket currencies and flatcoins as alternatives to dollar-denominated financial tools

Ethereum co-founder Vitalik Buterin has outlined a vision where low-risk decentralized finance protocols could become the network’s primary revenue driver. He compares this model to Google Search, which generates steady ad revenue that funds the company’s broader ecosystem.

In a recent blog post, Buterin argued that Ethereum needs a stable income source that doesn’t compromise its founding principles. The current ecosystem faces a split between high-fee speculative products and value-aligned applications that struggle financially.

Low-risk DeFi protocols offer a middle ground. These include basic financial services like payments, savings accounts, and collateralized lending that have matured since DeFi’s volatile early days.

Buterin points to Aave’s lending rates as a concrete example. Blue-chip stablecoins like USDT and USDC currently yield around 5% through these platforms. Higher-risk assets offer returns exceeding 10%.

The Ethereum founder believes these returns represent a reliable base layer of income. Unlike speculative trading or NFT markets, low-risk lending aligns with the network’s decentralized values while generating consistent fees.

DeFi Market Shows Recovery Signs

Ethereum’s DeFi ecosystem has shown recent strength. Total value locked across protocols has crossed $100 billion for the first time since early 2022.

Source: DefiLlama

Source: DefiLlama

This recovery comes after TVL lagged during the 2022-2023 bear market. Recent regulatory developments, including the Digital Asset Market Clarity Act, have helped revive institutional interest.

A survey from the DeFi Education Fund found that over 40% of Americans would consider using DeFi under stronger regulatory frameworks. This suggests potential for mainstream adoption of low-risk protocols.

Buterin contrasts Ethereum’s approach with Google’s advertising-dependent model. While Google provides valuable open-source tools like Chromium, its reliance on ads compromises user privacy.

Ethereum’s decentralized design could align financial performance with ethical outcomes. The network can generate revenue without sacrificing user data or control.

Revenue Challenges Persist

Despite the optimistic outlook, Ethereum faces current revenue challenges. On-chain revenue dropped 44% in August to $14.1 million, down from $25.6 million in July.

Network fees also fell 20% month-over-month. The Dencun upgrade, which reduced layer-2 transaction costs, has cut into Ethereum’s base-layer revenue long-term.

Some analysts describe August’s figures as among the weakest since early 2021. Critics worry that shrinking fee revenue could threaten ETH’s value proposition.

However, supporters argue Ethereum is evolving into a foundational layer for global finance. Lower costs could fuel broader adoption of DeFi services.

Buterin also promoted basket currencies and flatcoins as part of this stable foundation. These digital assets peg to consumer price indices or multiple fiat currencies rather than single dollar-denominated tools.

The Ethereum co-founder envisions future innovations like reputation-based lending and prediction markets. These would build on the stable base of low-risk protocols.

Ethereum’s DeFi total value locked currently stands above $100 billion, marking its highest level since early 2022.

The post Why Vitalik Thinks Low-Risk DeFi Could Be Ethereum’s Secret Weapon appeared first on CoinCentral.

You May Also Like

Big Day for Ripple and XRP ETFs: Everything You Need to Know

US SEC approves options tied to Grayscale Digital Large Cap Fund and Cboe Bitcoin US ETF Index