Dogecoin (DOGE) Price: Drops 18% as Weekend Massacre Wipes Out Recent Gains

TLDR

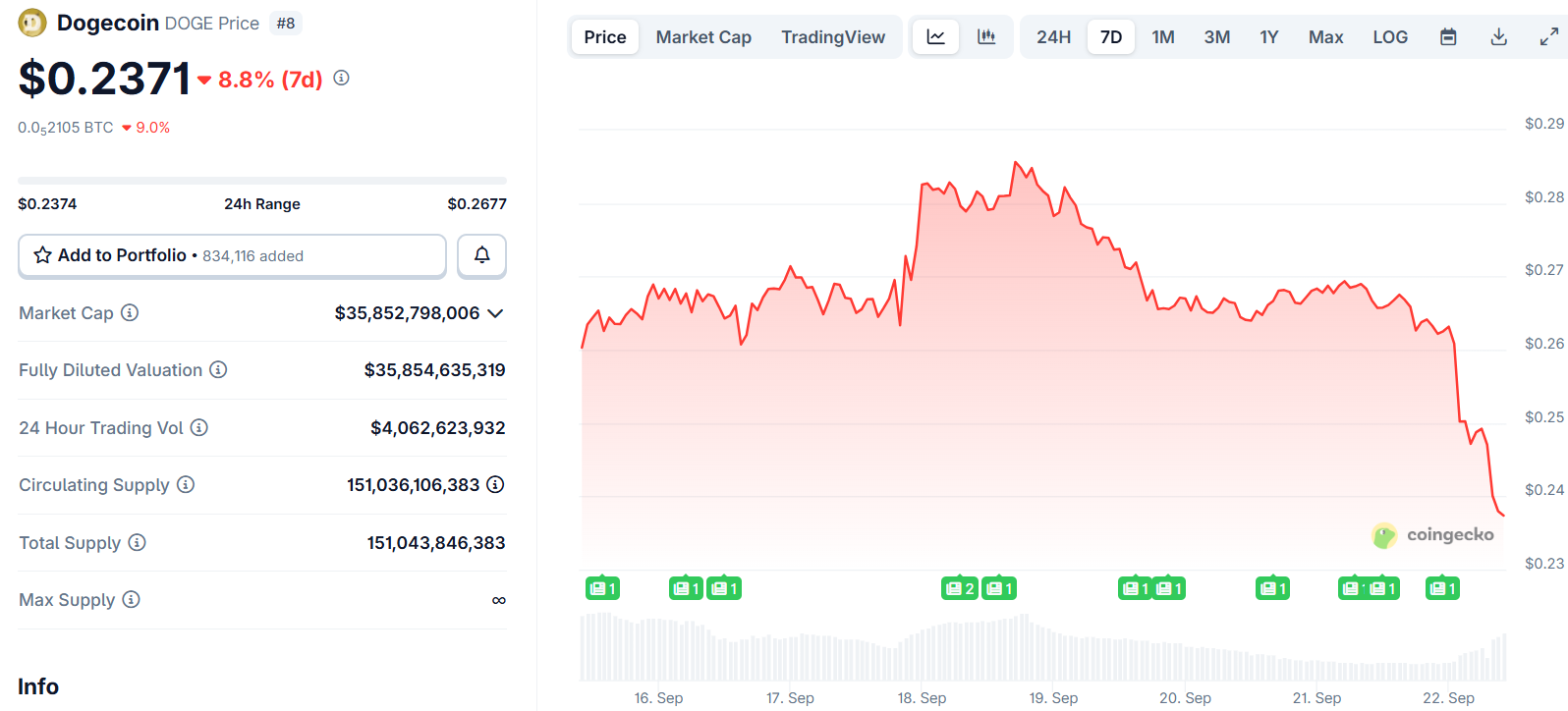

- Dogecoin fell more than 11% in 24 hours, becoming the biggest loser among top ten cryptocurrencies

- Trading volume surged 83% showing high selling pressure from traders

- The REX-Osprey DOGE ETF (DOJE) declined 5.76% since its Thursday launch

- Despite the decline, 80% of derivatives traders remain long on DOGE

- Price dropped from $0.27 peak to around $0.23 support level

Dogecoin experienced a sharp decline over the weekend, falling more than 11% in 24 hours. The drop made DOGE the worst performer among the top ten cryptocurrencies by market cap.

Dogecoin (DOGE) Price

Dogecoin (DOGE) Price

The selloff began late Sunday night and continued into Monday’s trading session. Price action saw DOGE drop from around $0.27 to support levels near $0.23.

Trading volume jumped 83% during the decline. The increased volume shows high selling pressure and strong trader interest in the move.

At the time of the decline, DOGE was trading around $0.2494. The price action came after a period of relative stability for the memecoin.

The drop coincided with the launch of the first Dogecoin ETF in the United States. The REX-Osprey DOGE ETF started trading on Thursday under the ticker DOJE.

ETF Performance Disappoints

The new ETF failed to generate positive momentum for Dogecoin. DOJE declined 5.76% since its debut, closing Friday at $24.80.

The fund holds a combination of DOGE and DOGE derivatives. REX Shares positioned the ETF as offering regulated access to Dogecoin exposure.

The ETF issuer included disclaimers about the fund’s performance. They stated that investing in DOJE is not equivalent to investing directly in DOGE.

The company also noted that the ETF’s performance is not designed to replicate the underlying asset exactly. This disclaimer may have dampened investor enthusiasm.

Trading volumes for the ETF remained modest in its first days. The lackluster reception contrasted with hopes for institutional adoption.

Market Sentiment Remains Mixed

Despite the price decline, derivatives data showed mixed sentiment. Nearly 80% of traders remained long on DOGE according to Coinglass data.

This suggests many traders still expect upward price movement. The high long ratio occurred even as spot prices were falling.

Market cap for Dogecoin dropped to around $34.5 billion during the decline. This represented a decrease from previous weekly highs near $40 billion.

Total trading volume across all exchanges exceeded $4.3 billion. This nearly doubled the 50-day average trading volume.

The volume surge indicated both institutional rebalancing and retail participation. Large traders appeared to be adjusting positions during the selloff.

Source: TradingView

Source: TradingView

Technical analysts noted the $0.25 level as key support. Some pointed to accumulation activity at this price point.

Resistance levels remain near $0.27 based on recent trading patterns. A break above this level could signal renewed upward momentum.

The decline occurred during a period of broader crypto market weakness. Other major cryptocurrencies also faced selling pressure over the weekend.

Global risk sentiment has been fragile due to macroeconomic uncertainty. Regulatory scrutiny on cryptocurrencies has also increased recently.

Current Market Position

As of Monday, DOGE was trading in the $0.24 to $0.26 range. The price found some stability after the initial sharp decline.

Analysts are watching key technical levels for future direction. Support at $0.25 and resistance at $0.27 remain important price points.

Conservative forecasts suggest possible further downside to $0.23 if selling continues. More optimistic predictions point to potential recovery toward $0.28-$0.30.

The average September price target among analysts sits around $0.263. Some experts see potential highs near $0.268 if market conditions improve.

Current trading volumes remain above average levels. This suggests continued active participation from both retail and institutional traders.

The post Dogecoin (DOGE) Price: Drops 18% as Weekend Massacre Wipes Out Recent Gains appeared first on CoinCentral.

You May Also Like

Polymarket signals 98% chance Fed will keep rates steady in January meeting

BlackRock boosts AI and US equity exposure in $185 billion models