Understanding Mutuum Finance’s Value

Understanding Mutuum Finance’s value is becoming a major focus in the crypto market. Investors are watching closely as this new crypto coin advances its presale, now in Phase 6.

The project has already raised $16,150,000 since launch and attracted 16,470 holders. Its current price of $0.035 represents a 250% gain from the opening presale phase at $0.01.

Importantly, Phase 6 is selling fast, and once Phase 7 begins, the token price will rise 14.3% to $0.04. The planned launch price is $0.06, meaning current buyers stand to lock in a 420% return once the token lists.

Inside Mutuum Finance Presale

Mutuum Finance (MUTM) is currently progressing through its 11-phase presale. Each phase comes with an automatic price increase, rewarding early participants with larger gains. Phase 6 is live, and investors are rushing to secure tokens before the next price jump.

The team has designed MUTM with a fixed supply of 4 billion tokens, allocating up to 45% to the presale. This structured release creates scarcity, which is critical for long-term value. Beyond the token sale, Mutuum Finance is preparing its decentralized lending-and-borrowing protocol.

The dual-market structure includes Peer-to-Contract for instant liquidity and Peer-to-Peer for tailored loan agreements. These markets complement each other, giving users more flexibility while maintaining efficiency.

Moreover, Mutuum Finance has finalized its Certik audit with a strong score of 90/100. Security has been reinforced further through the launch of a $50,000 Bug Bounty Program in partnership with Certik. Rewards are divided across four severity tiers, ensuring quick reporting of any vulnerabilities. This focus on trust and protection sets Mutuum apart from other new cryptocurrencies.

Mutuum Finance Utility And Investor Benefits

Mutuum Finance is introducing real-world utility through lending mechanics. Borrowers are required to overcollateralize, which keeps the system solvent and avoids reckless exposure. Interest rates shift dynamically depending on liquidity, encouraging capital efficiency.

Additionally, the platform will support stable borrowing rates in select cases, giving users predictability when markets are volatile.

Investors are also gaining from unique incentives. A newly launched dashboard now tracks the top 50 holders, with bonuses reserved for those who maintain their positions. This leaderboard feature creates engagement while rewarding loyalty.

Furthermore, a $100,000 MUTM giveaway has been announced, splitting the prize among 10 winners. Eligibility requires only a minimum $50 presale investment, opening the door for wider participation.

These steps show that Mutuum Finance is not just focusing on token sales but is also actively building systems that support long-term growth. Consequently, investors are treating MUTM as one of the best cryptos to buy now for exposure to lending and borrowing markets.

Conservative Price Predictions For 2025-2027

Mutuum Finance is steadily building a case for strong returns over the next two years. From its presale price of $0.035 in Phase 6 to a launch at $0.06, investors are already anticipating a 420% gain. Looking further, a conservative estimate places MUTM between $0.25 and $0.45 in 2025, and between $0.60 and $0.85 in 2027, assuming steady adoption of its lending protocol.

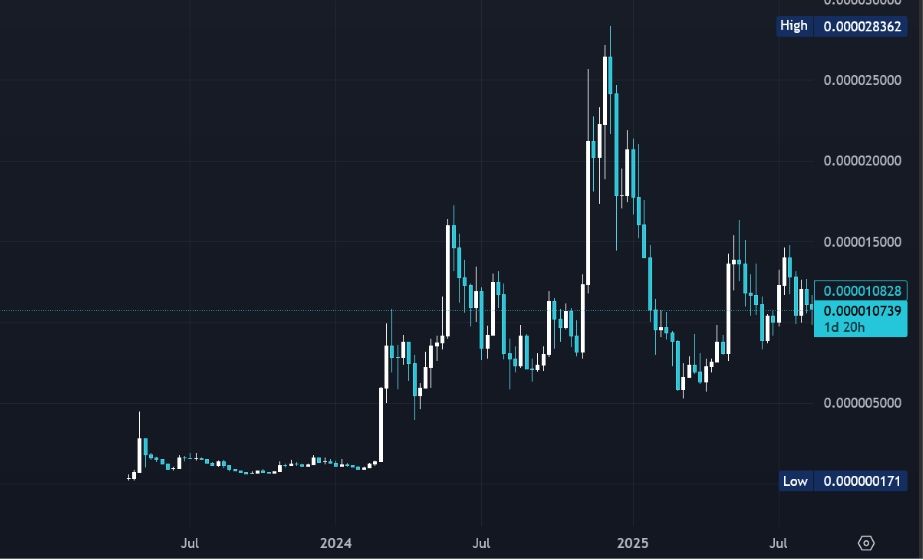

For context, Pepe coin in 2023 illustrates how fast crypto coins can move. Pepe started near $0.000000055 in April 2023 before rocketing to $0.0000043 in just one month. That rally delivered over 7,700% ROI for early buyers. While Pepe’s spike was short-lived and speculative, Mutuum Finance is anchoring its growth on utility. The comparison highlights that even modest projections for MUTM still offer strong upside.

\ Therefore, investors weighing which crypto to buy today for long-term gains are seeing Mutuum Finance as a standout. The token’s structured presale, clear roadmap, and strong risk management tools make it one of the best cryptocurrency to invest in as the market heads into 2025.

Looking Ahead To Long-Term Value

Mutuum Finance is showing that careful planning and product delivery can attract significant investment. Phase 6 is almost closing, the token is launching soon, and the lending protocol is moving closer to public rollout. Given the success of its presale, combined with its Certik-backed security, the project is positioning itself as one of the top cryptocurrencies to watch.

Investors should carefully consider that understanding Mutuum Finance’s value today means weighing long-term growth against current entry points. Those who act early stand to benefit as this altcoin transitions from presale to real-world use.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://mutuum.com/

Linktree:

:::tip This story was published as a press release by Btcwire under HackerNoon’s Business Blogging Program. Do Your Own Research before making any financial decision.

:::

\

You May Also Like

Born Again’ Season 3 Way Before Season 2

Fed forecasts only one rate cut in 2026, a more conservative outlook than expected