Ethereum (ETH) Price Prediction: Ethereum Whales Trigger $72M Sell-Off as Support Holds at $4K—Potential Rally to $5K

This large-scale sale has highlighted the influence of whales on Ethereum’s price movements and sparked discussions among traders and analysts about the next potential targets for ETH. The market is now closely watching critical support levels to determine whether a rebound toward $5,000 is possible.

Ethereum Price Today and Recent Movements

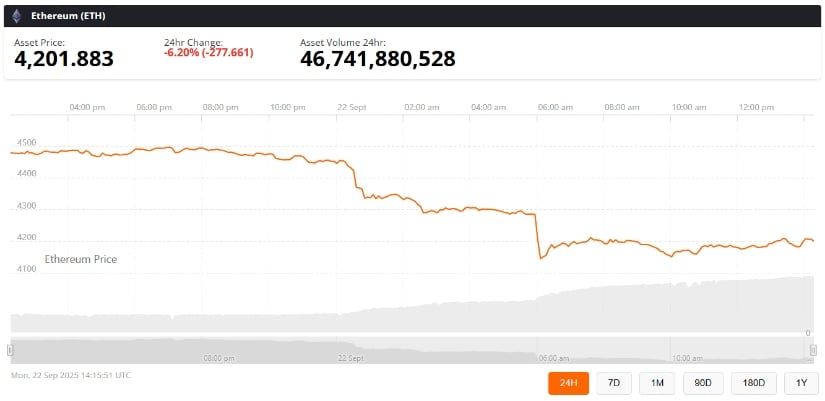

Ethereum is currently trading around $4,201, reflecting a notable 6.2% drop over the past 24 hours. According to Brave New Coin, the ETH price has faced strong downward pressure amid large liquidations and high-profile whale activity. Observers point out that such significant sell-offs often precede market corrections, highlighting the role of institutional actors in shaping short-term Ethereum price dynamics.

Ethereum (ETH) was trading at around $4,201, down 6.20% in the last 24 hours at press time. Source: Ethereum Price via Brave New Coin

Crypto commentator @TedPillows noted the whale’s timing, suggesting advanced market knowledge: “A whale sold $72,880,000 in ETH just before the market dump. He definitely knew something.”

Historical studies, including a 2020 Journal of Financial Economics report, support the idea that whale behaviors can amplify volatility in crypto markets. Patterns like this often align with technical indicators, such as the head-and-shoulders pattern forming on Bitcoin’s chart, which can precede bearish moves.

Key Support Levels and ETH Price Prediction

Ethereum is currently testing a critical support zone near $4,200, as highlighted by crypto analyst Kamran Asghar: “$ETH at a critical support zone. Will it hold and push for $5K? Let’s see.”

ETH tests a crucial $4K support, eyeing a potential rally toward $5K. Source: @Karman_1s via X

Recent data shows that over $86 million in ETH was sold by whales during this period, while $500 million in liquidations occurred across major exchanges, according to CoinGecko. Despite these pressures, analysts remain cautiously optimistic. Rising network activity and $5.4 billion in ETF inflows are cited as factors that could support a rebound toward $5,000, if the $4,200 support holds.

Fundstrat has projected that Ethereum could even target $5,500 by mid-October, assuming whale-induced volatility stabilizes. These forecasts are also supported by on-chain data and technical analysis, reflecting growing interest in Ethereum price prediction 2025 and potential future rallies.

Why Whales Influence Ethereum Price

Large-scale Ethereum holders, often referred to as “whales,” have the ability to move markets significantly. When a whale sells millions of dollars in ETH, it can trigger panic among smaller investors, leading to cascading liquidations. Conversely, whale accumulation can indicate confidence in the long-term ETH price prediction.

A whale dumped $72.8M in ETH right before the crash—insiders always swim ahead of the storm. Source: @TedPillows via X

Recent whale activity suggests a calculated strategy rather than random selling. Analysts point out that dormant whales often re-enter the market during periods of volatility, responding to macroeconomic signals or proprietary trading tools like Messari Agent on Warden Protocol.

Outlook for Ethereum in the Coming Weeks

Short-term analysis of the price of Ethereum indicates that ETH will likely stay near the $4,200 level of support. If the level remains intact, further upside towards $5,000 is likely driven by ETF inflows, network growth, and stabilizing market sentiment.

ETH moves within a descending channel, approaching a breakout with strong support below and potential upside targets—manage your capital carefully. Source: CryptoAnalystSignal on TradingView

The investors must remain vigilant in the case of whales, as the big holders are also drivers of sudden price movements and trend signals in the market. For Ethereum news watchers, the situation indicates the need to marry technical analysis with on-chain analysis and macroeconomic analysis.

Final Thoughts

The recent price fluctuations of Ethereum highlight the effect of whales on the Ethereum price today and short-term market trends. Though support at $4,200 is still paramount, a possible rally toward $5,000 could be feasible in case the market stabilizes. Analysts are still observing both ETF inflows and whale activity for indicators on the direction of Ethereum.

With Ethereum price prediction 2025 becoming increasingly popular, investors and traders should be careful to observe all that concerns applicable support levels, whales, and the overall market trend to make effective investment choices.

You May Also Like

Why Everyone Is Talking About Saga, Cosmos, and Mars Protocol

CME Group to Launch Solana and XRP Futures Options