XRP and Solana ETF Hype Returns — Price Prediction Momentum Builds Into SEC Decision

The crypto market is buzzing as XRP and Solana enter critical regulatory stages. The U.S. Securities and Exchange Commission (SEC) is contemplating major decisions regarding both altcoins that might influence investor sentiment. There is already speculation about a Solana exchange-traded fund (ETF) approval, and the launch of XRP-based ETFs created excitement around new institutional flows.

With these headline-grabbing altcoins, MAGACOIN FINANCE is proving to be a low-cost option with structural scarcity, attracting investors in search of early investment opportunities.

Meanwhile, the introduction of Rex-Osprey XRP ETF (XRPR) drew a lot of interest as over $37 million was traded within the first day. Asset managers, such as Franklin Templeton, Bitwise, WisdomTree, and 21Shares, are queuing up similar products, which could absorb 1% 4% of the 59.77 billion XRP in circulation in a year.

Market researchers observe that a 4% absorption at existing prices may trigger billions of fresh inflows, which will lead to a robust rally.

Therefore, the SEC’s future ruling on such ETFs will be critical. Acceptance would lead to additional institutional adoption and greater liquidity in the markets. Concurrently, any delays would create temporary volatility. Both assets show strong technical setups and heavy whale accumulation. With key regulatory milestones approaching, investors remain on high alert.

Ripple and Solana Price Eye New Highs

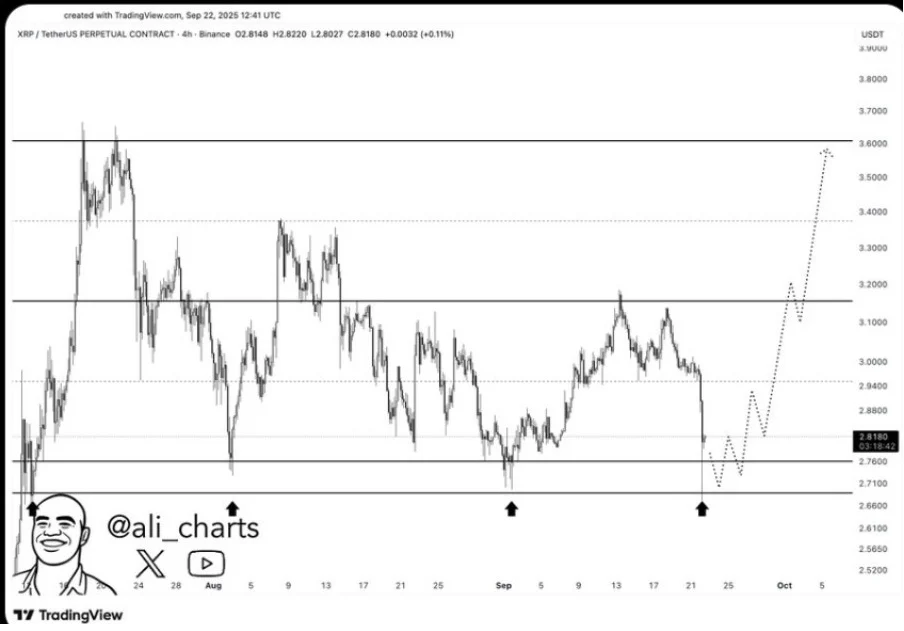

In the meantime, market signals are positive for both tokens. Solana has a relative strength index (RSI) of 68, indicating presence of strong momentum. In the case of XRP, analysts point to a support of $2.70, and the probable upside to a range of $3.60 to $5, provided the buying pressure is maintained.

These positive arrangements coincide with the expansion of crypto adoption, and risk assets are supported by macro conditions, including reduced U.S. interest rates. These regulatory catalysts make traders believe that the next all-time high for SOL and XRP may come soon if ETF approvals become a reality.In addition to these top assets, MAGACOIN FINANCE is an excellent presale. Its community and fixed token supply provide another type of opportunity to investors who want to get early exposure to a potential breakout project.

MAGACOIN FINANCE: The Hidden Gem to Buy in 2025

MAGACOIN FINANCE is emerging as one of the most promising crypto presales in 2025.The project is built based on a capped supply and a smart contract that was audited on two occasions, which has provided transparency and scarcity that most speculative tokens do not have.

Therefore, the features make MAGACOIN FINANCE attractive to retail and institutional investors who are interested in big returns.

Momentum is picking up with the presale activity, and whale wallets have already started their accumulation phase. This pattern is common in early bull-run tokens. Consequently, MAGACOIN FINANCE could deliver significant upside when market timing aligns.

Conclusion

With the SEC on the verge of deciding on key ETFs, XRP and Solana are at the center of attention. They have optimistic price forecasts, and more institutional investors are showing interest. The market is confident that Solana will get a 99% ETF approval status, and there is potential for multibillion-dollar inflows for XRP.

Concurrently, MAGACOIN FINANCE offers early investors the opportunity to diversify into a high-growth presale. Having great fundamentals and social momentum, MAGACOIN FINANCE is one altcoin to consider as 2025 end approaches.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

You May Also Like

Let insiders trade – Blockworks

What We Know So Far About Reported Tensions at Bitmain

Galaxy Digital’s head of research explains why bitcoin’s outlook is so uncertain in 2026

Copy linkX (Twitter)LinkedInFacebookEmail