RAY price at risk as Raydium users plunge 81%

Raydium’s token rose by over 12% on Thursday, June 19 as its active users and market share in the decentralized exchange industry retreated.

Raydium (RAY) price rose to an intraday high of $2.7040, up 40% from its lowest level this week. It then pared back those gains to trade at $2.30, giving it a market capitalization of $598 million.

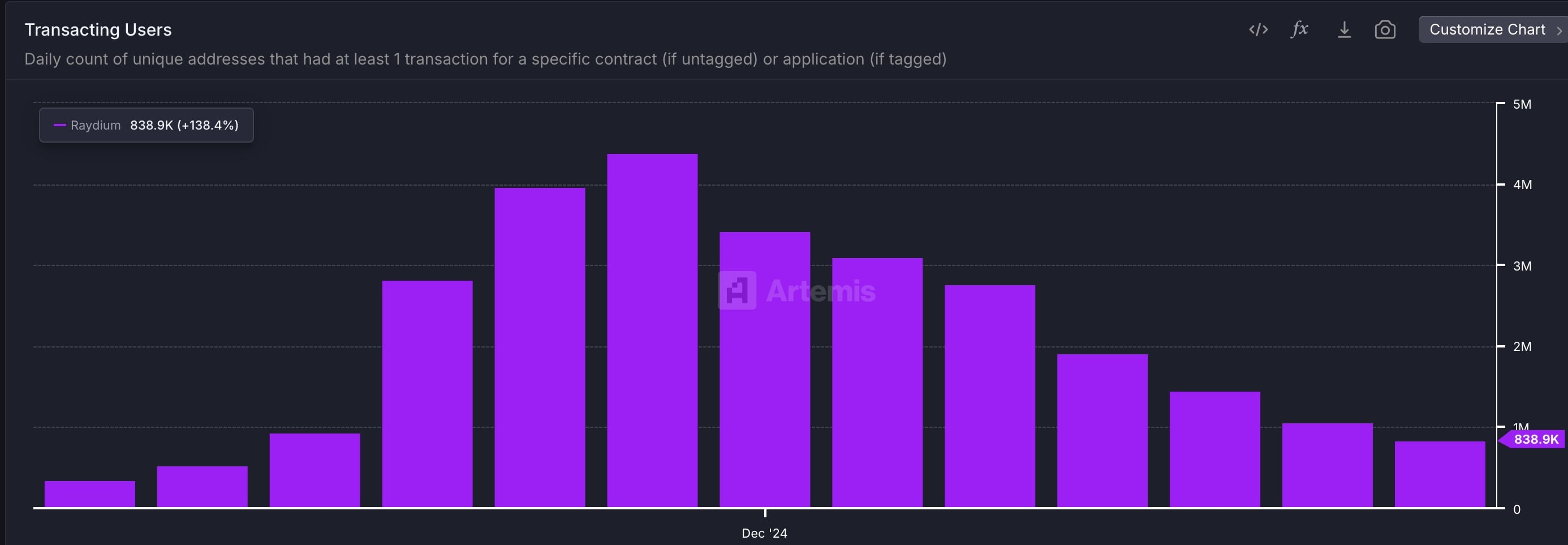

Third-party data shows that Raydium’s platform is under pressure. Data compiled by Artemis shows that Raydium has over 838,000 active transacting users, a figure that has dropped for six consecutive months. It is down 81% from its December level of over 4.4 million.

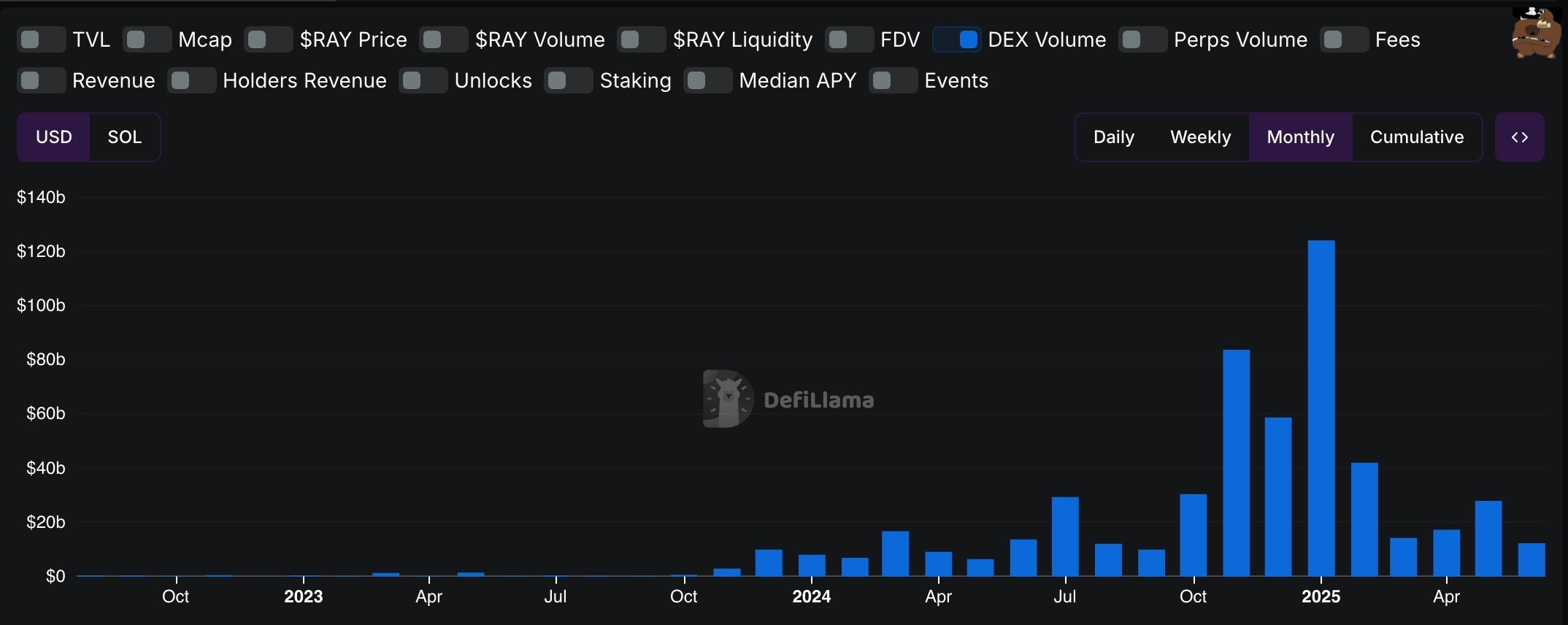

Additional data shows that Raydium has lost market share in the DEX industry. According to DeFi Llama, its network processed transactions worth over $21.9 billion in the past 30 days, far below PancakeSwap’s $138 billion and Uniswap’s $95 billion.

By comparison, the platform’s daily volume of $467 million trails other DEX networks such as PancakeSwap, Uniswap, Pump, and Aerodrome. Most notably, Raydium’s monthly transaction volume has dropped by 90%, falling from $124 billion in January to just $12 billion this month.

The decline is closely tied to the underperformance of Solana (SOL) meme coins. CoinGecko data shows that many of these tokens have plunged more than 15% in the past seven days, pushing their total market cap down to $9.7 billion, a steep drop from $30 billion in January. Raydium typically sees higher volume when these tokens are rallying.

Lower transaction volume has also weighed heavily on Raydium’s revenue, which has plummeted from $58 million in January to $1.9 million this month.

RAY price technical analysis

The three-day chart shows that Raydium’s price peaked at $8.5285 in January before pulling back to $2.25. It has since fallen below both the 50-day and 100-day Exponential Moving Averages, which have formed a bearish crossover.

A head-and-shoulders pattern has also emerged, a common bearish reversal signal. Based on this formation, the token could be headed for a breakdown toward $1.40, the April 10 low. However, a move above the right shoulder at $3.820 would invalidate this bearish setup.

You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

UBS CEO Targets Direct Crypto Access With “Fast Follower” Tokenization Strategy