Biggest Whale Buys This Week: Ethereum, XRP, Aster and Bitcoin Hyper

Experts believe that the crypto market is on the verge of this year’s most explosive bull run as Rektmber gives way to Pumptober.

Unsurprisingly, whales are quickly positioning themselves for massive gains over the next 3 months.

Besides sizable allocations in large-caps like Ethereum and XRP, smart money investors are buying low-cap gems like Bitcoin Hyper with 10x to 100x upside potential.

Ethereum, XRP Among The Biggest Whale Buys

Ethereum is in high demand among the whales, owing to a growing consensus among experts that the largest altcoin could hit $10,000 this year.

Just today, a whale made a massive $117 million allocation into ETH.

https://twitter.com/Altcoinbuzzio/status/1973035035717730594Unsurprisingly, ETH treasury firms are taking the full advantage of the recent correction. After a massive $963 million buy, Tom Lee’s BitMine Immersion now has Ethereum holdings worth $10.66 billion.

Meanwhile, Sharplink Gaming’s ETH position is worth $3.37 billion.

Besides Ethereum, XRP is in high demand. Prominent analyst Ali Martinez reveals that whales have purchased 120 million $XRP over the past 24 hours.

https://twitter.com/ali_charts/status/1972593693535150083With the US SEC’s recent Generic Listing Standards, the launch of spot XRP ETFs is imminent, which is expected to provide a massive boost to the token price.

Popular trader Crypto Tony projects that the XRP price will hit $4.80 this year itself.

Aster, PUMP Are The Most Popular Mid-Caps

Whales are quietly accumulating the Pump.fun token ahead of next quarter’s bull run. On-chain analytics platform Lookonchain flagged two whales buying 622.49 million PUMP, worth $3.48 million.

https://twitter.com/lookonchain/status/1973038700482421155The PUMP price is showing strong resilience despite the uncertain broader market outlook, up by nearly 13% on Tuesday, while BTC has remained largely flat.

Similarly, the new Aster coin is in high demand despite the sharp sell-off, with whales buying the dip.

Earlier this week, a whale accumulated $117 million worth of ASTER, with rumours circulating that the wallet is linked to Donald Trump’s social media company, Truth Social.

Similarly, Lookonchain flagged another $4.24 million buy on Tuesday.

Bitcoin Hyper In High Demand, Experts Call It The Next 100x Crypto

Bitcoin Hyper (HYPER) has already established itself as one of the hottest low-cap coins, as evidenced by $19.4 million raised in its presale.

For the uninitiated, Bitcoin Hyper is the latest BTC layer-2 project, powered by cutting-edge zero-knowledge architecture and the Solana Virtual Machine.

With its promise of high scalability, performance and programmability within the BTC ecosystem, Bitcoin Hyper is expected to onboard a wave of new payment apps, DeFi apps and meme coins. Unsurprisingly, its native token, HYPER, is in high demand.

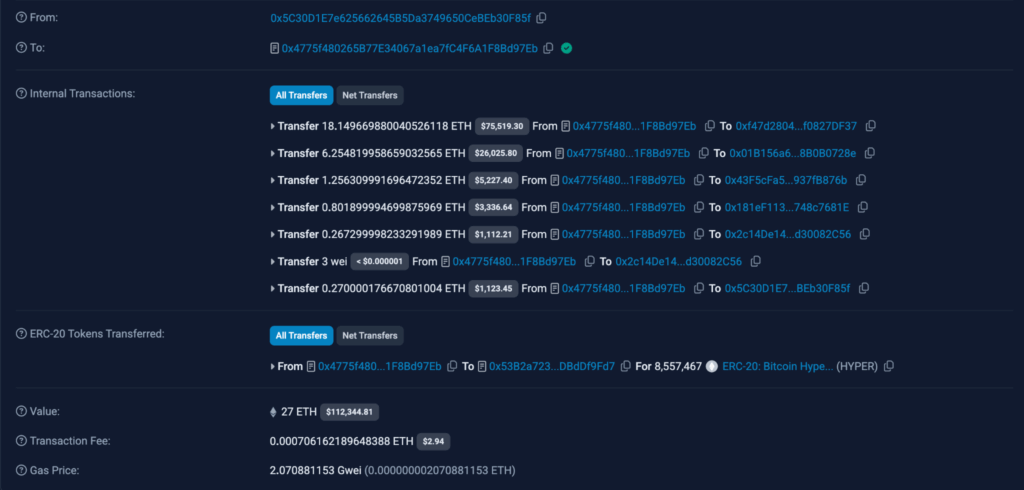

Whales have been particularly quick to recognize HYPER’s upside potential. For instance, one deep-pocketed investor swapped 27 ETH for Bitcoin Hyper, worth over $112k.

He then invested another $210k in HYPER in two separate transactions, maximizing exposure ahead of its open market launch.

Smart money investors are highly optimistic about Bitcoin Hyper’s post-launch prospects, especially in the upcoming bull run. After all, layer-2 coins show a strong correlation with their respective layer-1s. With Bitcoin expected to hit $200,000 in the coming months, HYPER is well-positioned to deliver outsized returns.

Several influencers and seasoned traders are even backing HYPER as the next 100x crypto.

Visit Bitcoin Hyper Presale

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware that our commercial partners may use affiliate programs to generate revenue through the links in this article.

You May Also Like

Visa Expands USDC Stablecoin Settlement For US Banks

Nasdaq Company Adds 7,500 BTC in Bold Treasury Move