Crypto Market Cap Clears $3.95T: Best Altcoins to Buy Now With Solana and XRP Outpacing BTC

The global crypto market cap has surged past $3.95 trillion, setting the stage for a new wave of growth across altcoins. With XRP, Solana, and MAGACOIN FINANCE leading analyst picks, many traders are seeking the best altcoin to buy as fresh liquidity flows into the market.

ETF Flows Put Solana and XRP Ahead of Bitcoin

Last week, Bitcoin ETF products saw heavy outflows of more than $700 million, dragging the overall market lower. Ethereum also faced over $400 million leaving funds, showing a pullback across large-cap assets.

But the story shifted when Solana and XRP recorded inflows instead. Solana alone gained $291 million for the week, taking its year-to-date inflows to $1.86 billion. XRP followed with $93.1 million in inflows, totaling $1.6 billion for the year.

Together, they brought in $384 million at a time when Bitcoin and Ethereum products were under pressure.

These numbers matter for traders looking at the best altcoin to buy right now. They show where capital is flowing. With U.S. ETF approvals expected soon for both assets, more institutional entry could follow. For now, Solana and XRP are proving that money is finding its way into alternatives even when the two biggest coins slow down.

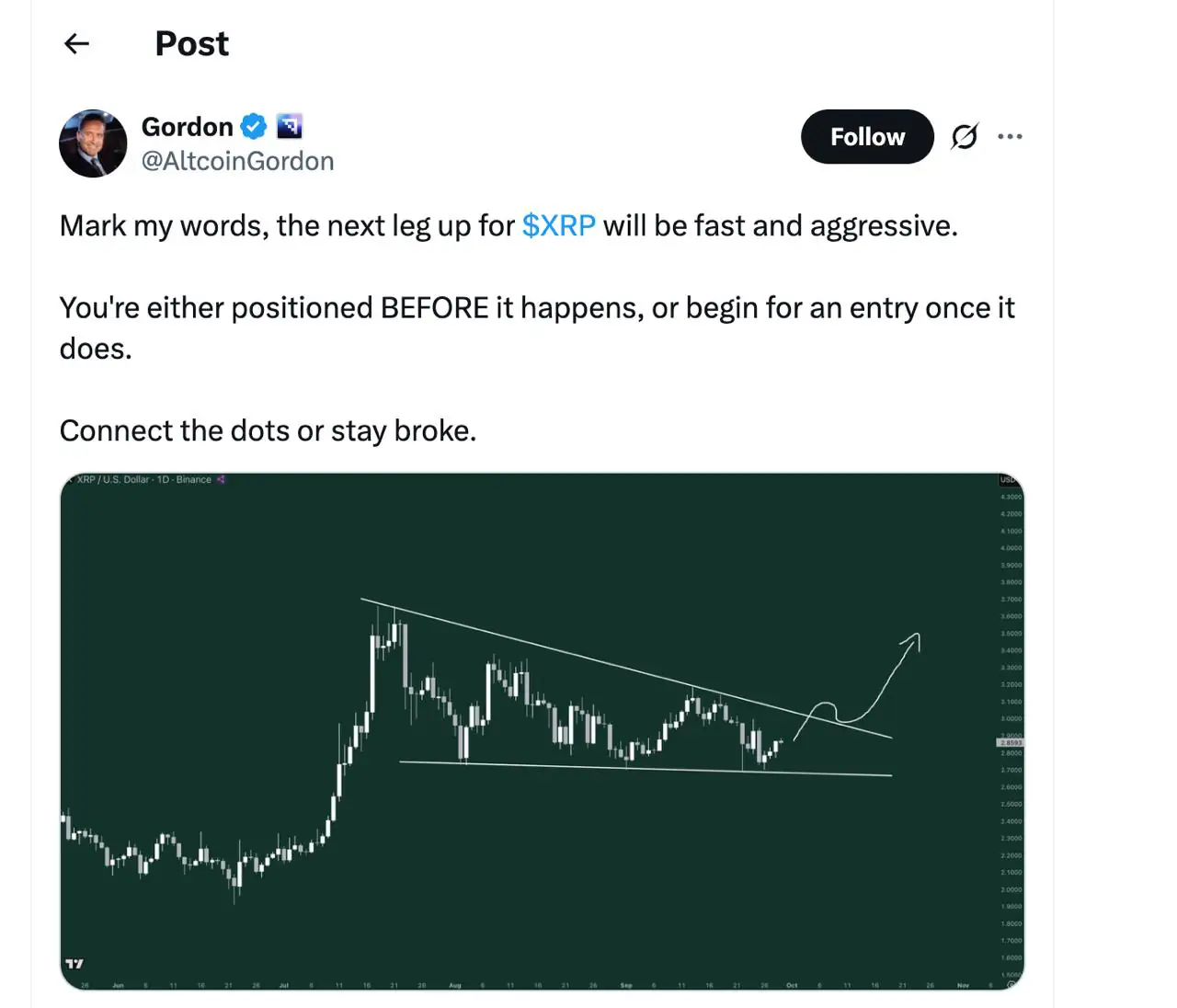

Why XRP Is Being Watched Closely

XRP has been trading under $3 for weeks, building pressure without a breakout. Analysts like Altcoin Gordon believe the move that follows will be fast. He noted that XRP has been coiling since it touched $3.60 in July, and the next expansion could catch traders off guard.

CoinCodex predicts XRP could hit $4 in the next six months. Sistine Research added that XRP is in its “tightest compression” in years, pointing to a breakout setup similar to its past rallies. Whales also appear to agree, as addresses with over 10 million XRP recently accumulated more than $300 million in a short period.

With ETF approval around the corner, XRP stands out as a best altcoin to buy for those who want exposure before larger players push in.

Solana Gains Fresh Demand

Solana has become the market’s favorite ETF play, with analysts pointing to billions ready to enter once U.S. products launch. Galaxy Digital’s Mike Novogratz said Solana will be a main channel for new institutional money, adding to its narrative as one of the best altcoins to buy right now.

Beyond ETFs, Forward Industries recently started buying $1.65 billion worth of Solana for its treasury, showing corporate-level confidence. A wave of Solana-focused funds is also on the way, with approvals from VanEck, Grayscale, and others expected soon.

This combination of new inflows and ETF anticipation has placed Solana among the market’s front-runners as crypto heads toward $4 trillion.

MAGACOIN FINANCE: Analyst Pick for Fresh Liquidity

Analysts are also pointing at MAGACOIN FINANCE as a best altcoin to buy now that the market cap is close to $4 trillion. As a newer project, it has the shine that grabs attention quickly. Already, over 18,000 holders are on board, and the team has hinted at both DEX and CEX listings soon.

Analysts say MAGACOIN FINANCE could deliver faster returns compared to older assets like XRP or Ethereum because new liquidity tends to chase fresh names first. That explains why it has been called one of the most exciting altcoins to watch right now.

How Traders Can Position Now

With Bitcoin lagging, traders should watch where ETF flows go. Solana, XRP, and MAGACOIN FINANCE are all drawing attention as the best altcoins to buy during this move toward $4 trillion. Early entry often makes the difference. Visit MAGACOIN FINANCE Website to learn more or join their communities on X and Telegram

- Website: https://magacoinfinance.com

- X: https://x.com/magacoinfinance

- Telegram: https://t.me/magacoinfinance

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

The post Crypto Market Cap Clears $3.95T: Best Altcoins to Buy Now With Solana and XRP Outpacing BTC appeared first on Coindoo.

You May Also Like

The Manchester City Donnarumma Doubters Have Missed Something Huge

Marathon Digital BTC Transfers Highlight Miner Stress