PepeNode Presale Nears Price Hike as ‘Mine-to-Earn’ Meme Coin Delivers 848% Staking Rewards

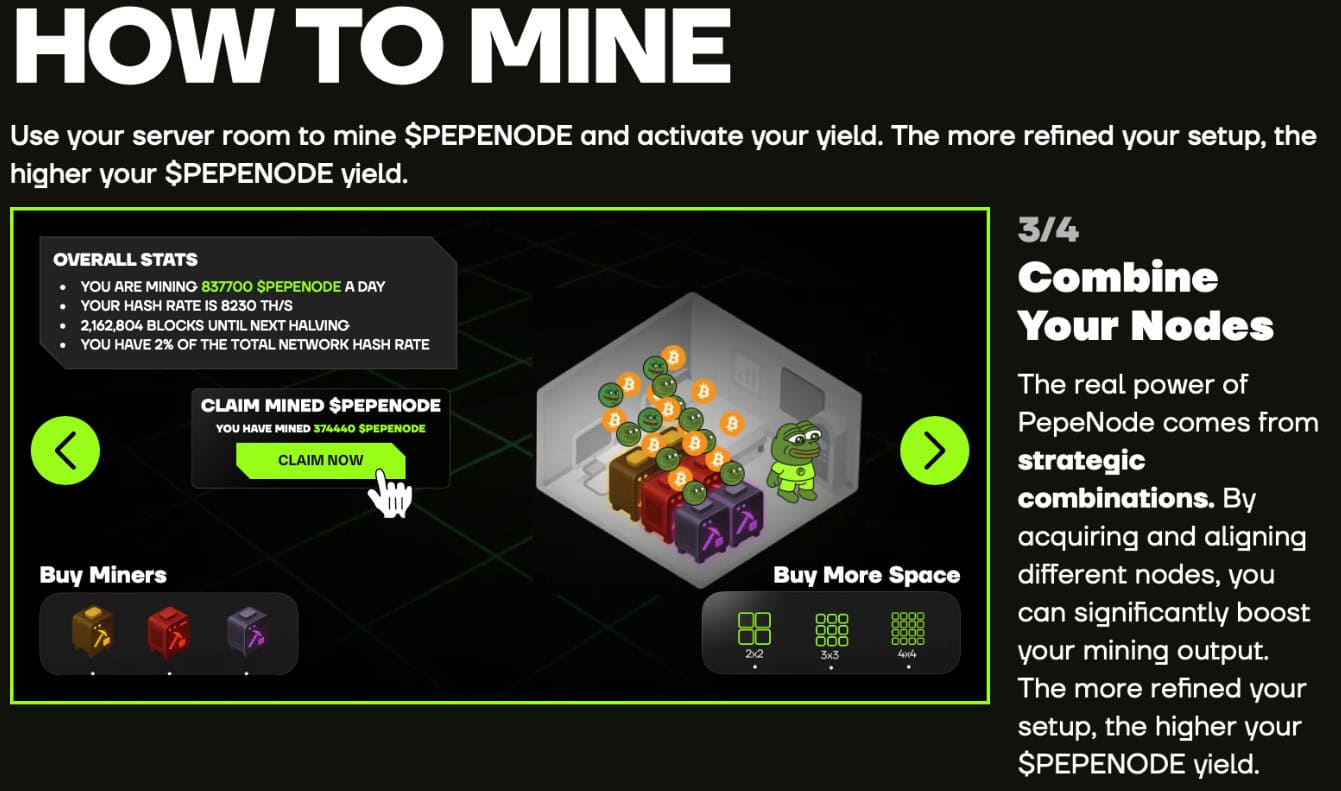

Rather than relying on expensive rigs and sky-high electricity costs, PepeNode reimagines mining as a strategic virtual game. Most crypto mining isn’t this fun – but with PepeNode, the whole process becomes a competition.

These aren’t minor meme coins no one’s ever heard of; $PEPE and $FARTCOIN have market caps of $4.26B and $688M respectively.

![]()

That makes PepeNode’s unique mine-to-earn mechanism a way to earn tokens beyond PepeNode, potentially positioning the project as a crucial addition for any dedicated meme coin trader.

Mining as a Strategy Game?

PepeNode represents more than a single-token game; it’s a multi-token income engine.

Smarter combinations and upgrades will deliver stronger yields, but set up your mining rig incorrectly, and your inefficient setup will fall behind.

That said, a race to earn as many tokens as possible could flood the zone with too many tokens.

To fight against $PEPENODE token inflation, the project will deploy a deflationary tokenomics design: every upgrade will burn 70% of the tokens used. That mechanism both reduces supply and reinforces value, creating a more sustainable model compared to earlier P2E ecosystems.

Take Mine-to-Earn Mainstream With $PEPENODE

The PepeNode ($PEPENODE) presale is open, with purchases available via $ETH, $BNB, $USDT (ERC-20 or BEP-20), or even credit and debit cards.

Simply head to the official PepeNode presale website and connect a Web3 wallet, such as the Best Wallet app (where, by the way, you’ll also find $PEPENODE in the ‘Upcoming Tokens’ section). From there, you can purchase, track, and eventually claim your $PEPENODE seamlessly through the app.

As the clock ticks down on the current presale round, PepeNode’s unique blend of mining gamification, staking rewards, and deflationary tokenomics has already put it on the radar of meme coin enthusiasts.

Interested in adding this meme coin mine to your portfolio? Follow PepeNode on X and Telegram for updates, or head directly to the official PepeNode website to participate before the price increases and staking rewards go down.

Mine, Stake, Earn – The Serious Fun Side

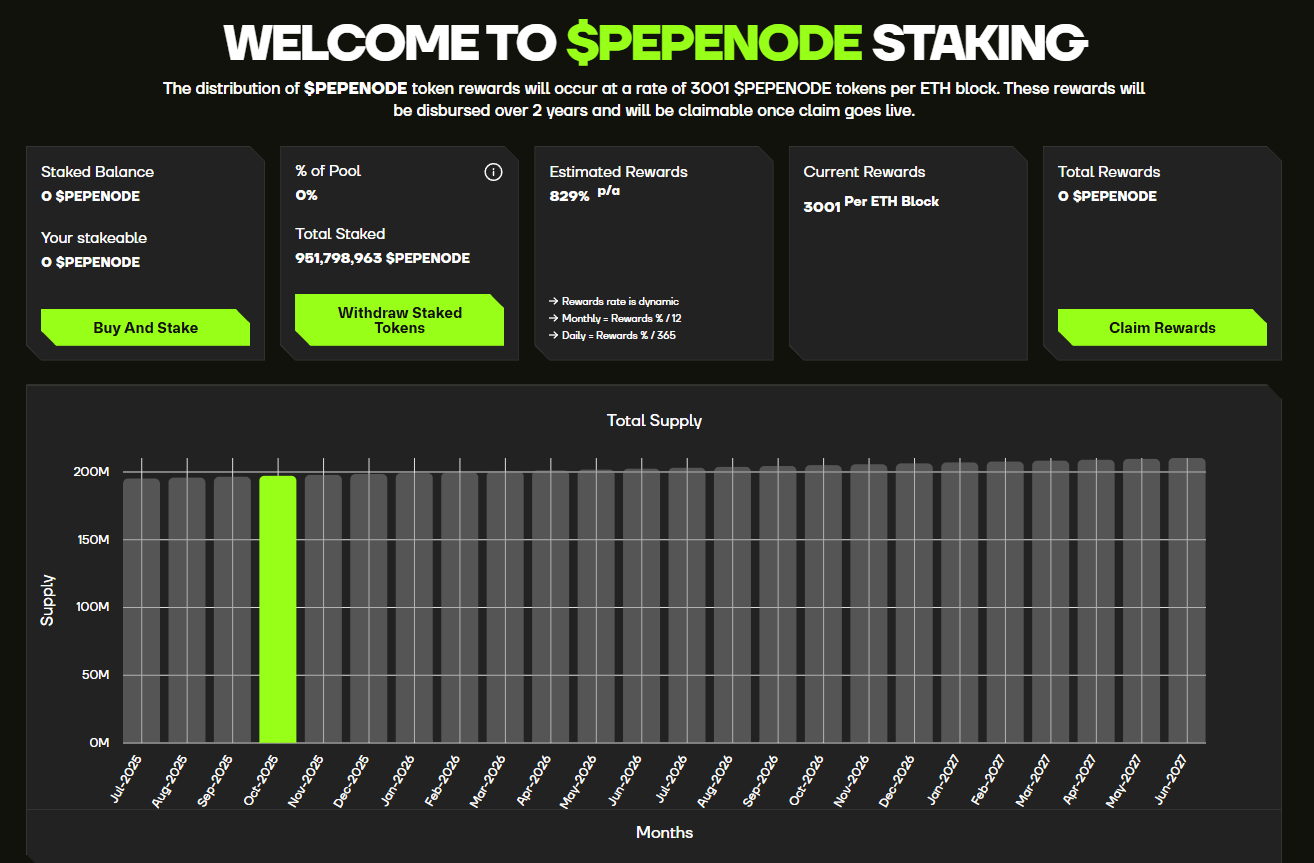

Investors are interested in more than just the concept. You can earn $PEPENODE instantly by staking your PepeNode tokens. $PEPENODE currently delivers an eye-catching 848% annual percentage yield (APY). This gives you the chance to expand their holdings even before the official game launch.

However, time is short. $PEPENODE’s presale price is currently $0.0010831, but being a presale, its price goes up in stages. The current price is locked in for just 28 more hours before automatically increasing in the next round.

As with all dynamic protocols, yields decline as more tokens are locked up, but early adopters are seeing significant rewards. Already, over 951M $PEPENODE have been staked, and that figure is expected to climb further as the presale continues to attract attention.

Combining gamified mining with staking rewards, PepeNode is carving out a niche similar to the excitement that play-to-earn (P2E) titles generated at their peak. That could well make this unique meme coin one of the best presales of 2025.

Ready to jump in? Buy your $PEPENODE today and stake it for 848% APY.

You May Also Like

xAI Launches Grok 4 Fast: A Leap in Cost-Efficient AI

Bitcoin $123K Prediction as Poland Launches First Bitcoin ETF, Bitcoin Hyper Nears $17M, and More…