Russia-backed A7A5 stablecoin moved over $6B despite US sanctions: report

Russian ruble-backed stablecoin A7A5 has helped move over $6 billion across borders since August 2025, despite some of its key operators being hit by Western sanctions.

- Over $6.1 billion in transactions were allegedly processed through A7A5 stablecoin wallets after U.S. sanctions were imposed on affiliated entities.

- More than 80% of A7A5’s supply was reportedly destroyed and reissued following sanctions on Grinex-linked wallets.

- A7A5 was granted formal digital asset status in Russia and is backed one-to-one by rubles held at Promsvyazbank.

According to a recent report by the Financial Times, A7A5 allegedly has close ties with multiple entities already sanctioned by the United States, including crypto exchanges Grinex and Garantex, as well as Russia’s state-backed Promsvyazbank.

A7A5 re-minted after Grinex sanction

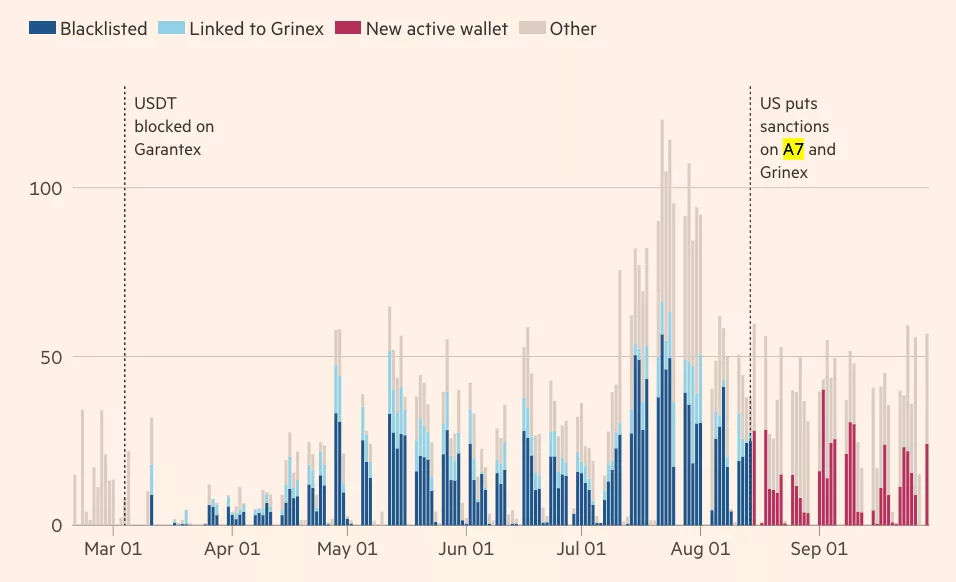

U.S. regulators imposed sanctions on Grinex in August, as authorities believed it was a successor of another blacklisted platform, Garantex, which has been known to facilitate illicit transactions tied to hacking, terrorism, and drug trafficking. Garantex was initially sanctioned in March of 2022 as part of Washington’s crackdown on Russian financial channels following the invasion of Ukraine.

Notably, blockchain data reviewed by the Financial Times showed that more than 80% of the total A7A5 supply was destroyed and reissued right after fresh sanctions were announced on wallets linked to Grinex. Wallet balances were set to zero using a smart contract function called “destroyBlackFunds,” which labeled the tokens as “dirtyShares” and removed them from circulation.

The report alleges this was an effort to wipe the slate clean and erase any transactional history before the same value was minted again in new addresses identified as ‘TNpJj.’

Unlike a standard token transfer, which maintains a visible on-chain link between the source and destination, this method effectively severs that connection, making it far more difficult to trace the movement of funds and identify ties to sanctioned entities, the report said.

Since then, more than $6.1 billion worth of transactions have been routed through the new TNpJj wallet using A7A5.

Grinex, which is a Kyrgyzstan-based exchange, has denied any connections to Garantex, but past investigations have uncovered several on-chain evidence suggesting the two had a close relationship.

Back in March, Swiss blockchain analytics firm Global Ledger found several large transactions directed towards Grinex using the A7A5 stablecoin soon after Garantex went offline. The report also cited an unnamed Grinex staff member who reportedly admitted in private conversations that Garantex customers were physically visiting Grinex’s office to move funds between the two platforms.

Garantex officially ceased operations in March this year, shortly after stablecoin issuer Tether froze approximately 2.5 billion USDT from the exchange.

“Setting up the new wallet suggests the operators of A7A5, which trades on Tron and Ethereum blockchains, have drawn lessons from the takedown of Garantex,” the Financial Times report said.

A7A5’s connection with multiple sanctioned entities

Transaction activity on the TNpJj wallet reportedly mirrored that of earlier sanctioned accounts connected to Grinex, sharing many of the same counterparties and following similar trading hours, the report added.

A7A5 is registered in Kyrgyzstan through a company called Old Vector, which was also sanctioned by the United States in August for its role in issuing and managing the stablecoin.

The stablecoin was recently granted formal digital financial asset status by Russian authorities, a move that effectively legitimized its use for trade settlements, allowing exporters and importers to transact officially through a platform owned by Promsvyazbank, which backs each token with a ruble held in reserve.

The state-owned bank, already under Western sanctions, also holds a 49% stake in the A7 cross-border payments network, which was reportedly involved with early-stage development of A7A5.

Despite these allegations, A7A5 developers have touted the stablecoin as an independent and transparent project, with A7A5 executive Oleg Ogienko recently telling media that the project operates legally under Kyrgyzstan’s regulatory framework and has no involvement in illicit activity.

Oleg’s comments came as TOKEN2049, a major cryptocurrency event held in Singapore, removed all references to A7A5 from its website and speaker list following a media inquiry regarding sanctions. Ogienko had been scheduled to appear at the event but was quietly pulled from the agenda after confirming on the sidelines that A7A5 was indeed targeted by Western sanctions.

Previous estimates have suggested that over $9.3 billion in transactions were facilitated by the stablecoin within just four months of its launch.

You May Also Like

Federal Reserve’s Rate Cuts May Affect Cryptocurrency Market

‘High Risk’ Projects Dominate Crypto Press Releases, Report Finds