Building the Internet Above the Clouds

The problem with centralized internet infrastructure goes beyond just service disruptions or high costs. Outages, censorship, and monopolies are major weaknesses in the global communication system that impact economic growth, democracy, and emergency responses. With 2.6 billion people still offline and current users facing more limits on accessing information, these issues become obstacles to human development and social progress.

\ Recent events have shown these weaknesses. The 2021 internet blackout in Kazakhstan disrupted global Bitcoin mining, and cuts to submarine cables in the Red Sea in 2024 affected internet traffic between Asia, Europe, and the Middle East. Chad's nationwide outage in August 2024, caused by fiber cuts in Cameroon, shows how geographical dependencies create big risks. These incidents highlight structural issues in internet infrastructure that require new ways of thinking about network design and management.

Satellites as Infrastructure Liberation

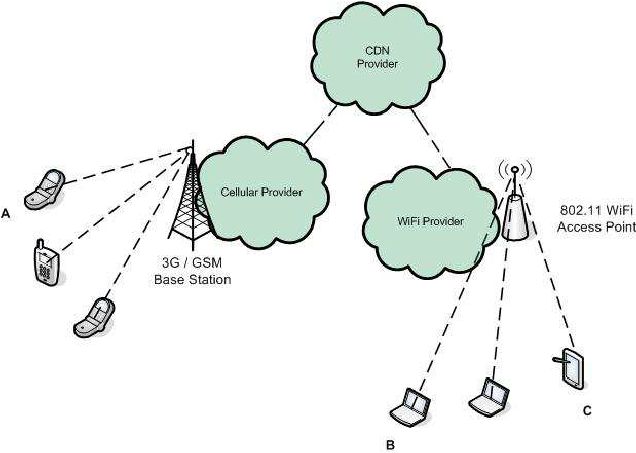

\ Satellites avoid using local ISPs and government blocks by creating their own communication networks. Unlike fiber optic cables, satellite networks are harder to block or control, providing neutral and unbiased connectivity. Traditional internet setups need cooperation between regions, which can lead to restricted access. Satellite networks can work across these borders, keeping the service running. However, services like Starlink, managed by single companies, show that centralization is still a weak point. SpaceX's Starlink, with over 8,000 satellites, shows that global satellite internet is possible but also highlights the risks of having control concentrated in one place.

The main difference isn't in the technology itself but in how it's controlled and managed. Centralized satellite networks might offer better coverage and faster connections than traditional options, but they don't solve the key issues of avoiding censorship and ensuring democratic access, which are important reasons for looking for new internet solutions

Decentralized Orbital Infrastructure

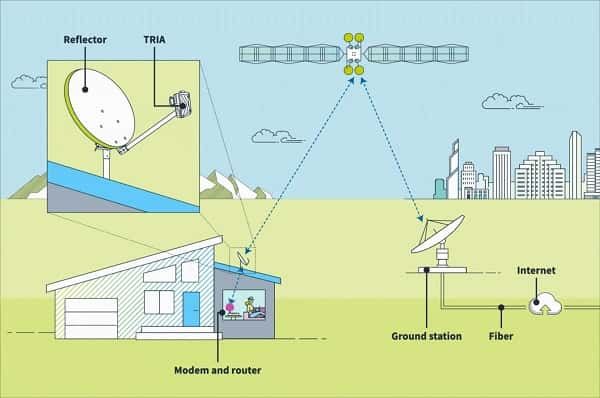

SpaceCoin uses satellites to run decentralized nodes, working without central control and using space connectivity. It combines blockchain for data checks and payments with a satellite network to reach beyond telecom limits. Satellites with blockchain nodes verify transactions and keep the network running, creating a space-based computing network. The CTC-0 satellite, launched in December 2024, successfully sent blockchain transactions from Chile to Portugal, showing that blockchain can work well in space, providing transparency and resistance to censorship.

\ Satellite-based blockchain nodes offer backup that's hard to get with ground systems, as ground nodes can be shut down, while satellite nodes operate in international space, making them hard to interfere with. Blockchain in satellites keeps data secure and allows decentralized payments, letting users pay with cryptocurrency without traditional banks, which is helpful in areas with limited financial services.

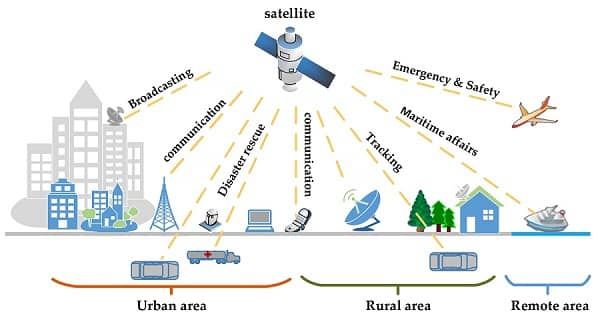

Blockchain transparency offers accountability that traditional internet providers don't have, letting users check payments and ensure fair use of resources. Satellite networks can reach places that are too expensive for ground infrastructure, like remote islands and mountains, without needing local investment. This coverage also reaches areas with limited internet access, providing alternative ways to communicate. However, satellite communications must deal with complex regulations, and projects like SpaceCoin need to balance technical capabilities with legal requirements.

Real-World Applications

Satellite-based decentralized internet can help remote places like a village in the Amazon rainforest, where regular internet is too expensive and hard to set up. SpaceCoin's method provides direct internet access without needing a lot of ground equipment. Users just need satellite receivers and a way to pay. Once the satellite network is running, adding more users is affordable. This system keeps working even if there are local problems, as long as the receivers function and there's a clear view of the sky.

\ Challenges include the cost of satellite receivers, keeping the equipment in good shape, and local support, which might limit how many people use it. Power can be an issue in areas without steady electricity. While natural disasters can disrupt ground communications, satellite networks keep working, helping emergency teams stay in touch. Decentralized payment systems using blockchain can send resources straight to people in need. Multi-orbit satellite technology, like Intelsat's MOO COW, could offer fast speeds similar to 5G during emergencies. However, bad weather can affect signals, and portable equipment might have power and antenna problems. Also, connecting with existing systems during disasters can be tough

Benefits for the World: Democratic Infrastructure

Satellite-based decentralized internet brings up key issues about access, opportunity, and participation in our digital world. These networks make it harder to censor content compared to traditional ways. While governments can block sites using DNS filtering, satellite networks with blockchain can get around these blocks. Blockchain's secure verification helps stop information from being altered, protecting against content tampering and reducing the effects of disinformation.

\ Censorship resistance isn't perfect; governments can still jam satellite signals and control internet infrastructure. How well it works depends on the skills of both network operators and censors. Satellite networks can connect remote areas, helping economic growth by providing access to digital economies and education. They can level the playing field between urban and rural areas, giving rural communities the same resources. Decentralized networks could give communities more control over their digital infrastructure, reducing dependence on foreign entities and affecting economic and political independence. For developing countries, satellites could lower the need for costly infrastructure and foreign investment. Blockchain could allow decentralized management of network policies and resources.

Policy Implications and Regulatory Challenges

The growth of satellite-based decentralized internet brings important policy questions beyond just technical issues. It involves regulation, international cooperation, and balancing innovation with oversight. Managing radio spectrum and orbital positions is essential to prevent system interference. Current rules, made for traditional satellites, might not fit decentralized networks. The rise of small satellites and large constellations makes coordination harder, raising worries about space debris and spectrum congestion. Decentralized networks face challenges in getting regulatory approvals and meeting national rules.

Satellite networks cross national borders, making it hard to apply territorial regulations. Data can move through several countries without using their infrastructure, complicating the enforcement of privacy laws, content rules, and data localization. These networks offer both opportunities and risks by operating outside national internet systems. In emergencies, they need to work with existing services to be effective, which raises questions about regulatory oversight. Frameworks might need to address reliability, emergency access, and coordination for critical communications.

Infrastructure for Freedom

SpaceCoin is a new technology that focuses on decentralization and accessibility. It uses satellite connections and blockchain to create global networks without traditional control. Tests show that satellite-based blockchain can work, but making it global and decentralized is tough. This brings up questions about digital independence and economic opportunities, which could help underserved communities. Success will depend on handling regulations, creating a sustainable economy, and proving its usefulness. Balancing decentralization with following rules and innovation with stability will guide satellite internet growth. Regulatory choices will affect how decentralized networks can expand access and support digital freedom. The goal is to build infrastructure that prioritizes people over institutions, with policies that encourage innovation and maintain openness and accessibility.

You May Also Like

Top NYC Book Publishing Companies

Sensorion Announces its Participation in the Association for Research in Otolaryngology ARO 49th Annual Midwinter Meeting