Hyperliquid and Aster start the Next Era, Sui DeFi Ecosystem Expands with Native DEX

[PRESS RELEASE – Abu Dhabi, UAE, October 6th, 2025]

This year the SUI blockchain transformed into one of the fastest-growing Layer-1 ecosystems, with more than 150 active DeFi projects. Just in the first week of October, SUI TVL grew from $1.8B to $2.46B with a massive dominance of stablecoins, with a 65% rise to $886 million. Recent updates made Sui a real trading hub that attracts institutional capital, developers, and ordinary traders.

New fast consensus, cross-chain interoperability, and DeFi adoption became a healthy ecosystem for new yield farming platforms, lending, and staking projects. The number of daily active wallets continues to climb, and major exchanges and aggregators are increasing support for SUI – the results speak for themselves – Sui’s TVL has tripled in just three months.

However, trading efficiency is constrained and liquidity is dispersed in the absence of a robust DEX. This will be resolved with the upcoming launch of SuiDEX – native DEX on Sui Blockchain, which will serve as the foundation for DeFi’s expansion and enable both ordinary traders and institutional investors to take advantage of rapid swaps, reliable order books, and liquidity incentives.

Sui Ecosystem: The Next Wave of DeFi Scalability

Ethereum, BNB Chain, and Solana have become massive ecosystems, but each faces trade-offs and stop signals. While Ethereum remains the DeFi foundation, high gas fees and slow transaction times limit its accessibility and development. Solana outperforms other chains with its incredible transaction speed, but still has problems with downtime, reliability, and security. BNB Chain’s PancakeSwap dominates retail traders but operates in a semi-centralized environment.

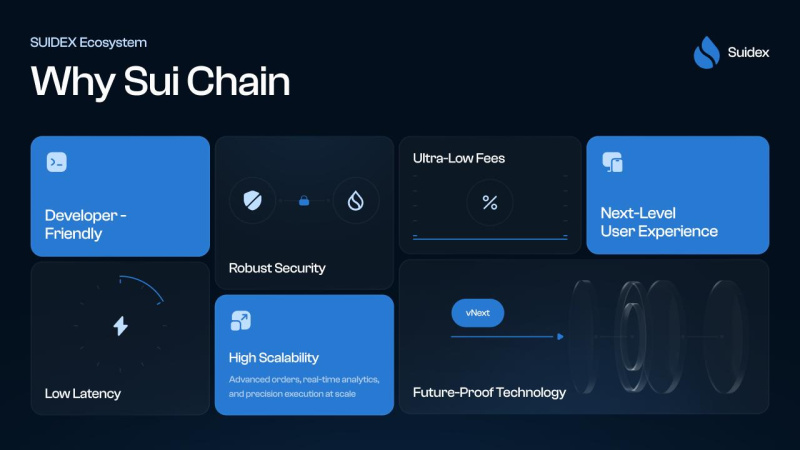

Sui Blockchain was designed to overcome the limits of other chains with its Move programming language and parallel transaction execution. It is becoming a high-performing network with an architecture that allows instant, low-cost, and secure transactions. This year Sui gained strong developer support with cross-chain options that brought attention from retail, ordinary traders, and institutions.

SuiDEX: How It Can It Boosts Liquidity and Trading Volume on Sui

SuiDEX can become the primary liquidity engine for the Sui blockchain and DeFi ecosystems. It is a non-custodial DEX that will deliver lightning-fast swaps, deep liquidity pools, and seamless integration across Sui’s expanding DeFi infrastructure.

Core Features:

- Cross-Chain Swap Support: It will enable token swaps between Sui, Ethereum, BNB Chain, and Solana.

- Hybrid Liquidity Model that will combine AMM pools for instant swaps with intelligent order routing for precision trading.

- Staking and Yield Programs with dynamic APY liquidity pools for holders and traders.

- $SUIX token holders will be able to participate in DAO governance to vote for new trading pairs, liquidity pools, swaps, and future platform development.

- SuiDEX will implement advanced trading tools for ordinary and professional traders. It will combine optimized analytics dashboards, real-time charts with AI support, and automated routing.

With the main features of the Sui Blockchain, its speed, scalability, and advanced programming language, SuiDEX will ensure minimal trading fees, strong network reliability, and near-zero latency, giving traders and investors a better experience than most existing DEXs can offer.

How SuiDEX Stands Against Top DEX Competitors

While Uniswap, 1inch, PancakeSwap, and Jupiter each dominate their ecosystems, SuiDEX enters the scene as a next-generation alternative built natively for the Sui blockchain.

- Uniswap remains Ethereum’s DeFi pioneer but still struggles with high gas fees and slower transaction speed. SuiDEX will deliver instant, low-cost swaps powered by the Sui chain parallel execution engine.

- 1inch with its multi-chain complexity often leads to higher costs and bridge risks. SuiDEX can avoid this problem with its native cross-chain swap system within Sui’s secure environment.

- While PancakeSwap performs with its accessibility, it still operates in a semi-centralized manner. In contrast, SuiDEX combines full decentralization and DAO-based governance, giving traders transparency and investors long-term influence.

- Jupiter dominates with its speed, but Solana’s outages and centralization concerns limit its reliability. SuiDEX can operate at Sui’s stronger stability, providing better staking opportunities and sustainable liquidity programs for participants.

SuiDEX can combine the best elements of these leading DEXs to become a core liquidity hub for Sui’s DeFi future, offering unmatched scalability, native integration, and long-term ecosystem growth potential.

SuiDEX Roadmap

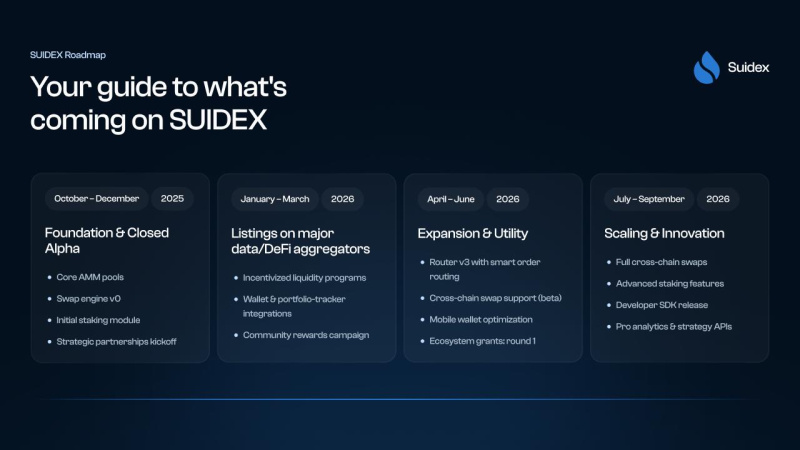

The Q4 2025 roadmap sets the foundation for SuiDEX’s ecosystem role, with milestones including the mainnet launch, token swap functionality, and the initial staking module. SuiDEX will be an active component of Sui’s DeFi environment from the start thanks to these features.

The SuiDEX team plans to list $SUIX on major DEXs, implement incentive liquidity programs, start a community rewards campaign, and carry out the Token Generation Event (TGE) in Q1 2026. In order to guarantee a robust and integrated ecosystem, the project is also concentrated on forming strategic alliances with important Sui DeFi protocols.

About

SuiDEX is a Sui native DEX with improved features like staking options, quick token exchanges, and advanced liquidity pools Its design satisfies the demands of the modern DeFi market, where cheap costs, scalability, and security are necessary for long-term adoption.

SuiDEX is in a strong position to help the Sui blockchain expand, which is being propelled by new initiatives, higher TVL, and expanding institutional interest. By supplying the infrastructure needed for governance, liquidity, and commerce, the goal is to strengthen the entire ecosystem and help Sui rank among the leading DeFi networks in the years to come.

The post Hyperliquid and Aster start the Next Era, Sui DeFi Ecosystem Expands with Native DEX appeared first on CryptoPotato.

You May Also Like

Young Republicans were more proud to be American under Obama than under Trump: data analyst

Vitalik Buterin Outlines Ethereum’s AI Framework, Pushes Back Against Solana’s Acceleration Thesis