Strategy Boosts Bitcoin Holdings to 640,250 BTC After $27.2M Purchase

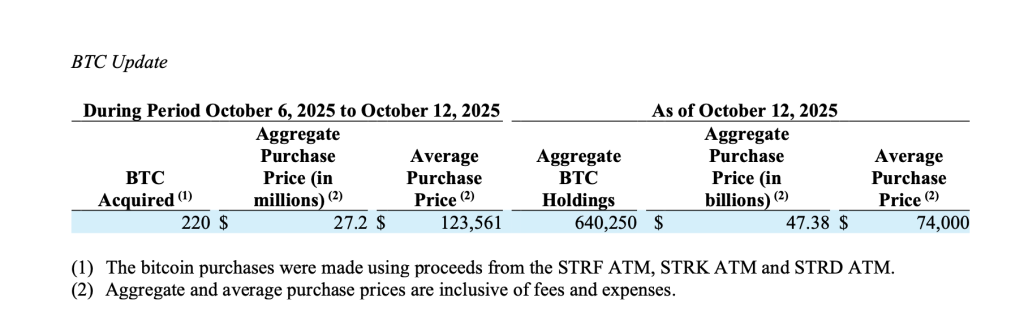

Strategy Inc. has expanded its already-massive Bitcoin treasury, acquiring an additional 220 BTC for $27.2 million at an average price of $123,561 per bitcoin during the week of October 6–12.

The company’s total Bitcoin holdings now stand at 640,250 BTC, purchased for an aggregate $47.38 billion at an average price of $74,000 per BTC.

The latest accumulation shows Strategy’s continued conviction in Bitcoin as a core treasury reserve asset and follows the company’s ongoing series of equity sales through its At-The-Market (ATM) programs.

ATM Programs Fuel Bitcoin Accumulation

Strategy funded its most recent Bitcoin purchases using proceeds from its STRF ATM, STRK ATM, and STRD ATM programs. According to the company’s filing, these programs collectively raised around $27.3 million in total notional value during the reporting period.

The STRF ATM, tied to Strategy’s 10.00% Series A perpetual strife preferred stock, sold 170,663 STRF shares, generating $19.8 million in net proceeds.

Meanwhile, the STRK ATM, associated with its 8.00% Series A perpetual strike preferred stock, brought in $1.7 million from 16,873 shares. The STRD ATM, based on its 10.00% Series A perpetual stride preferred stock, contributed $5.8 million from 68,775 shares.

Collectively, these offerings have become key financing vehicles for Strategy’s ongoing Bitcoin accumulation strategy—mirroring the company’s long-standing practice of converting equity proceeds into digital assets.

Strategic Expansion Across Equity Classes

Beyond its active ATM programs, Strategy maintains substantial capacity for future issuances.

As of October 12, the company had $1.7 billion, $4.1 billion, $20.3 billion, and $15.9 billion available for issuance under its various preferred and common stock classes (STRF, STRD, STRK, and MSTR, respectively).

This provides a wide financial runway for further expansion of its Bitcoin reserves, signaling that additional purchases could follow as market conditions evolve.

Reinforcing Leadership in the Bitcoin Treasury Space

With 640,250 BTC now under management, Strategy remains among the world’s largest corporate holders of Bitcoin—alongside peers such as MicroStrategy and publicly listed digital asset firms adopting similar treasury models.

The company’s bold move reflects growing institutional confidence in Bitcoin amid tightening monetary policy and increased regulatory clarity across major markets.

By blending creative capital-raising strategies with disciplined accumulation, Strategy continues to redefine how corporations integrate Bitcoin into their balance sheets—cementing its reputation as one of the pioneers in the digital-asset treasury landscape.

You May Also Like

Cardano Price Prediction: ADA To Rally 6000%? Win For Grayscale Large Cap Fund

Surges to weekly high as Pound strengthens