Crypto Markets Face a New Question: Should Trading Ever Pause?

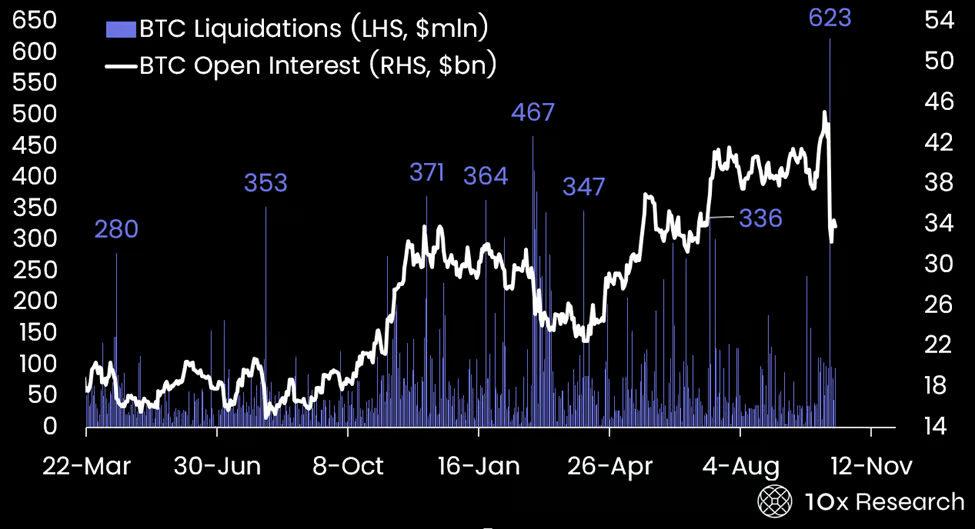

The events exposed a paradox in crypto’s design, according to 10x Research. The same mechanisms meant to keep liquidity flowing ended up accelerating the panic. Automated liquidation engines, opaque insurance funds, and uneven data reporting magnified the chaos instead of containing it. For the first time in years, major players are openly discussing whether the crypto ecosystem needs a fundamental redesign.

A Market Running Without Brakes

When traditional markets collapse too quickly, circuit breakers kick in to stop the bleeding. Stocks pause, traders breathe, and liquidity can recover. Crypto, however, has no such safety valve. It trades non-stop, with algorithms liquidating positions around the clock – often faster than traders can react.

That 24/7 exposure is part of what gives digital assets their edge, but also what turns volatility into carnage. Many now wonder if it’s time for exchanges to borrow a page from Wall Street’s rulebook and install circuit breakers that automatically halt trading after extreme moves.

Learning From Old Scars

This isn’t the first time crypto has flirted with structural reform. The scars of May 2021 remain fresh, when Elon Musk’s remarks about Bitcoin’s environmental impact triggered one of the fastest unwinds in the asset’s history. Billions vanished in minutes, and regulators worldwide began asking how such collapses could happen without intervention.

READ MORE:

Bitcoin and Ethereum ETFs Recover Strongly as Rate-Cut Hopes Rise

In response, several exchanges quietly reworked their liquidation and reporting systems, but the recent crash showed that those adjustments were far from enough. Many analysts now warn that without coordinated safeguards, future meltdowns could make 2021 look modest in comparison.

The Risk of Doing Nothing

Introducing circuit breakers wouldn’t just slow the pace of market crashes – it could alter how volatility itself behaves. A pause in trading could give investors a window to reassess risk, but it might also interfere with crypto’s founding ethos of open, continuous trading. Detractors argue that centralized control undermines decentralization; proponents counter that without reform, the market will keep repeating the same destructive pattern.

In the end, the crypto industry faces a dilemma: either adapt with mechanisms that bring stability or continue living with the wild swings that have defined its past. Whether circuit breakers are the answer or not, one thing is clear – the discussion has moved from theory to urgency.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

The post Crypto Markets Face a New Question: Should Trading Ever Pause? appeared first on Coindoo.

You May Also Like

Satoshi-Era Mt. Gox’s 1,000 Bitcoin Wallet Suddenly Reactivated

Zycus Launches Industry-First AI Adoption Index to Measure Real-World AI Maturity in Procurement