DeepSeek AI Predicts Bitcoin Price Will Dip to $100K – Investors Turn to Bitcoin Hyper for Stability

KEY POINTS:

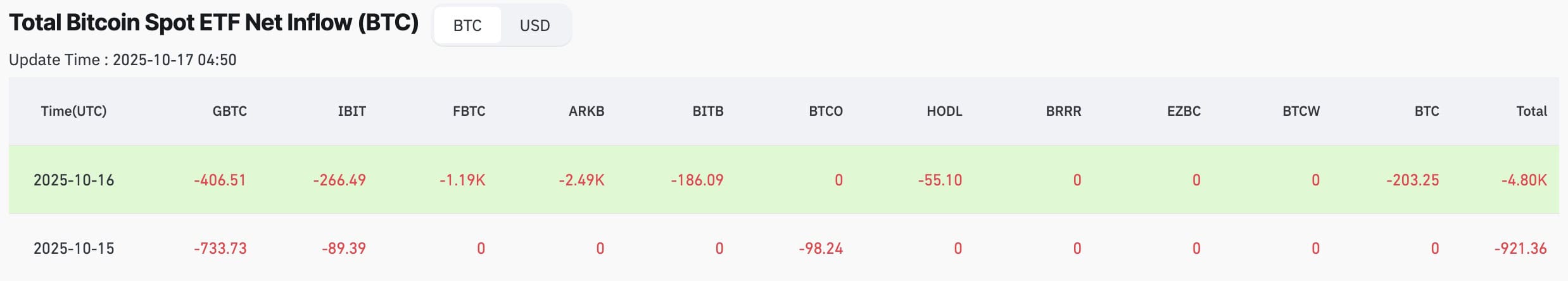

DeepSeek AI forecasts a short-term Bitcoin correction to around $100K, driven by ETF outflows of 4.8K Bitcoin yesterday.

DeepSeek AI forecasts a short-term Bitcoin correction to around $100K, driven by ETF outflows of 4.8K Bitcoin yesterday.

Bitcoin ($BTC) dropped roughly 6.7% in 24 hours to $104K, entering the ‘caution zone’ between $102K-$107K.

Bitcoin ($BTC) dropped roughly 6.7% in 24 hours to $104K, entering the ‘caution zone’ between $102K-$107K.

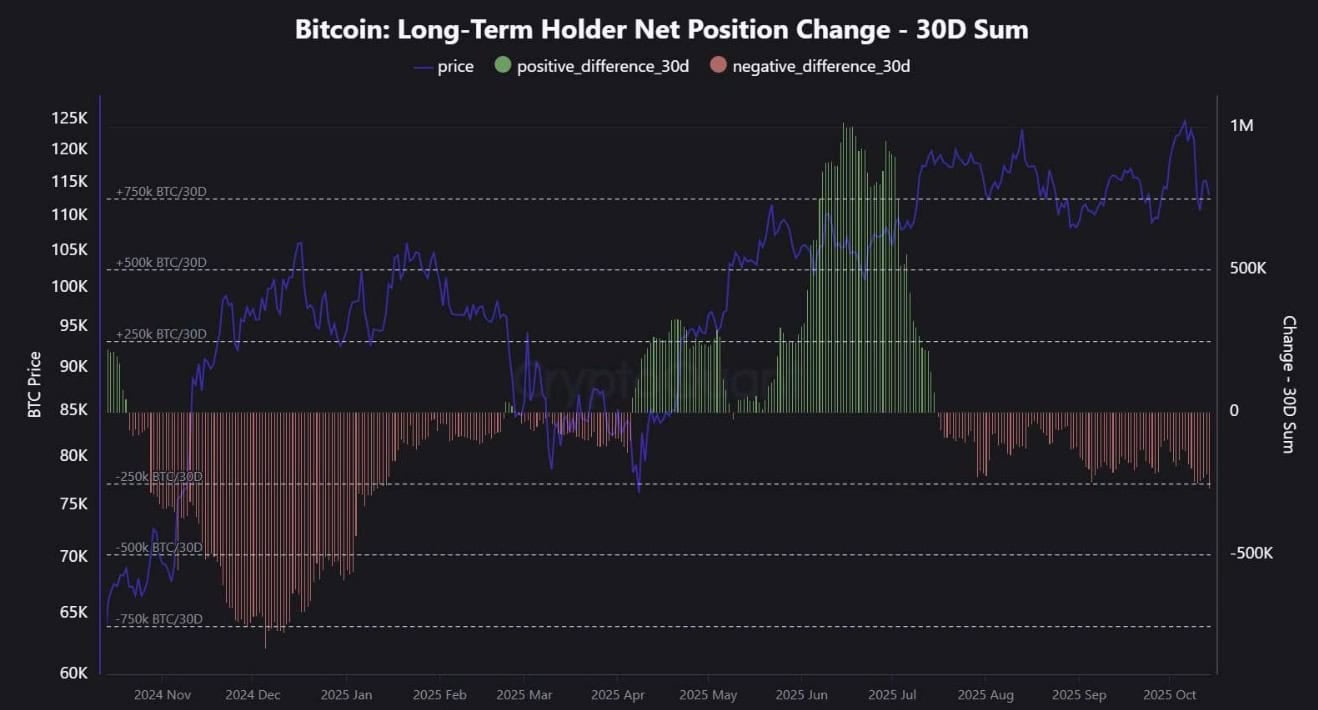

Long-term holders have moved over 265K $BTC this month, signalling the largest profit-taking shift since January.

Long-term holders have moved over 265K $BTC this month, signalling the largest profit-taking shift since January.

As volatility rises, investors are rotating toward presales like Bitcoin Hyper ($HYPER), which offers Layer-2 scalability and steady phase-by-phase growth.

As volatility rises, investors are rotating toward presales like Bitcoin Hyper ($HYPER), which offers Layer-2 scalability and steady phase-by-phase growth.

The model has analyzed ETF flows, order book depth, and on-chain movement to flag elevated outflows from U.S. spot funds as the primary driver behind the latest selloff.

Data shows that institutional selling accelerated yesterday with 4.8K Bitcoin (around $530M worth) flowing out. This forced $BTC to lose its support near $110K and fall into what analysts refer to as the ‘caution zone’ between $102K and $107K.

Source: Coinglass

DeepSeek claims that another cause of the recent selloff is the increased activity of long-term holders. Over 265K $BTC has been moved this month, the largest transfer since January.

But traders like to believe that this is simply ‘old money taking profit, new conviction stepping in.’

Source: @WhatIsTheTicker on CoinMarketCap

Still, DeepSeek’s model doesn’t see this as a collapse. Or the start of a bear market like you’ll read on crypto Twitter (now X). Instead, it points to a healthy reset that will fuel the next leg up.

However, periods like this often prompt capital to shift toward alternative investments. Some investors now seek ways to remain connected to Bitcoin’s upside without direct exposure to its volatility.

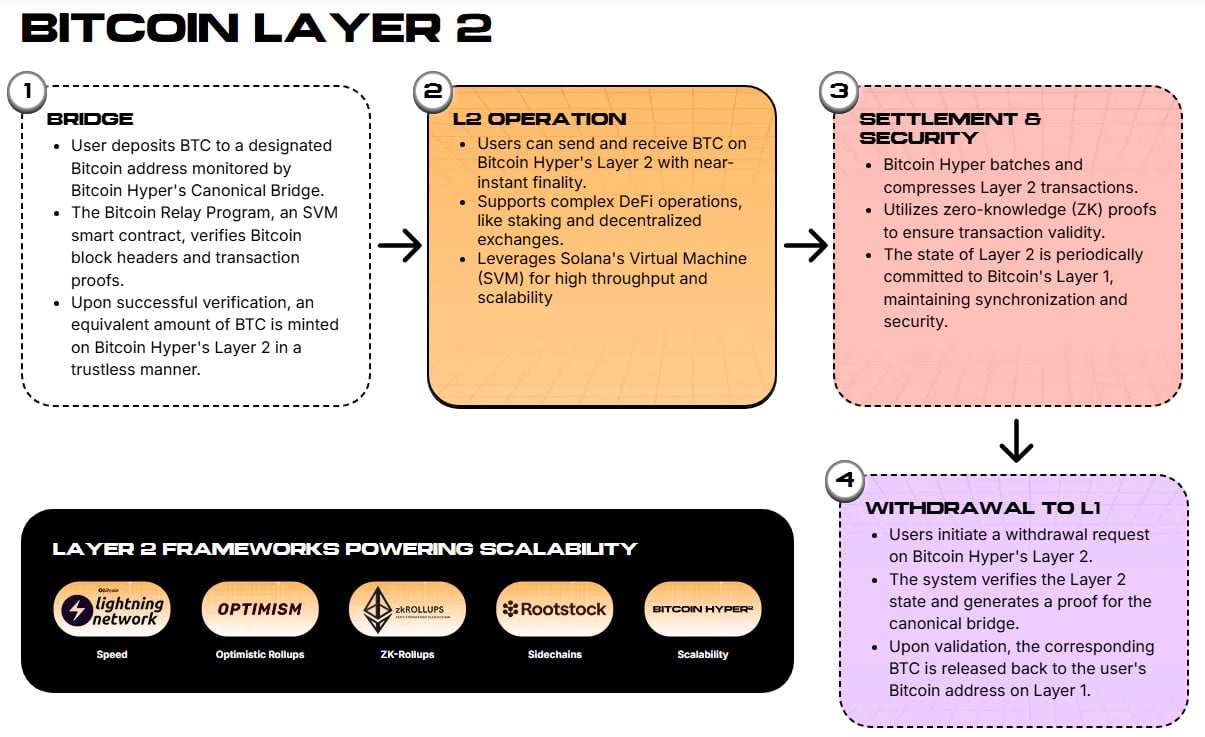

That’s why Bitcoin Hyper ($HYPER) is garnering significant attention – a new Layer-2 ecosystem designed to scale Bitcoin’s speed and utility, while offering presale investors structured, phase-by-phase growth.

Investors Rotate Toward Presales as Bitcoin Consolidates

Bitcoin’s pullback has investors split. Some see it as a short-term shakeout. Others panic, thinking it signals the start of a deeper rotation. Either way, the market’s tone has shifted from greed to caution.

And that’s often when early-stage projects start attracting fresh capital. Presales don’t move with market fear. Their prices only rise in incremental phases. So if the coins start to dump 10-20%, presales give investors a sense of control that’s rare in crypto.

So while $BTC tests support around $104K, fresh capital is flowing into $HYPER.

Bitcoin Hyper ($HYPER) – Bitcoin’s Speed Problem Finally Gets a Fix

Let’s be honest, Bitcoin’s biggest weakness has always been speed. According to data, the network handles just 6.28 transactions per second (TPS) in real-time. Add to that the high fees that often make small transfers impractical, and it doesn’t look good.

Bitcoin Hyper ($HYPER) was designed to address this issue. It’s a full L2 network that delivers Solana-level performance to Bitcoin, utilizing the Solana Virtual Machine (SVM) for sub-second execution.

You bridge $BTC to the Hyper network, where it’ll be mirrored 1:1. From there, you can trade or stake instantly with near-zero gas fees. This opens up a whole world of opportunities for DeFi, dApps, and meme coins all on Bitcoin.

Later, the mirrored $BTC can be bundled back onto Bitcoin’s base chain, utilizing zero-knowledge (ZK) proofs for secure settlement. It’s not an attempt at a sidechain or a wrapped $BTC; it stays fully synced with Bitcoin for a trustless experience.

Learn how to buy Bitcoin Hyper in our step-by-step walkthrough.

Bitcoin Hyper is all cross-chain from day one. It connects with the Bitcoin, Solana, and Ethereum ecosystems, allowing assets and apps to move freely. Think of it as Bitcoin’s execution engine running on Solana-grade speed.

Early buyers earn 49% APY through staking plus governance, airdrops, and launchpad access. On-chain trackers also show multiple six-figure buys in recent weeks, including $379.9K and $274K purchases. This indicates that there’s a firm conviction among whales in $HYPER.

Each presale phase lifts the price slightly, meaning no downside for early entries. While $BTC churns between $102K and $107K, $HYPER’s growth remains linear.

Buy $HYPER before the next price increase.

You May Also Like

Trump roasts Mike Johnson for saying grace at prayer event: 'Excuse me, it's lunch!'

Where Can You Turn $1,000 Into $5,000 This Week? Experts Point Towards Remittix As The Best Option