Solana highlights 3,200 active devs, $1b+ app revenue for second straight quarter

Solana’s network continues to attract strong engagement, with more than $1 billion in app revenue.

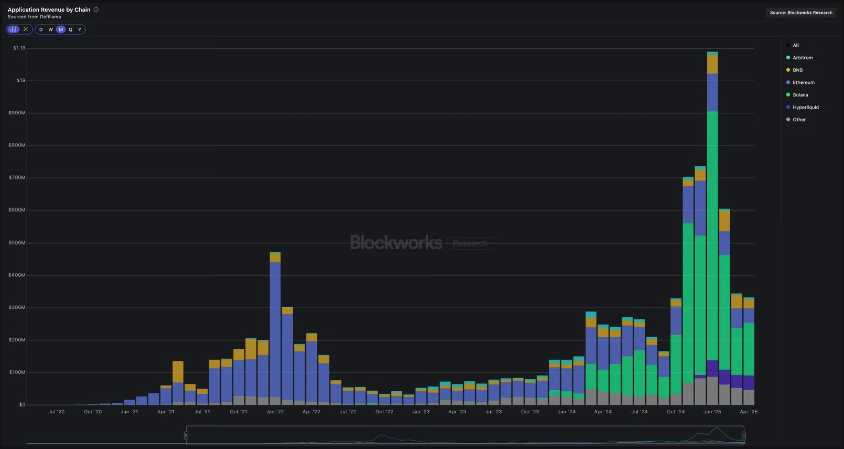

Solana (SOL)continues to see strong user engagement. On Friday, the Solana Foundation published its Solana Network Health Report, showcasing its performance in Q2 of 2025. Notably, the app revenue on the network exceeded $1 billion for the second quarter in a row.

In Q2, Solana’s app revenue rose compared to Q1—even as application revenue on other major networks declined. In fact, Solana’s app revenue now surpasses the combined total of all other blockchain networks.

This activity also contributed to a sharp rise in validator income, which reached an average quarterly level of $800 million. The peak occurred on Jan. 19, with $56.9 million earned in a single day. At the same time, validator costs have dropped dramatically.

Notably, the breakeven SOL stake required for validators to cover their costs has fallen significantly. Validators now require just 16,000 SOL to break even, down from 50,000 SOL in 2022. According to the Solana Foundation, this reflects substantial improvements in network efficiency.

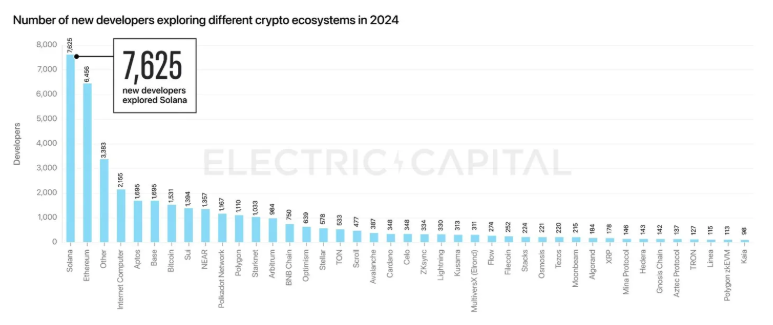

Solana has also topped the charts in attracting new developers. In 2024, the network drew 7,625 developers, more than any other blockchain, including Ethereum.

Solana Foundation showcases decentralization gains

According to the Solana Foundation, the network has made significant gains in decentralization. The Nakamoto Coefficient, used to measure how decentralized a network is, reached 20 by June. This puts Solana ahead of Ethereum, Sui, and Sei, which have coefficients of 6, 18, and 7, respectively.

Solana validators are also geographically distributed, with no single country or data center controlling more than 33% of the total stake. Germany leads with 23.55%, followed by the U.S. at 17.37%, and the Netherlands at 14.36%.

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

Fed Decides On Interest Rates Today—Here’s What To Watch For