Here’s Why Solana and XRP Futures Are Surging on CME – Could PEPENODE be the Next Crypto to Explode?

KEY POINTS: Solana and XRP futures are the hottest crypto products on CME, reaching over $3B in outstanding contracts.

Solana and XRP futures are the hottest crypto products on CME, reaching over $3B in outstanding contracts. Market maturity, infrastructure developments, and softer crypto regulations are driving this trend.

Market maturity, infrastructure developments, and softer crypto regulations are driving this trend. Meanwhile, the viral Solana meme coin, PEPENODE, hit $2M raised in its hot presale, sparking FOMO with its mine-to-earn model.

Meanwhile, the viral Solana meme coin, PEPENODE, hit $2M raised in its hot presale, sparking FOMO with its mine-to-earn model.

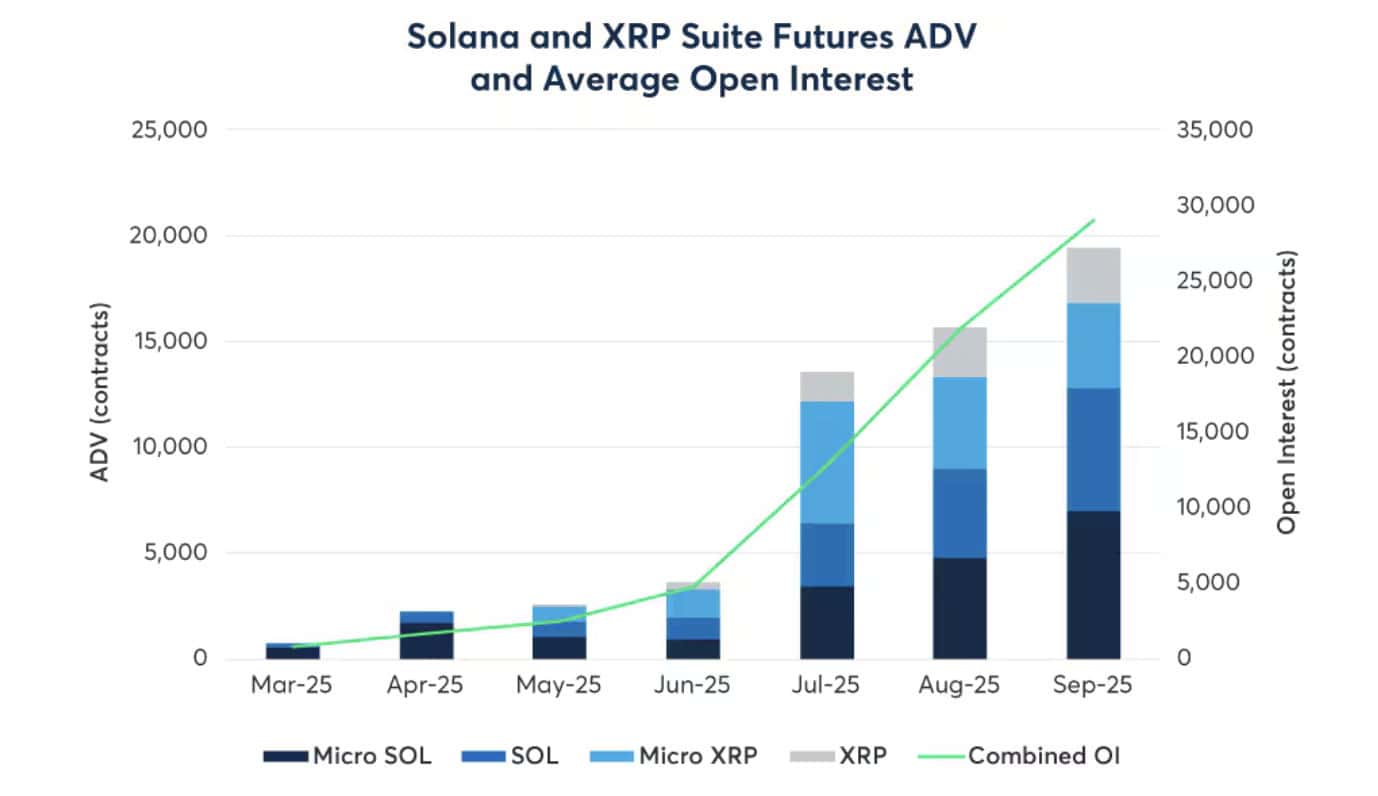

Crypto products tied to Solana and XRP on CME reached a new milestone on Monday, surpassing $3B in ppen interest.

The derivatives giant began offering Bitcoin futures in 2017 – a bold step at a time when crypto ETFs didn’t exist and regulatory frameworks were uncertain.

It took a long time for CME to expand its lineup beyond $BTC and $ETH, finally adding other cryptocurrencies like Solana and XRP earlier this year.

Source: CME Group

In August, both products crossed $1B in outstanding contracts, with XRP futures first to reach the milestone. But over the next 18 days, the notional value of open interest for Solana futures nearly doubled.

What’s more, Solana futures have seen an average daily volume of $700M in October, despite market jitters.

What’s Behind this Surge in Activity?

CME’s regulated platform gives users exposure to popular cryptocurrencies through derivatives – without the complications of directly holding the underlying tokens.

If anything, the deleveraging event of Oct 10 serves as a reminder of why regulated platforms and structured frameworks like CME’s matter.

According to Giovanni Vicioso, CME Group’s global head of cryptocurrency products, the XRP and Solana offerings ‘were able to benefit from the learnings that we saw in the marketplace with the launch of Bitcoin and Ethereum.’

While XRP and Solana futures have clearly built upon the foundation laid by previous products, growing regulatory clarity has also been a crucial factor, attracting more players to the cryptocurrency market.

Source: CME Group on X

This is because ETFs are attracting traditional players who previously wouldn’t touch crypto. They’ve made it easier to run basis and arbitrage trades between ETFs and CME futures, bypassing crypto wallets and exchanges.

As futures volumes climb and open interest surges, traders are seeking speed, liquidity, and credible alternatives to legacy chains.

PEPENODE’s presale taps into that shift. With early traction and a clear use case as a viable crypto-mining alternative, Pepenode positions itself as a retail-accessible complement to the institutional surge.

Solana Meme Coin PEPENODE Crosses $2M in Viral Presale

PEPENODE ($PEPENODE) is rapidly becoming one of the hottest meme coin presales this season.

The Solana-based project is building a mine-to-earn platform that provides investors with thrilling, gamified ways to generate passive income.

While crypto mining has long been inaccessible to everyday traders, PEPENODE changes this. It removes the technical and financial entry barriers to crypto mining by replacing expensive mining rigs with a virtual mining simulator that runs on-chain.

Using the native $PEPENODE token, anyone can purchase digital mining nodes and set up their own virtual server room.

- Each node has unique features and mining power.

- To maximize your earning potential, you mix and match nodes.

- You can also upgrade facilities to optimize your mining setup.

- Your earning potential grows in proportion to your hash rate.

- $PEPENODE tokens are used to make all payments and rewards on the network.

Top players are also eligible for airdrops in popular meme coins like $PEPE and $FARTCOIN. In addition, a referral program lets referrers earn 2% mining rewards.

Since 70% of all tokens used for upgrades are burnt, presale participants have a unique edge in the community. The earlier you buy the token during the presale phase, the more its value grows over time, given the declining total supply.

However, investors must act promptly to secure the token at its current discounted price of just $0.0011272, as the next price rise is scheduled for just two days’ time. The staking APY will also decline as more investors join in.

Visit the PEPENODE website to join the presale and stake now for 640% APY.

You May Also Like

Jerome Powell’s Press Conference: Crucial Insights Unveiled for the Market’s Future

Shiba Inu Price Forecast for Feb 9: Here’s Key Overhead Resistance for Any Move Upwards