Fidelity: Has Bitcoin reached the peak of this cycle?

By Zack Wainwright, Fidelity Analyst (Originally published on March 19)

Compiled by: Felix, PANews

As the current market cycle progresses, investors are closely watching for potential signs of a post-U.S. election rally for Bitcoin.

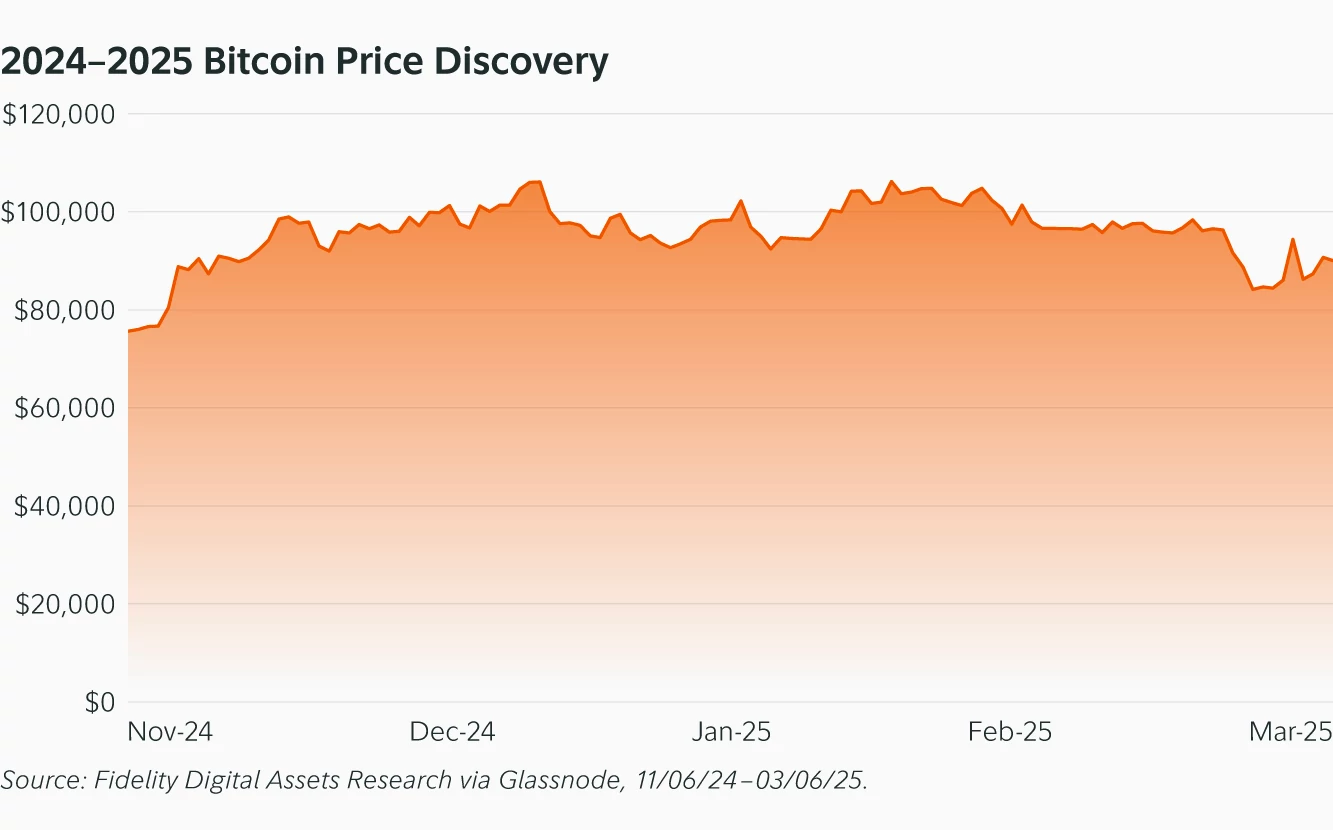

In November 2024, Bitcoin surpassed its previous all-time high set in March 2024, according to Glassnode Close, entering a true price discovery phase for the first time since surpassing $20,000 in December 2020. Historically, this shift has occurred during previous acceleration phases, which are periods in Bitcoin’s price cycles characterized by high volatility and high profits.

The key question now is: has Bitcoin already hit the top of this cycle, or is there further room to rise?

Post-Election Bitcoin Rally and Historic Gains

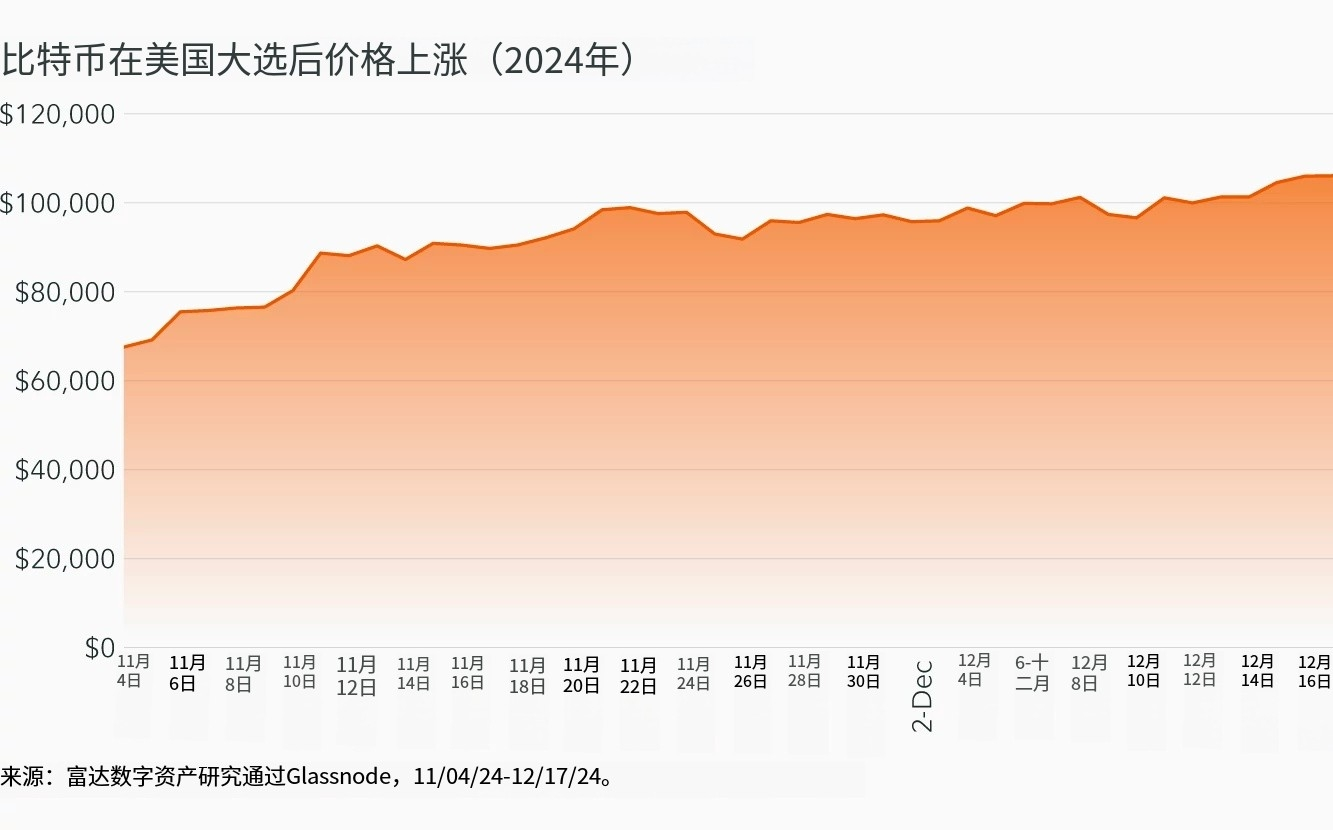

Bitcoin gained 56% in its November 2024 rally, entering a price discovery period reminiscent of past acceleration phase rallies, as shown in the chart “Bitcoin Rises After US Election (2024)”.

Historically, Bitcoin first broke through $30 in 2013, with prices soaring to an all-time high of $229 before cooling off. Bitcoin similarly broke through $1,100 in 2017, entering a price discovery period that saw the asset rise to nearly $3,000 before cooling off.

Both breakouts highlight the volatility and profit patterns that typically occur during acceleration phases. Each advance was followed by a sideways move. In both 2013 and 2017, the sideways move eventually broke out into a second advance.

While the trajectory of the current cycle has yet to fully unfold, these historical parallels suggest that a similar uptrend is possible.

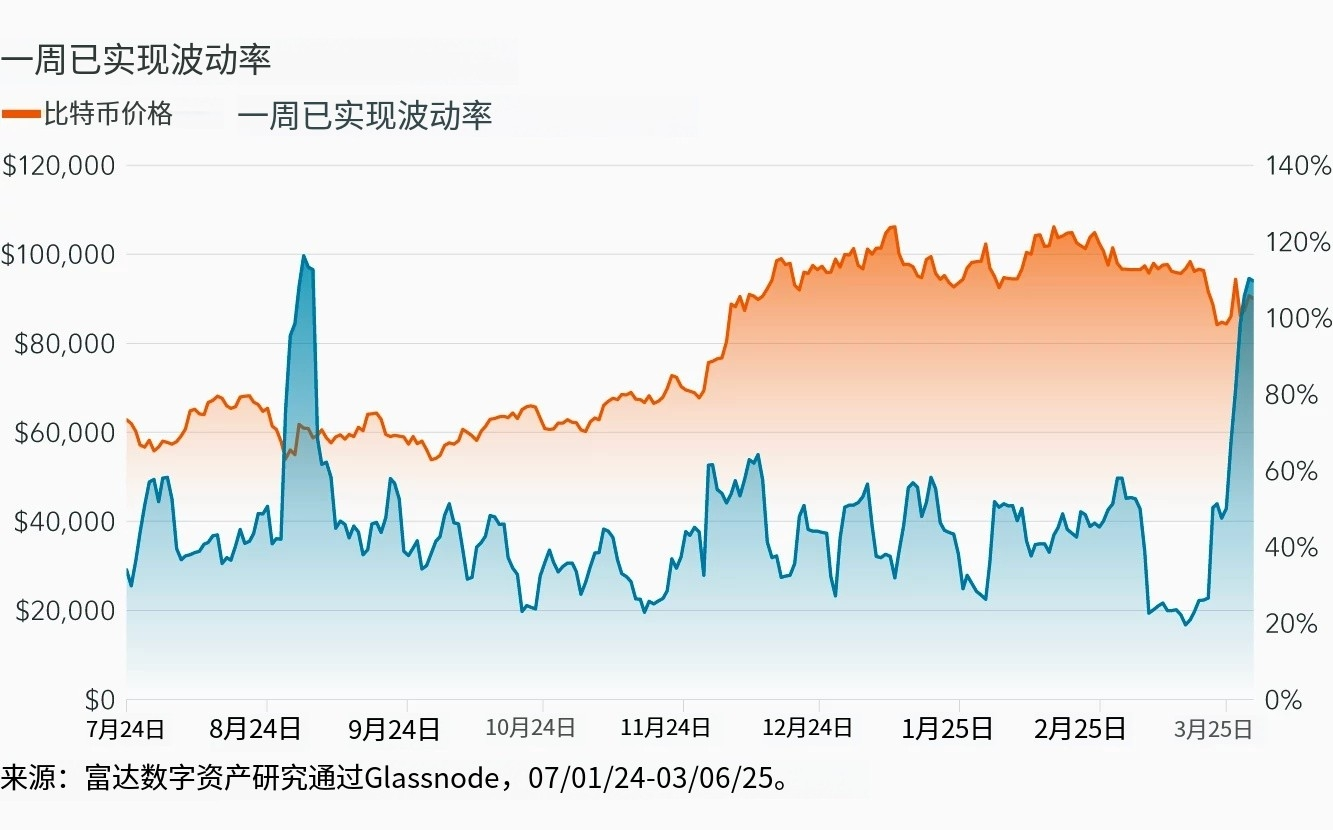

Rising volatility levels

On a weekly basis, Bitcoin's realized volatility is rising rapidly, which may indicate that the sideways trend of the past few months may be coming to an end. This is consistent with the behavior observed in the acceleration phase. Historically, the realized volatility of one year in the acceleration phase has been rising. From the start of the acceleration phase on July 15, 2024 to March 6, 2025, the realized volatility of one year increased from 45% to 51%.

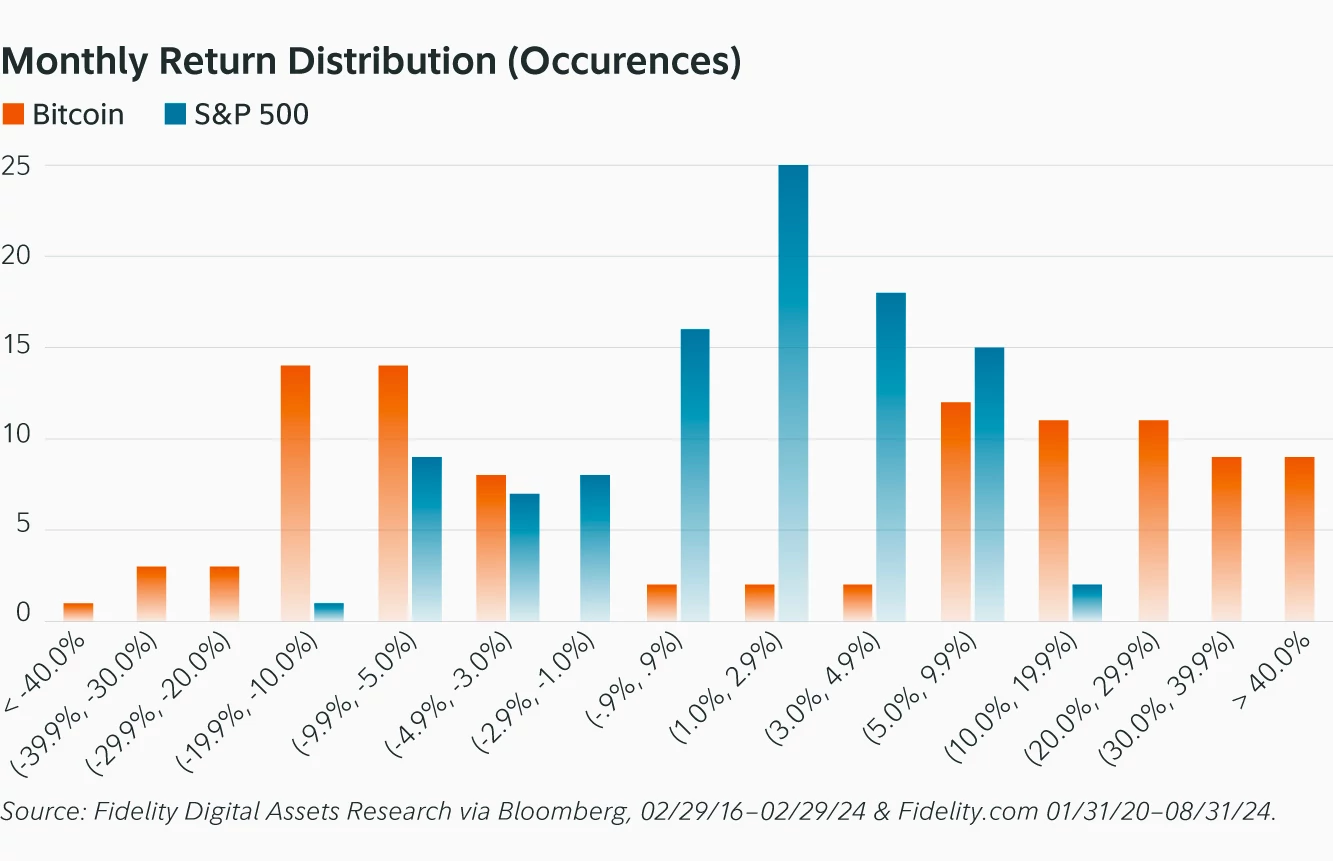

Furthermore, Bitcoin’s volatility has historically been biased to the upside. Looking at monthly returns, using the S&P 500 as a reference point, Bitcoin has seen higher levels in both directions, but the upside has been more frequent and larger.

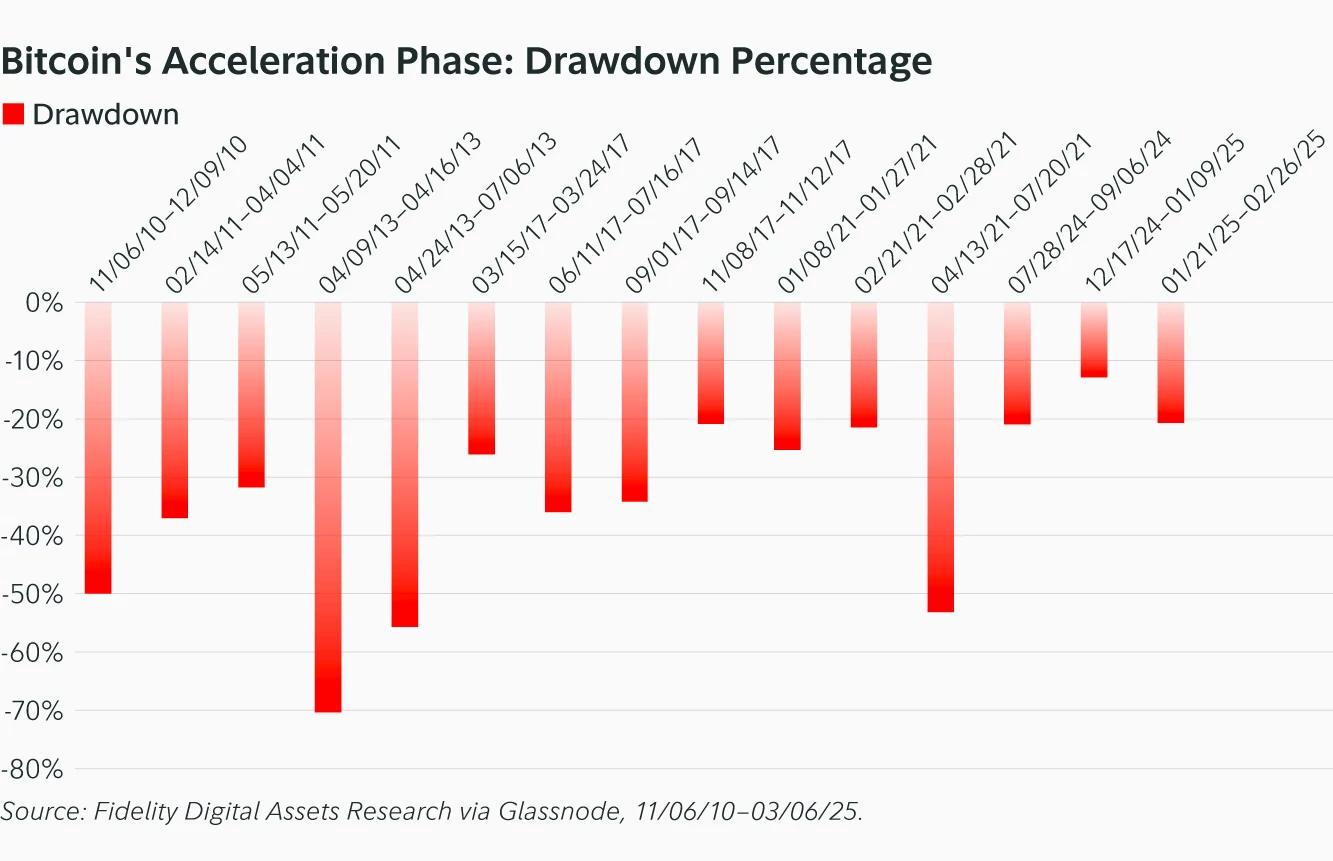

Still, retracements are an “inevitable” part of the acceleration phase — and they can be challenging for investors. However, the retracements Bitcoin has experienced recently have been relatively average compared to previous cycles. This suggests that volatility may diminish in both directions as Bitcoin matures.

Are we approaching the end of this cycle?

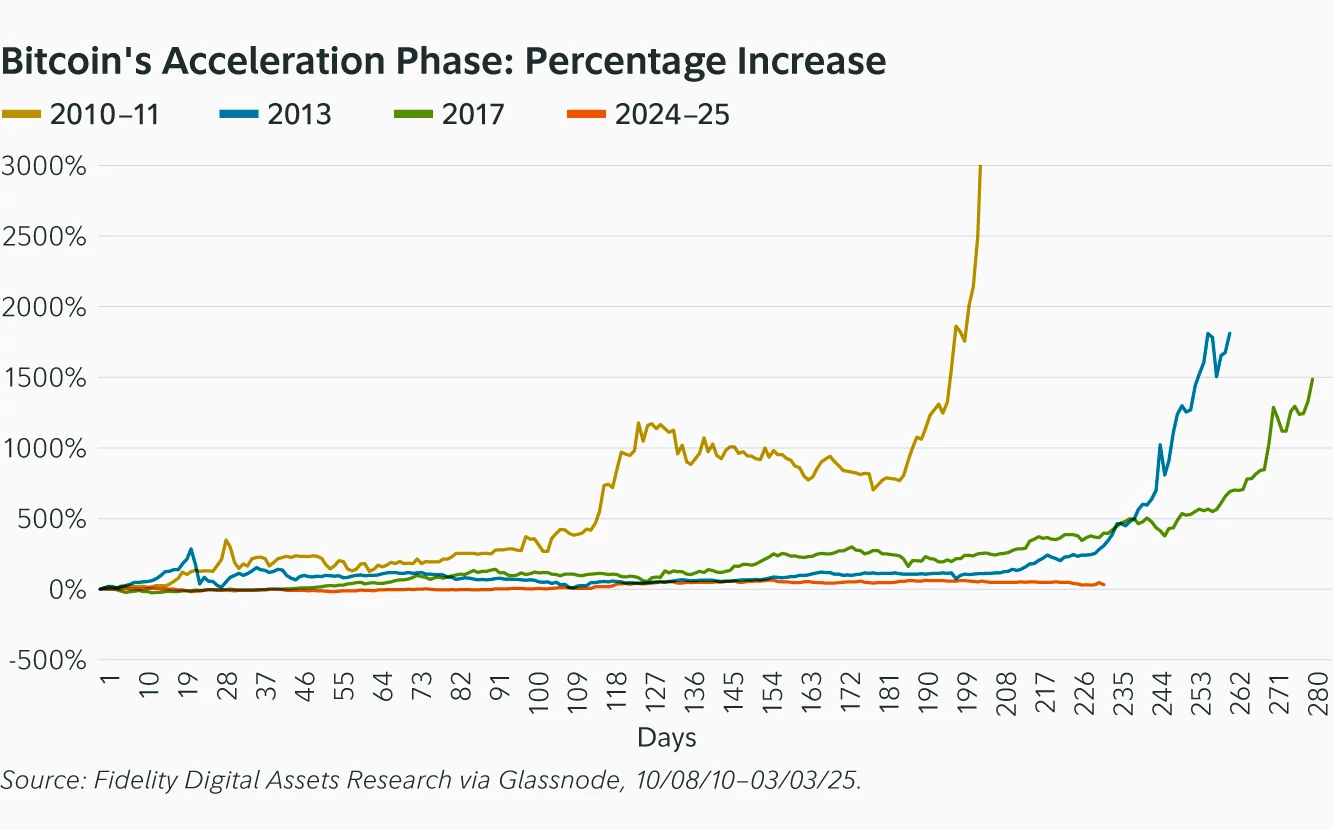

While the future remains uncertain, historical experience shows that as the acceleration phase lengthens, the likelihood of an explosive peak increases. As of March 3, Bitcoin has entered the 232nd day of the latest acceleration phase, approaching the peak reached in the previous phase and suddenly reversing. The acceleration phases in 2010-11, 2013, and 2017 peaked on the 244th, 261st, and 280th days, respectively, indicating that the acceleration phase of each cycle has been slightly extended.

This does not necessarily mean that the current phase will end within this specific time frame. However, history shows that Bitcoin’s acceleration phases can end with a sharp, dramatic rally (similar to the finale of a fireworks display) before quickly losing momentum and entering a reversal phase.

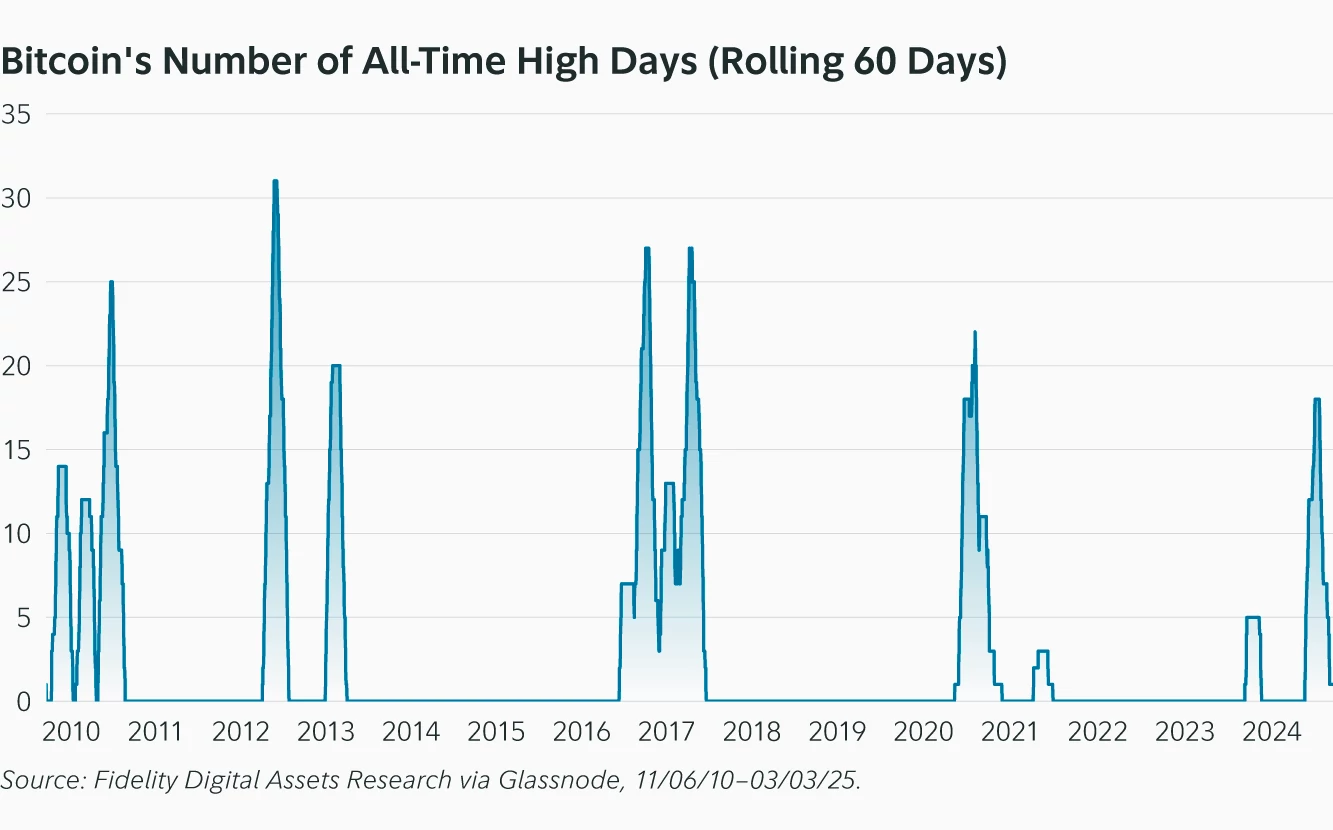

A key metric to watch during the acceleration phase is the number of days Bitcoin reaches a new all-time high over a 60-day period. In previous acceleration phases, Bitcoin typically experienced two major rallies, the first after the election. If a new all-time high is imminent, its starting price will be close to $110,000.

It is worth noting that the only time a second rally failed to materialize was in November 2021. While continuing to monitor the current cycle, it will be important to watch whether Bitcoin follows its historical pattern or begins to show signs of divergence.

Related reading: BTC is approaching $80,000, where is the bottom?

You May Also Like

Trump’s fury 'will end up hitting the economy and Republicans': WSJ

THR Stock Alert: Halper Sadeh LLC is Investigating Whether Thermon Group Holdings, Inc. is Obtaining a Fair Price for its Shareholders