Ethereum Foundation Proposes “EIL” for Unified Wallet Experience to Make it Like One Chain

The Ethereum Foundation has unveiled the Ethereum Interop Layer (EIL), a technical initiative intended to unify the user experience of Ethereum’s expanding rollup ecosystem, according to a recent proposal by the Account Abstraction team.

EIL promises a wallet-driven solution for seamless activity across Layer 2s, aiming to make Ethereum function as a single chain for users and developers.

EIL targets fragmentation in Ethereum’s layer 2 ecosystem

The emergence of rollups brought efficiency and affordable transactions, but introduced fragmentation for both assets and user experience. Navigating tokens that reside on Arbitrum, Base, Scroll, or Linea currently requires awareness of each chain’s specifics, the use of bridges and relayers, and constant manual interaction.

EIL seeks to eliminate these touchpoints by abstracting away the complexities and consolidating transaction logic inside the user’s wallet. With the interop layer, users can perform operations such as sending tokens, minting NFTs, or swapping assets across Layer 2s with a single click, without needing to identify or interact with individual chains.

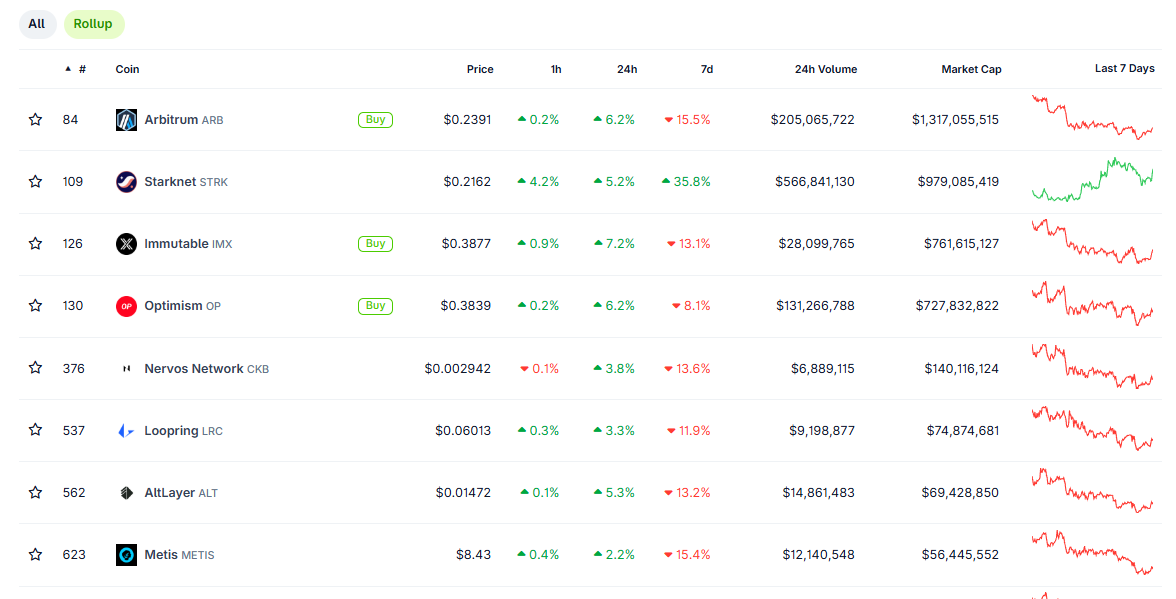

There are many Layer 2 chains, making it hard to use Ethereum. Source: CoinGecko

Preserving Ethereum’s core security principles

EIL is built on top of the ERC-4337 account abstraction and guided by the principles outlined in the Trustless Manifesto, unveiled on Nov. 13. The system ensures that all cross-L2 actions are initiated and settled directly from user wallets, without new trust assumptions or intermediaries.

Essential values like self-custody, censorship resistance, privacy, and on-chain verifiability are maintained. The trust model stays minimal; users do not rely on third-party bridges or off-chain operators but instead transact under rules encoded in smart contracts and open-source wallet code.

Impact on users and developers

For users, EIL is designed to feel like “one Ethereum,” removing friction caused by fragmented balances and chain-specific procedures. Transactions such as cross-chain transfers, minting, and swapping are executed as if all assets coexisted on a unified ledger. Wallets become universal portals, with the selection of chains and coordination of asset movement handled invisibly behind the scenes, according to the Ethereum Foundation blog.

From a developer perspective, EIL centralizes interoperability within the wallet, bypassing the need for bespoke app-level integrations and accelerating the onboarding of new networks. As a result, dapps and wallets are multichain-native out of the box, enabling a familiar and streamlined experience for both new and existing rollups.

Ethereum’s next steps toward unified scalability

The Ethereum Interop Layer marks a move from transaction throughput achievements to improvements in interaction simplicity and cross-chain composability.

By giving users a window into the whole Ethereum ecosystem through a single wallet interface, EIL aims to restore the sense of unity and trustless operation that characterized Ethereum’s early vision. The initiative, from the team at the Ethereum Foundation, calls on wallet teams, dapp builders, and network designers to participate in its development and help realize the prospect of a seamless, singular Ethereum network.

nextThe post Ethereum Foundation Proposes “EIL” for Unified Wallet Experience to Make it Like One Chain appeared first on Coinspeaker.

You May Also Like

Galaxy Digital Authorizes $200M Share Buyback as Stock Rebounds

Kalshi debuts ecosystem hub with Solana and Base