These New Shareholder Tools Make Bitcoin Activism Easy to Launch and Hard to Ignore

Bitcoin Magazine

These New Shareholder Tools Make Bitcoin Activism Easy to Launch and Hard to Ignore

For most of my life, the limiting factor in bringing my ideas to life has been code. I’ve always had a clear vision for the tools I wanted to build, but the execution gap was real. The ideas stayed on whiteboards, in notebooks, or in half-finished PhotoShop mockups.

That barrier no longer exists.

AI has collapsed it.

In just 9 days, I built two fully functioning consumer applications designed to equip shareholders with the leverage they’ve never had: the ability to advocate—cleanly, credibly, and at scale, for Bitcoin on the corporate balance sheet.

These tools weren’t commissioned. No one told me to build them. They are not fancy, intricate, or technically complicated. They came from a simple observation: 1) corporations control the majority of global capital, and 2) shareholders deserve a frictionless way to push those corporations toward strategic, long-term Bitcoin adoption.

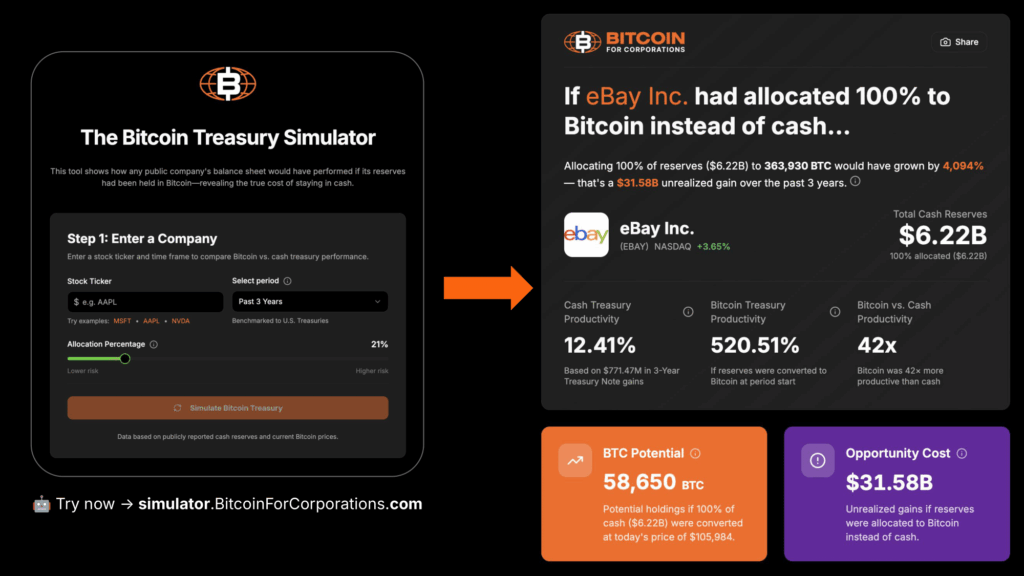

1. The Bitcoin Treasury Simulator

The Bitcoin Treasury Simulator answers a question that should be trivial but wasn’t:

How would a company have performed if it had allocated even a portion of its treasury to Bitcoin?

Retail investors can now enter a ticker, choose a time frame, and instantly see the opportunity cost of holding cash instead of Bitcoin—expressed in clear, defensible terms that anyone can understand.

For the first time, shareholders have a factual, data-driven tool they can bring to boards, IR teams, and fellow investors to show exactly what’s at stake.

Try the simulator: simulator.bitcoinforcorporations.com

Try the simulator: simulator.bitcoinforcorporations.com

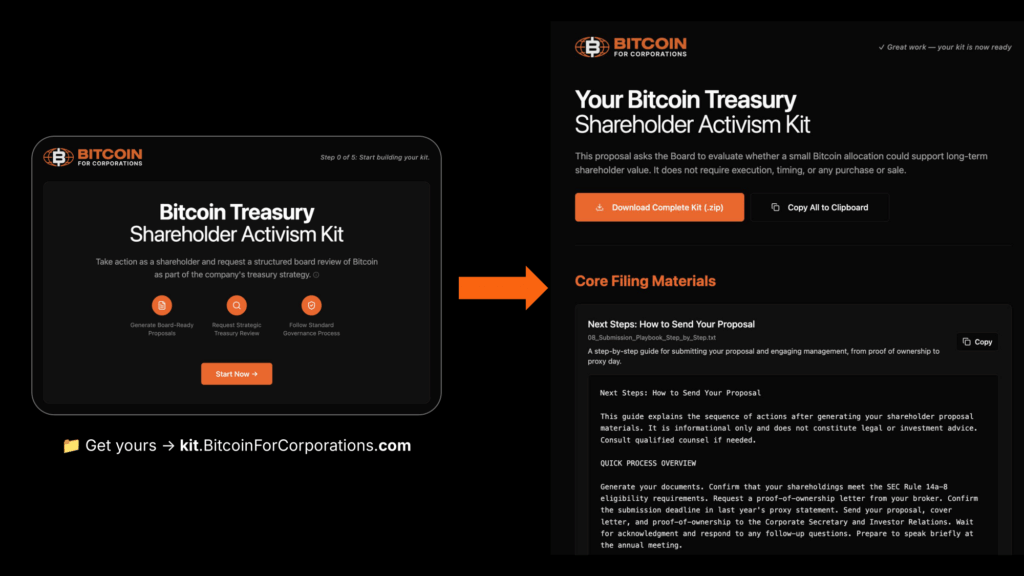

2. The Bitcoin Treasury Shareholder Activism Kit

Shareholder activism has always been powerful, but it’s been inaccessible to most investors. The rules are complex. The legalese is intimidating. The entire process feels like a wall you only get past if you’re a lawyer or a billion-dollar fund.

So I built a generator that removes all of that friction.

The Bitcoin Treasury Shareholder Activism Kit walks any verified shareholder—step by step—through generating a legitimate, SEC-compliant proposal asking a company to evaluate or adopt a Bitcoin treasury strategy. It produces the documentation, the language, the filing structure, and the instructions needed to get the proposal included in the company’s proxy.

Something that once felt like it required attorneys and institutional resources can now be completed in 2 minutes.

Create your kit: kit.bitcoinforcorporations.com

Create your kit: kit.bitcoinforcorporations.com

Why These Tools Exist

Corporate Bitcoin adoption does not happen by accident. It happens because someone—inside or outside the company—pushes for it with clarity, precision, and persistence.

These tools are built for the people willing to make that push.

They give shareholders:

- Clear data.

- A credible filing pathway.

- A structured way to change corporate behavior.

- And the confidence to take action without needing permission.

What Comes Next

This is just the beginning. Both tools will evolve, expand, and integrate more deeply into the broader Bitcoin For Corporations ecosystem. But the important part is this: AI has made technical hurdles of these projects much easier to overcome.

And if enough people decide to build the future they want—one tool at a time—we accelerate corporate Bitcoin adoption far faster than anyone expects.

Disclaimer: This content was written on behalf of Bitcoin For Corporations. This article is intended solely for informational purposes and should not be interpreted as an invitation or solicitation to acquire, purchase or subscribe for securities.

This post These New Shareholder Tools Make Bitcoin Activism Easy to Launch and Hard to Ignore first appeared on Bitcoin Magazine and is written by Nick Ward.

You May Also Like

Kalshi Jumps to 62% Market Share While Polymarket Eyes $10B Valuation

Visa Expands USDC Stablecoin Settlement For US Banks