Bitcoin, crypto market begin recovery as Israel and Iran agree to a ceasefire

- The cryptocurrency market rebounded from a weekend dip, with Bitcoin, Ethereum, and XRP rising by 5%, 9%, and 7%, respectively.

- The recovery comes as President Donald Trump announced that Israel and Iran have agreed to a complete ceasefire.

- Iran earlier launched a "de-escalatory" missile attack on a US military base in Qatar.

The cryptocurrency market made a comeback on Monday, rebounding from a weekend dip as top assets, including Bitcoin (BTC), Ethereum (ETH), and XRP, staged a recovery. The rebound follows United States (US) President Donald Trump's statement that Israel and Iran will each conduct a 12-hour ceasefire, after which the war threats will come to an end.

Top cryptos Bitcoin, Ethereum, XRP recovers as Trump announces Israel-Iran ceasefire

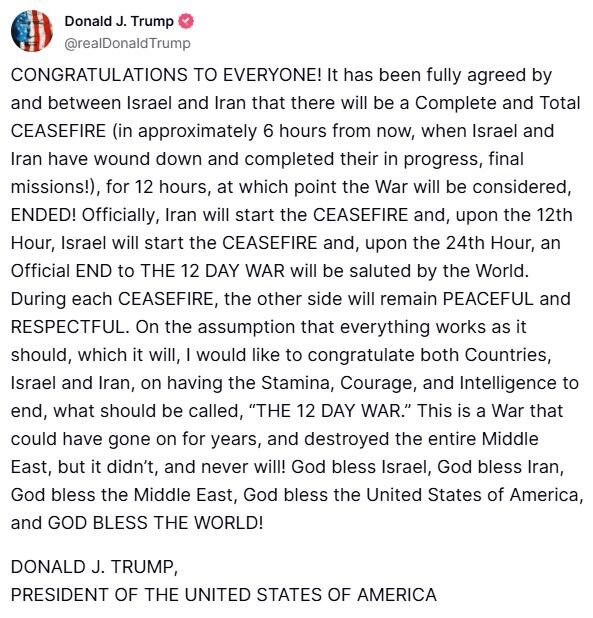

President Trump announced that Israel and Iran have agreed to a full ceasefire set to begin within a few hours, potentially ending what he referred to as "The 12 Day War," according to a Monday post on the social media platform Truth Social.

Source: President Trump’s Truth Social

President Trump stated that the ceasefire will unfold in two phases, where Iran will observe the first 12 hours, followed by Israel, leading to a formal end of the clash between the two sides.

Trump also noted that Iran notified the United States (US) before it launched attacks on a US military base in Qatar. He shared that there were no casualties from Iran's actions, suggesting that the attacks were "de-escalatory."

The event follows an escalation of war tensions over the weekend after Israel intensified its air attacks, targeting multiple sites across Iran on Saturday and Sunday. The US also joined the conflict by conducting air strikes on three Iranian nuclear facilities on Sunday, sending the crypto market tumbling.

However, recent talks of a ceasefire have sparked a recovery among crypto assets, with Bitcoin rising 5% to around $106,000 after plunging to $98,000 — a six-week low — on Sunday.

Top altcoins rebounded alongside Bitcoin, with Ethereum, XRP and Solana (SOL) recording gains of 9%, 7% and 10%, respectively.

Several crypto categories also reacted positively to the update late Monday. The meme sector rose 9% following President Trump's statement, with Dogecoin (DOGE), Shiba Inu (SHIB), and PEPE rallying 9%, 10%, and 12%, respectively.

Likewise, the artificial intelligence (AI) token category marked a 9% gain following the news of a ceasefire. Top AI tokens, including Bittensor (TAO), Internet Computer (ICP), Near Protocol (NEAR), Artificial Superintelligence (FET), Render (RENDER), and Virtual Protocol (VIRTUAL), saw double-digit gains as President Trump shared positive updates around Israel-Iran peace talks.

The development follows the Federal Reserve's removal of the term "reputational risk" from its bank supervision guidelines, easing restrictions placed on banks dealing with crypto clients.

You May Also Like

MoneyGram Taps Stablecoins To Shield Colombians From Peso Weakness

BDACS Launches KRW1 Stablecoin Backed by the Won