XRP and Solana ETFs Surge as Investors Pour In

- US spot Solana (SOL) ETFs have maintained an unbroken 20-day streak of net inflows, totaling US$568.24 million since their late-October debut.

- Monday’s SOL ETF net additions reached US$58 million, the third strongest day, with Bitwise’s BSOL accounting for the majority at US$39.5 million.

- US spot XRP ETFs also saw strong demand on Monday with a net inflow of US$164 million, marking their second-biggest daily intake.

US spot crypto ETFs tracking Solana and XRP continued to pull in new money this week.

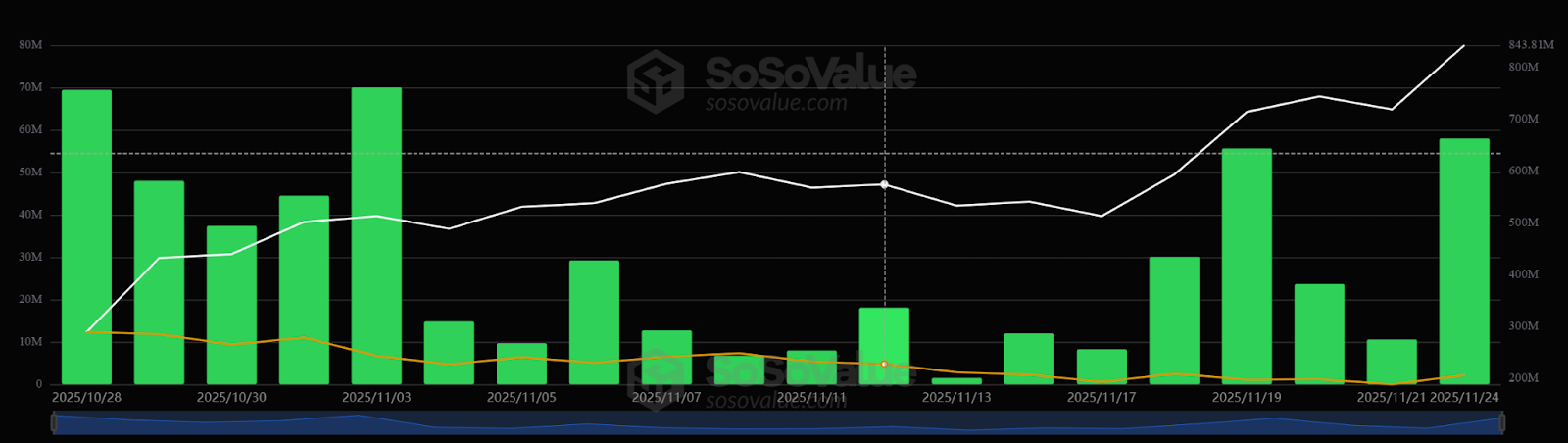

Solana ETFs have now logged net inflows for 20 straight trading days, an unbroken run since their late-October debut. Data provider SoSoValue put Monday’s net additions at US$58 million (AU$88.74 million), the third-strongest day so far and the largest since Nov. 3.

Total SOL spot ETF net inflow. Source: SoSo Value.

Total SOL spot ETF net inflow. Source: SoSo Value.

Bitwise’s BSOL ETF accounted for most of that with US$39.5 million (AU$60.44 million) in net buying, while Fidelity’s fund added US$9.7 million (AU$14.84 million), and products from Grayscale and VanEck saw inflows of US$4.7 million (AU$7.19 million) and US$3.1 million (AU$4.74 million).

BSOL launched on Oct. 28, debuting with a trading volume of around US$56 million (AU$85 million). Two days later, it added around US$72 million (AU$110 million). That’s more than nearly 850 ETFs this year.

Overall, the six US spot Solana ETFs have accumulated US$568.24 million (AU$869.41 million) of net inflows and now manage US$843.81 million (AU$1,291.03 million) in total, roughly 1.09% of SOL’s market value.

Read more: Bitcoin Premium in Michael Saylor’s Strategy Stock Nears ‘Crypto Winter’ Lows, But TD Cowen Still Sees 200% Upside

XRP ETFs See Strong Demand As Well

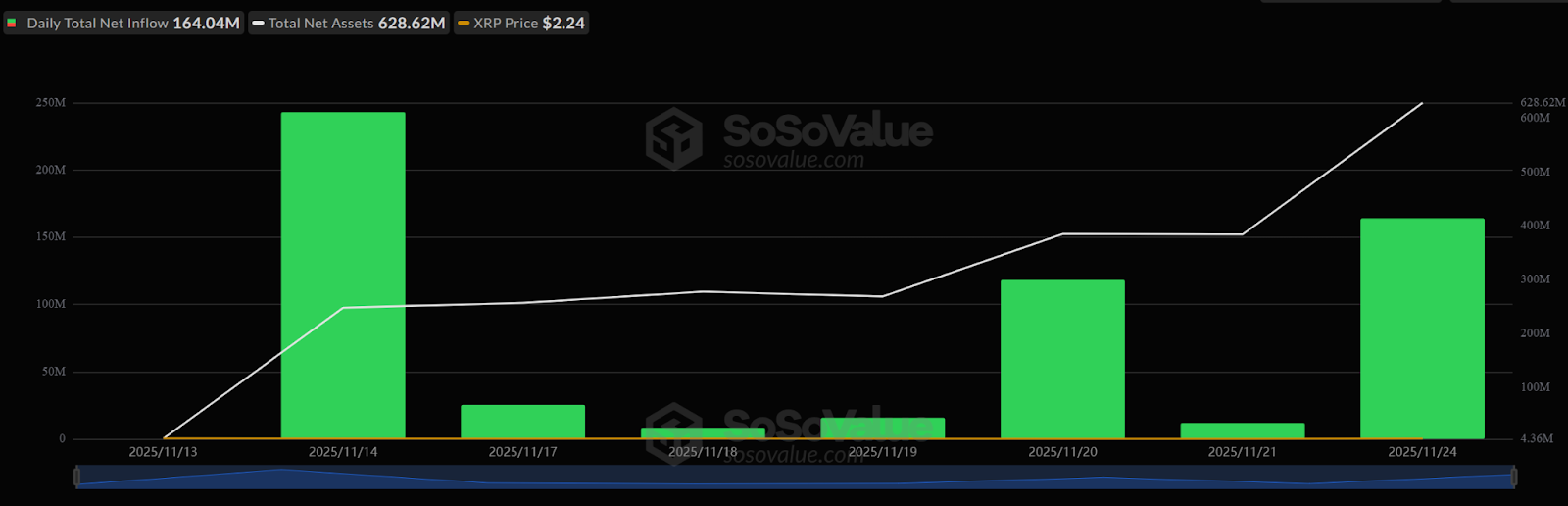

XRP products also saw strong demand, as all spot XRP ETFs received US$164 million (AU$250.92 million) on Monday, their second-biggest daily intake after the US$243 million (AU$371.79 million) record set on Nov. 14.

Total XRP Spot ETF Net Inflow. Source: SoSo Value

Total XRP Spot ETF Net Inflow. Source: SoSo Value

XRP ETFs run by Grayscale and Franklin Templeton each drew more than US$60 million (AU$91.80 million), and some additional inflows by Canary and Bitwise, per SoSo Value data.

Read more: Bitwise CIO Says Token Value Capture Set to Supercharge Crypto Prices by 2026

The post XRP and Solana ETFs Surge as Investors Pour In appeared first on Crypto News Australia.

You May Also Like

Visa Expands USDC Stablecoin Settlement For US Banks

Nasdaq Company Adds 7,500 BTC in Bold Treasury Move