Ethereum News: Ethereum’s MVRV Z-Score Flashes Buy Signal as ETFs Surge

Ethereum MVRZ-score reaches 0.29, which indicates accumulation area. BlackRock dominates inflows of 78.6M ETF. Technical trends are indicative of a possible breakout of 9K.

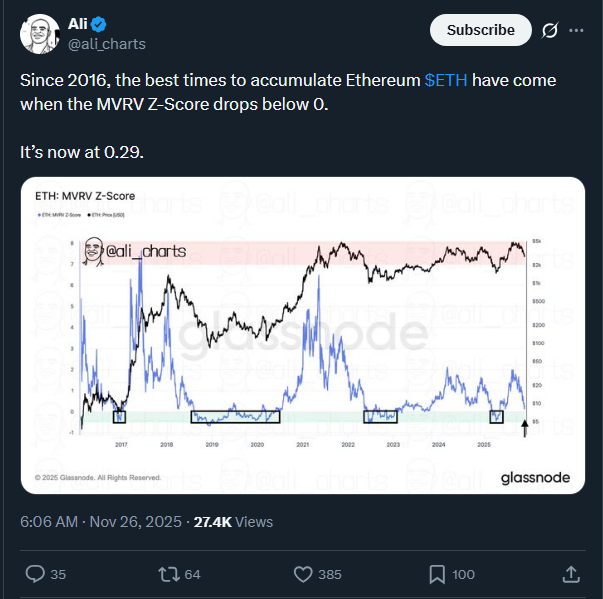

Ether has good accumulation patterns based on several indicators. The MVRV Z-Score has declined to 0.29. This is the point at which investors have a history of ideal entry.

Ali Charts on X indicate that Ethereum accumulation has been best at times when the MVRV Z-Score is negative. The indicator is at 0.29, which is an indication that the asset is in attractive territory. This measure has been effective in determining places of accumulation since 2016.

Source – Ali Charts X

BlackRock Dominates Record ETF Inflows

There is an upward trend in institutional demand for Ethereum. Yesterday, ETF inflows totalled $ 78.6 million. BlackRock was the first to make the purchases totaling $46.1 million.

Source – X Ted Pillows

Ted Pillows posted these numbers on X. The information underscores increasing institutional interest in Ethereum exposure. The huge hold of BlackRock shows their belief in the future prospects of the asset.

Such inflows are a drastic change in institutional behavior. Ethereum is seeing increased investments by traditional finance players. The trend indicates mainstream adoption is picking up.

You might also like: Ethereum News: Ethereum’s Powerful Bullish Reversal: 3 Elliott Wave Signals Defying Market Fear

Years of Consolidation Point to Explosive Move

Since 2021, Ethereum has been in consolidation. CryptoAnup wrote on X that the asset is stuck in a huge accumulation range. Prices have been rejected by the macro trendline on numerous occasions.

Source – CryptoAnup X

The coiling pattern may be extended, resulting in explosive motion. Technical analysis suggests a possible target of between $8.5K and $9K. This is an estimate of the present price behavior and structural trends.

The consolidation over the years has created a lot of energy. The move might be important once the breakout takes place. Historical trends indicate that there are long accumulation durations before significant rallies.

Bullish is supported by the market structure. Ether has been building a foundation for years. The technical layout, together with institutional inflows, leads to good conditions.

The post Ethereum News: Ethereum’s MVRV Z-Score Flashes Buy Signal as ETFs Surge appeared first on Live Bitcoin News.

You May Also Like

Sushi Solana integration expands multichain DeFi reach

Sushi Solana integration signals strategic DeFi expansion on a fast-growing blockchain