Memecoins Shows Market Activity Picking Up: Is Rally Coming Or An Exit Opportunity?

The post Memecoins Shows Market Activity Picking Up: Is Rally Coming Or An Exit Opportunity? appeared first on Coinpedia Fintech News

The memecoins sector is beginning to show early recovery signals after months of decline, renewing expectations for a potential short-term rebound. Recent movement on memecoin price charts, rising weekly gains, and increasing activity across major launchpads suggest that the broader market may be entering a transition phase before December 2025 begins, despite rumors of memecoins to die like NFT’s.

Memecoins Begin Recovering After Deep Market Lows

At the end of November 2025, memecoins started displaying notable strength after a prolonged period of stagnation, witnessed on several memecoin price charts.

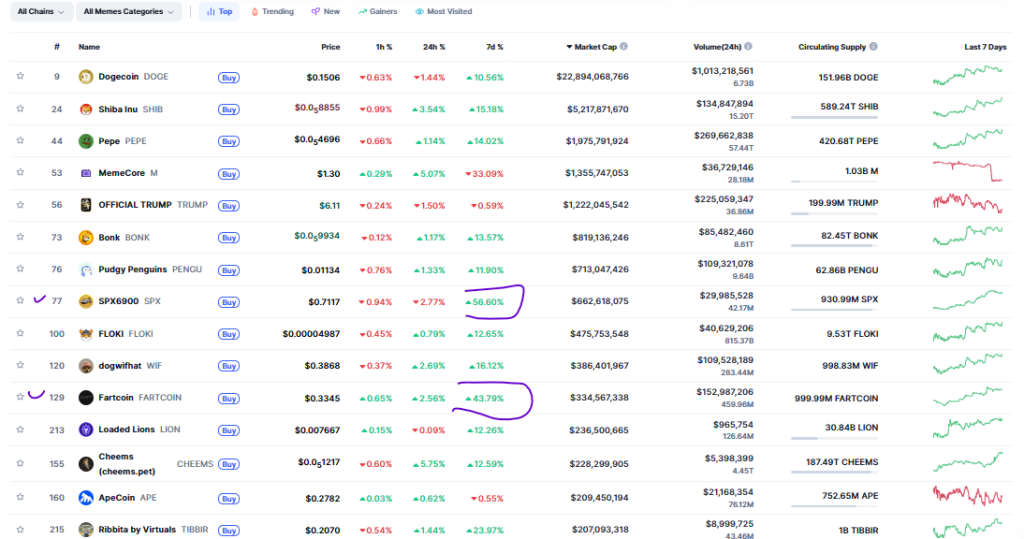

Several memecoin assets showed potential breakout structures on memecoin price charts, that are hinting at a possible shift in sentiment. This week alone, SPX6900 (SPX/USD) surged 56% while Fartcoin (FART) gained 43%, making them the top performers among the top 15 memecoin cryptos by market cap.

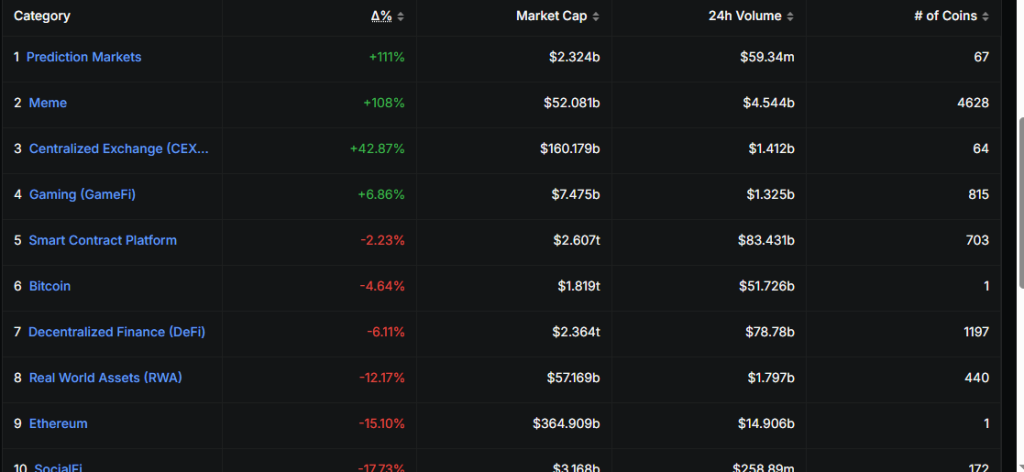

Moreover, DeFiLlama’s narrative tracker placed the memecoin narrative at the 6th rank, with a 12.14% rise over the past seven days. In the yearly timeframe, it still held the 2nd position, posting an impressive 108% gain across 365 days.

These numbers highlight that, despite steep declines earlier in the year, the sector retains significant underlying interest.

Pump.fun Strengthens Market Dominance on Solana

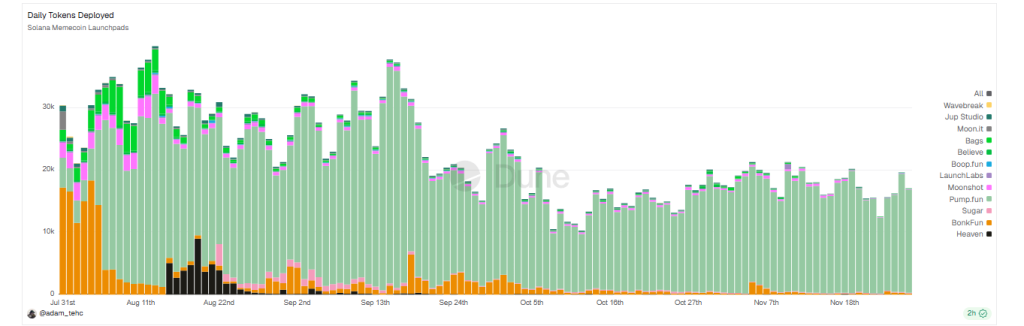

A major catalyst behind this renewed memecoin momentum is the rise of Solana’s Pump.fun, which is now a dominant force in token launches.

As SOL price USD holding significant market price and even the market cap that it has most of its contribution is of Pump.fun memecoin launchpads work, activity on the launchpad has intensified. Although “LetsBonk” previously led token creation, Pump.fun overtook it and reached over 20,000 token creators by September, Based on Dune analytics.

Even in late November, out of 5,339 total token creators, 5,091 came from Pump.fun alone, signaling overwhelming preference. This dominance also reflects in market share where Pump.fun drives 95% of volume across eight major Solana meme launchpads.

The surge in new tokens indicates that interest in memecoin cryptos never disappeared; instead, it was quietly piling up beneath the surface.

- Also Read :

- 3 Altcoins Showing Silent Strength Despite Low Market Attention

- ,

Fading Selling Pressure Sets the Stage for Accumulation

Currently, many memecoins remain at deep-bottom price ranges after months of decline. Holders who once panicked now mostly assume their positions are already “lost,” reducing active selling.

Consequently, selling pressure has eased dramatically, creating a quiet accumulation zone typically favored by larger players.

However, if the ongoing rise extends into December, it may also open an exit window for long-time holders still carrying heavy losses. They may be unwilling to accumulate high-risk assets at elevated levels and could instead use any temporary rally to reduce exposure.

Additionally, the current online search interest by Google for “memecoins” is at historic lows, suggesting little attention from the general public.

Paradoxically, in previous cycles, such periods of low external interest have often preceded rapid internal expansion phases.

FAQs

Memecoins are rebounding as selling pressure fades, launchpad activity rises, and charts show early breakout signals that hint at renewed market interest.

Low search interest often means the public isn’t watching, which historically has preceded early accumulation phases and quiet growth among early buyers.

It’s too early to confirm a long-term trend, but rising weekly gains, reduced selling, and active launchpads point toward a short-term recovery window.

Accumulation may appeal to risk-tolerant investors, but prices are still volatile. A cautious approach and clear strategy help manage potential market swings.

You May Also Like

Michael Saylor’s Strategy follows Metaplanet, adding 6,269 BTC worth $729 million

Payward Revenue Hits $2.2 Billion as Kraken Exchange Reports Strong 2025 Growth