How does decentralization of intent simplify operations and remove complexity?

Written by: Rishabh Nagar

Compiled by: Felix, PANews

Doing anything on-chain currently feels like assembling furniture from IKEA — the steps are long, confusing, and there’s always a risk of screwing up. It’s even more confusing when you have to switch between different blockchains. You need to remember every step, be wary of scams, calculate fees, and not lose your mind in the process.

Now, imagine that instead of having to go through all the different operations on various blockchains — buying, exchanging, sending tokens across bridges, farming yields, and then exchanging back to your favorite cryptocurrency — all you have to do is say out loud what you want, and magically, everything happens securely and smoothly. That’s exactly what Intentions do.

Why does intention matter in the crypto world?

Intents are like digital wishes. They help users achieve what they want to do on the internet, like send money or vote directly and automatically. In the crypto world, understanding intents is important because they allow users to control their actions without the need for middlemen or companies. This makes things faster, cheaper, and more secure.

Let's say you want to send a letter to a friend. Traditionally, you would give it to a postman, who might first deliver it to a large office, and then another person would deliver it to your friend. This is how it is usually done in today's technological world.

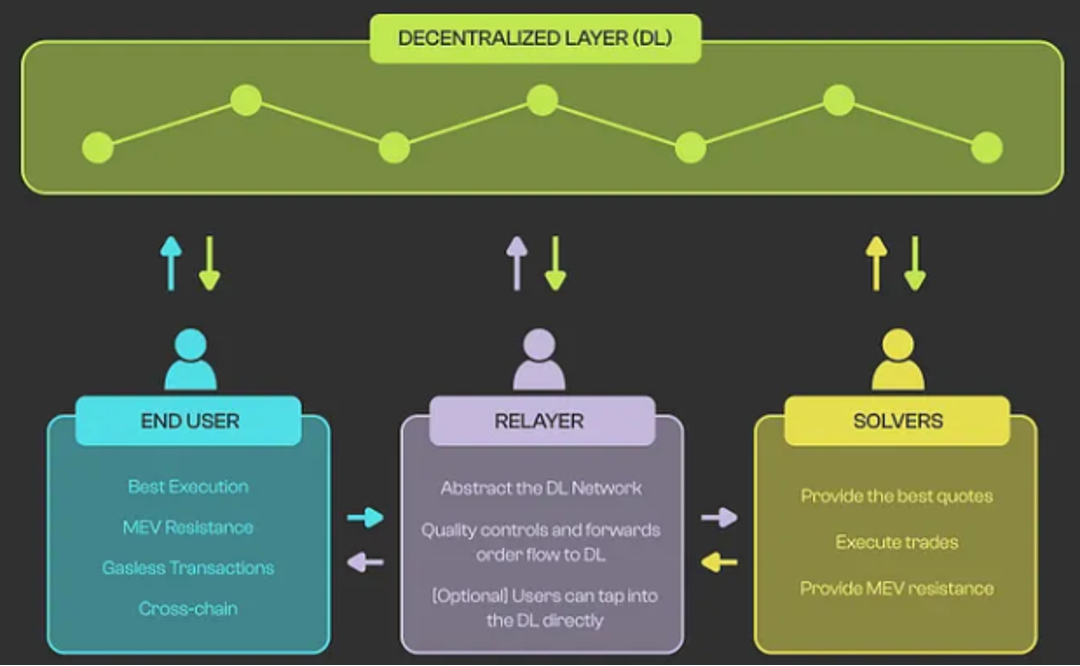

Now, if you could just press a button, your letter would magically appear in your friend's hand. This is what decentralization of intent looks like - skipping the middleman and doing what you want directly, securely, and quickly. This is important because it means you don't have to worry about other people interfering, slowing things down, or losing the letter.

Introduction to Decentralized Intentions

Intentions are at the core of what an individual wants to achieve - whether it's a simple transfer of assets, or a more complex execution of a series of coordinated transactions. Traditionally, these intentions are managed through centralized systems, but blockchain technology increasingly allows them to be achieved in a decentralized manner.

For example, consider the intention to participate in a vote in a decentralized autonomous organization (DAO). In a traditional setting, this requires interacting with a centralized platform where votes can be manipulated, delayed, or even censored. In a decentralized system, by contrast, this intention is expressed through smart contracts, which can automatically collect votes, count them, and make decisions without the need for a central authority.

This shift towards decentralized intent fulfillment is significant because it represents a move away from reliance on centralized intermediaries, giving users greater control, transparency, and security over their actions. It allows for the creation of systems that can directly fulfill intent without unnecessary obstacles or risk of third-party intervention.

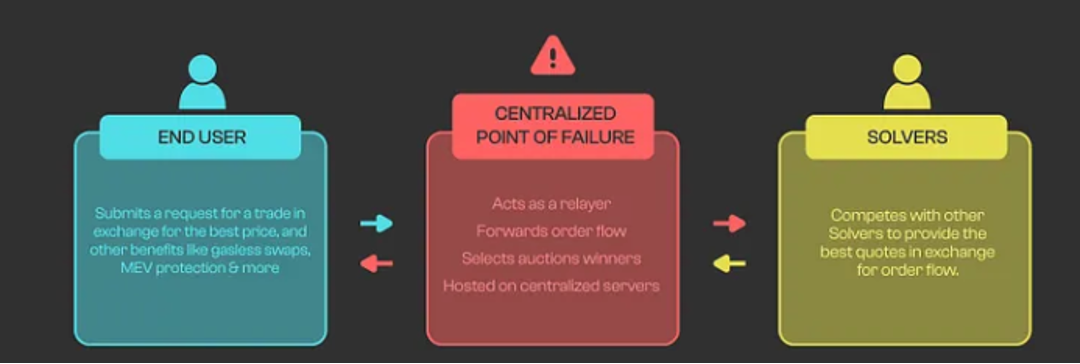

Source: Paraswap

Intent in decentralized applications

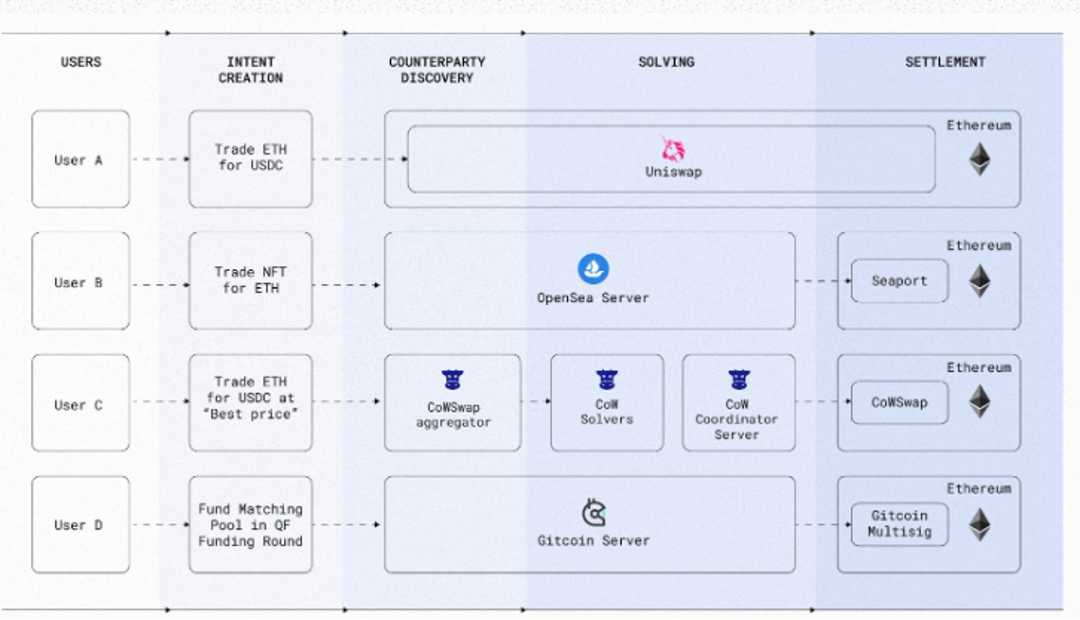

In the decentralized world, intents can be simple or complex. A simple intent might be similar to executing a trade on a DEX, where a user’s desire to exchange one cryptocurrency for another is processed directly on-chain, and once the necessary conditions are met, the transaction is automatically completed.

However, intent can also be complex. Imagine a scenario where a user wants to optimize a portfolio across multiple decentralized finance (DeFi) platforms, balancing yield farming, liquidity provision, and automated trading strategies. This involves not just one action, but a series of coordinated interactions with various protocols, each with its own unique requirements and risks. Here, intent is multifaceted and requires complex mechanisms to ensure it is achieved in the most efficient way.

In these cases, decentralized mechanisms like smart contracts, oracles, and decentralized or off-chain solvers come into play to execute complex intent in a trustless and transparent manner. In traditional systems, these complex tasks are impossible to accomplish without centralized control.

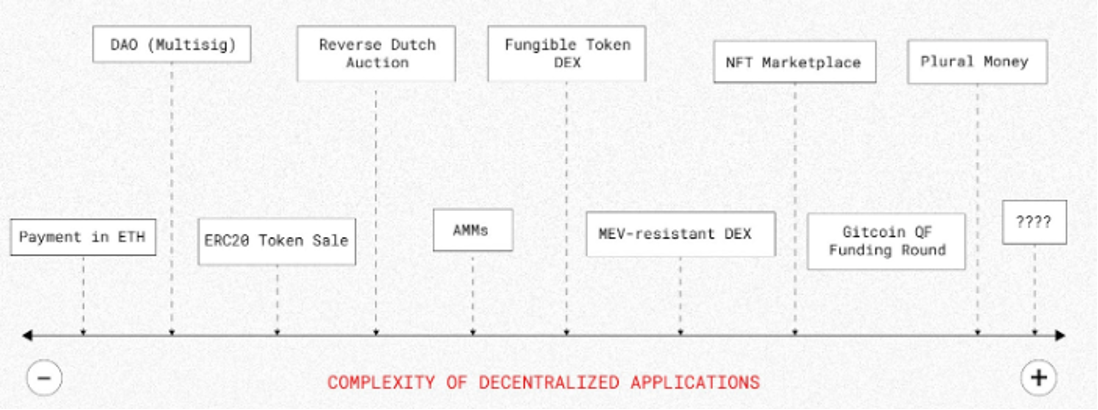

Source: Anoma

What is Chain-Agnostic and why is intent needed?

Chain-Agnostic means you can do what you want on any blockchain. Imagine using the internet: it doesn’t matter which Wi-Fi you’re connected to — you just want to send a message or watch a video.

In the crypto world, intentions are like your digital instructions or wishes. In order for them to work smoothly on different blockchains, a Chain-Agnostic is needed. In this way, you can easily and securely implement your intentions on any blockchain without understanding or caring about the differences between them.

Chain-Agnostic Intention

The intent-centric model in the current ecosystem

In various blockchain ecosystems, intent-centric models are emerging as a way to simplify user interactions and improve the efficiency of dApps. For example, in an ecosystem like Ethereum, intent is often handled through smart contracts that handle everything from DeFi transactions to NFT transactions. These systems are designed to ensure that once a user expresses an intent, the underlying infrastructure takes care of the rest, including finding a counterparty, executing the transaction, and recording it on the blockchain.

In other ecosystems, such as Polkadot or Cosmos, intent-centric architectures are being explored to leverage the interoperability capabilities inherent in these networks. For example, in Polkadot, intents can be implemented between different parachains, allowing users to interact with various dApps without having to worry about the underlying technical differences between the chains. Similarly, Cosmos is experimenting with cross-chain intent implementations, where users can initiate actions on one chain and complete them on another, while maintaining a high level of security and decentralization.

Source: Anoma

The Need for a Chain-Agnostic Framework

Despite these advances, the current ecosystem remains largely fragmented, with most intents tied to specific blockchains. This fragmentation can lead to inefficiencies. The Chain-Agnostic Framework aims to overcome these challenges by providing a unified system where intents can be expressed, processed, and fulfilled on any blockchain, regardless of its underlying architecture.

In the Chain-Agnostic model, intent is a universal expression that is not limited to any one application or chain. For example, a user might express an intent to trade a token, and the network will handle this intent in the most efficient way, regardless of whether the transaction occurs on Ethereum, Binance Smart Chain, or another blockchain. This approach not only simplifies the user experience, but also enables greater interoperability and composability between dApps on different chains.

Source: Paraswap

Building a Chain-Agnostic Architecture

To build an intent-centric Chain-Agnostic architecture, several key components are required:

- Generic Intents: Intents must be designed to be flexible and adaptable, able to execute on any blockchain without modification.

- Decentralized counterparty discovery: The system must include a decentralized mechanism for discovering counterparties that can fulfill intent, regardless of which chain they operate on.

- Cross-chain solvers: Solvers responsible for executing intent must be able to run across multiple blockchains, determining the best path to achieve the intent based on factors such as speed, cost, and security.

- Universal Settlement: Finally, the results of completing the intent must be recorded in a way that all blockchains recognize, ensuring that the user's actions are verified and secure.

What technical components are involved in the decentralization effort?

Core components:

- Generic Intents: These are adaptable building blocks that allow users to express outcomes in decentralized systems.

- Solver Mechanism: Decentralized agents interpret and implement these intents, working across different blockchains to achieve the user’s goals, whether it’s a simple token swap or a complex operation. — Think of solvers as digital personal assistants that listen to your wishes (intents) and find the best way to implement them across multiple blockchains.

- Counterparty Discovery: In a multi-chain ecosystem, the decentralized process of finding entities that match and fulfill intent is critical, ensuring that the correct counterparty can be identified without the need for centralized control.

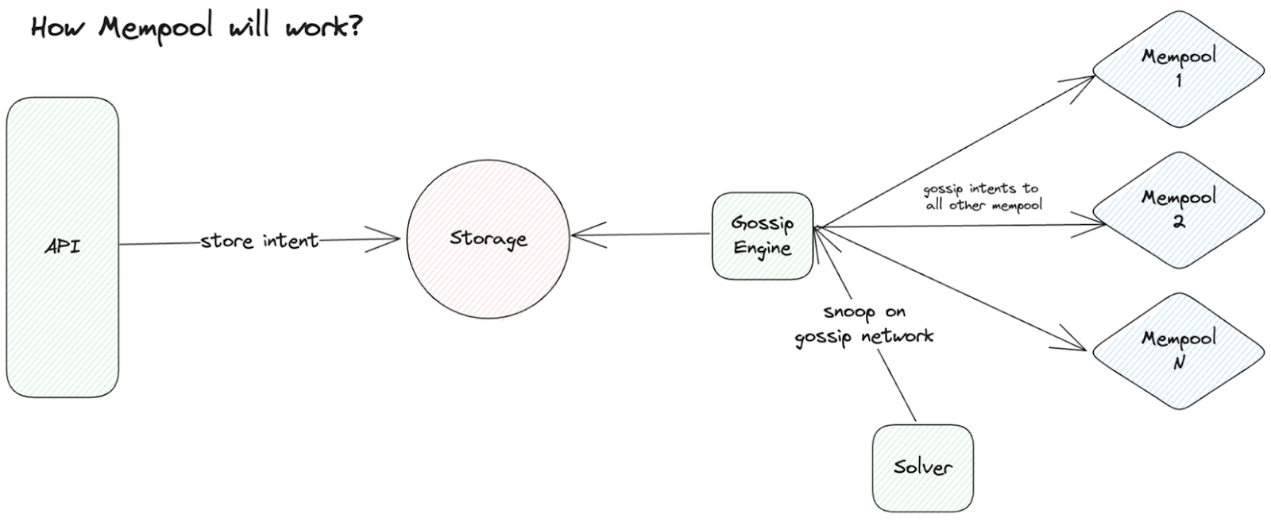

Challenges of Mempool Decentralization

Open vs. closed mempools across chains: Open mempools allow any solver to access and process intents, which increases transparency, but also brings risks such as front-running. On the other hand, closed mempools provide greater security, but at the cost of decentralization. The challenge is to balance openness and security, ensuring that intents are processed fairly and efficiently on different blockchains. Everyone can see what is happening, but there is a risk that someone may try to use your idea before you. Closed mempools are similar to private messaging - more secure but less transparent.

Source: Ethresearch

How does Ethereum solve the intention problem?

This section focuses on a specific case study: ERC-4337, a new standard on the Ethereum chain that changes the way user accounts and intents are handled. It aims to provide users with greater flexibility and security by enabling smart contract wallets to perform complex operations independently.

ERC-4337 Overview

ERC-4337 introduces an account abstraction system in Ethereum, which aims to make smart contract wallets (SCW) more independent and powerful. This new standard enables users to perform complex operations through wallets without relying on externally owned accounts (EOA), solving a major limitation in the current Ethereum setup.

Key Features:

UserOps : ERC-4337 uses UserOps instead of traditional transactions. These are user-signed operations that detail the desired action. Multiple UserOps are collected into another memory pool and bundled together by specialized entities called bundlers. These bundles are then processed as a single transaction, which increases efficiency.

Censorship resistance : ERC-4337 is built to be as decentralized as possible. It is open to permissionless participation to ensure that UserOps cannot be censored or manipulated by any single entity. If all packagers refuse to process UserOps, the permissionless nature of the system will encourage new packagers to enter the network and reap potential profits, making the system vulnerable.

Safety measures : To prevent abuse and attacks, ERC-4337 enforces several rules:

- Gas usage limit: By limiting the Gas that can be used during the UserOp verification phase, the packager can be protected from denial of service attacks.

- Validation rules: To prevent operations from being unfairly invalidated, ERC-4337 separates the validation phase from the execution phase, ensuring that validated operations remain valid as long as the account state has not changed.

- Reputation system: Packagers also use a reputation system to manage entities that require relaxed verification rules, ensuring that these entities cannot easily subvert the network.

Importance of Unified Memory Pool

ERC-4337 emphasizes the need for a unified mempool, where all packagers follow the same rules. This uniformity prevents mempool fragmentation, where different rules can result in smaller, more isolated mempools that are more vulnerable to censorship and attacks. A consistent set of rules across all packagers ensures a stronger and more resilient network, just as multiple Ethereum clients follow the same protocol rules.

Challenges and Solutions

- Fragmentation risk: If different packers apply different rules, the network may fragment, resulting in smaller and less secure memory pools. ERC-4337 solves this problem by establishing a comprehensive test suite and reference implementation to ensure that all packers are compatible and run safely.

- Security Exceptions: While ERC-4337 sets strict rules, exceptions are allowed in certain circumstances. Packagers can participate in alternative memory pools with different rules if they maintain security and compatibility with the main network. This flexibility allows for innovation while maintaining the overall security and integrity of the system.

Intent on a decentralized future

The future of decentralization lies in overcoming the challenges posed by the current limitations of blockchain infrastructure and the broader ecosystem. As intentions shift from traditional transaction-based systems to more declarative user-centric models, there is great potential to improve user experience, reduce inefficiencies, and enhance privacy.

Key focus areas:

- Cross-chain interoperability: Future developments must enable intent to operate seamlessly across multiple blockchains, leveraging the strengths of each while maintaining user control and custody of assets.

- Decentralized Infrastructure: The design of intent pools, whether permissioned or permissionless, will play a key role. A decentralized approach that allows open access while ensuring security and trust will be critical to scaling intent-based applications.

- Reduce centralization risk: As adoption grows, especially for standards like ERC-4337, there is a risk of centralization if execution is dominated by a few entities. The ecosystem must foster competition and innovation to prevent monopoly and ensure fair execution.

challenge:

- Trust and transparency: Developers must carefully balance the needs for privacy and security with transparency, ensuring that users can trust the system to process their intentions without sacrificing the core principles of decentralization.

- Research and Innovation: The field is still nascent, and continued research is critical to address the complexity of expressing, executing, and integrating intent across different domains. Emerging projects like Anoma, SUAVE, Portikus, and others are laying the foundation, but there is still much work to be done.

- While there are challenges, decentralization of intent will make the blockchain space more accessible, more secure, and more user-friendly — ultimately making it easy for everyone to fulfill their digital aspirations.

Related reading: Open Intents: Can ERC-7683 become the “Walmart” supermarket for inter-chain intention collaboration in Ethereum?

You May Also Like

SBI VC Trade Adds Litecoin to Japanese Lending Program

Work Dogs TGE Is Running — Is WD About to Drop in Q2 After March 30?