Ethereum Sheds $6.4B in Leverage as Whales Buy Big

As the market clears with open interest losses of 6.4B, institutional investors continue to buy ETH. Structural strength is indicated by DeFi dominance and whale activity.

Ether has an acute leverage reset. Open interest fell across boards as values fell between $4,830 and $2,800. But institutional buyers continue to add ETH.

The disconnection indicates a divided market. Retail traders leave leveraged positions. Deep-pocketed entities amass during the downfall.

DeFi Empire Remains Untouched Despite Price Carnage

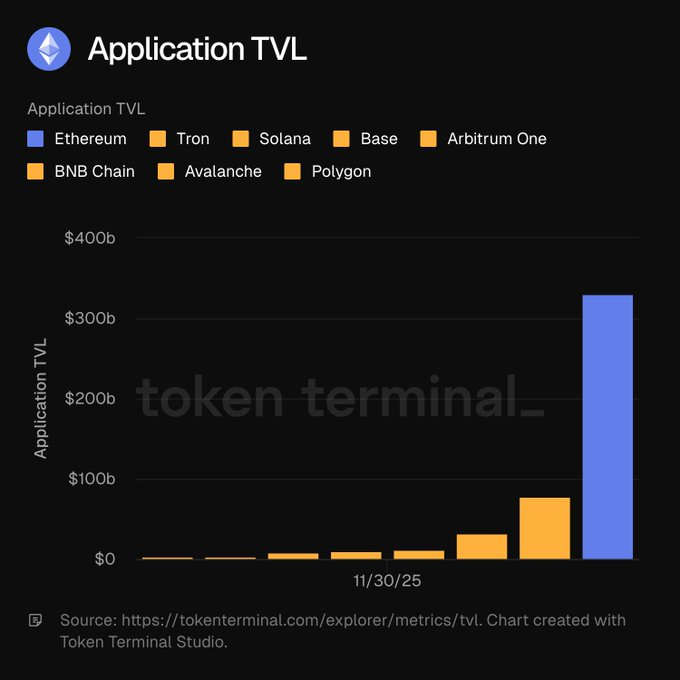

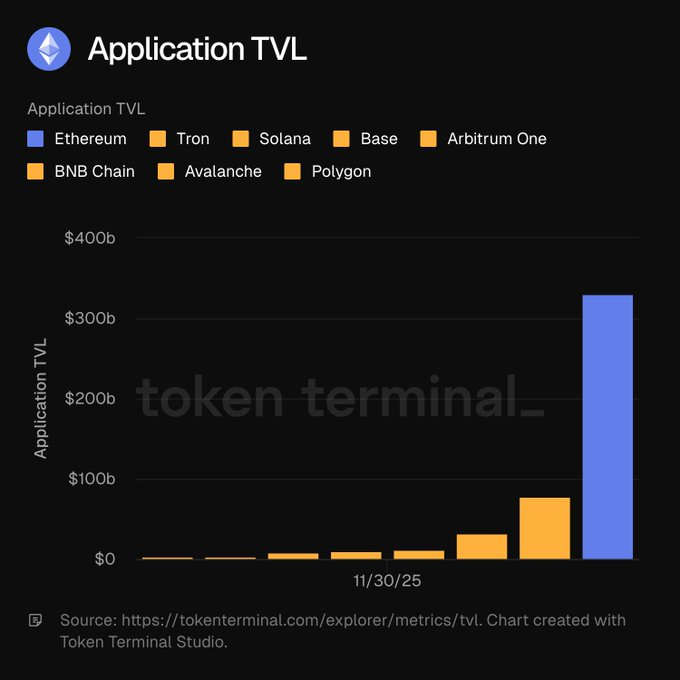

Ether controls the most precious infrastructure in crypto. As per Token Terminal on X, there is more than 330 billion in user deposits on Ethereum applications. Nothing can compare to this number with other competing chains.

Source: Terminal on X

The same is the case with the stablecoin dominance. According to Token Terminal, the market cap of Ethereum stablecoins is over 180 billion. TRON and Solana are a long way behind.

Ethereum is also a tokenized real-world assets leader. The network tokenized funds have a market cap of over $15 billion. Even tokenized stocks are valued at over 140 million on Ethereum alone.

This liquidity base holds significant protocols pegged to ETH. Straight lending markets and DEX volume keep running over Ethereum rails. There is no migration indicated in the infrastructure layer.

You might also like: Ethereum News: Vitalik Says: Build on Ethereum L1 in 2025

Bitmine Scoops Another $19.8M in ETH

The investment firm of Tom Lee took a bold step. Bitmine bought 7,080 ETH priced at around 19.8 million dollars, as Lookonchain tweeted on X. The purchase occurred two hours prior to the posting.

Source – Lookonchain X

This is the other round of accumulation for the firm. This is timed when ETH is trading around multi-month lows. The institutional confidence does not seem to be deterred by short-run price weakness.

Past examination indicated that ETH is structurally undervalued. Ten of twelve measures of valuation placed fair value far above current prices. Composite fair value estimates were also close to 4,800, even in the stress market conditions.

The whale’s behavior is an indicator of long-term positioning. Smart money is still using Ethereum as core infrastructure. Price volatility opens doors, and not gravity.

You might also like: Ethereum News: Ethereum Whale Wakes: $120M Staked After 10 Years

Leverage Flush Wipes Out Billions in Positions

The derivatives market underwent a savage reset. Open interest on Binance dropped 51% what it had been during August. Positions dropped to $12.6 billion to $6.2 billion.

The same decrease was observed in Gate.io. In recent months, open interest fell to $3.5 billion, as compared to $5.2 billion high. Bybit experienced the worst decline, with its value dropping to 2.3 billion at a time when it was worth 6.1 billion.

The overall washout was over 6.4 billion lost positions. This unwinding, combined with a price fall of ETH by a margin of 43 percent since the peak. The overheated leverage cycle ultimately collapsed.

The post Ethereum Sheds $6.4B in Leverage as Whales Buy Big appeared first on Live Bitcoin News.

You May Also Like

CME Group to launch options on XRP and SOL futures

Sharplink’s ETH Stack Nears 870K as Institutions Claim 46% Stake