Crypto AI Market Sentiment Survey: The Community is Clearly Divided, with Early Users Having the Most Bullish Sentiment

Original article by Yuqian Lim, Coingecko

Compiled by: Zen, PANews

The combination of cryptocurrency and AI is seen as an important direction to promote industry innovation, but against the backdrop of continued sluggish market conditions and cooling enthusiasm for AI, market sentiment is showing a clear differentiation.

Recently, Coingecko conducted a survey of 2,632 crypto market participants, and the results showed that nearly half of the respondents were bullish on crypto AI products and token prices in 2025, while about a quarter of the respondents were pessimistic.

Nearly 30% of respondents are on the sidelines, while 1/4 are firmly bullish

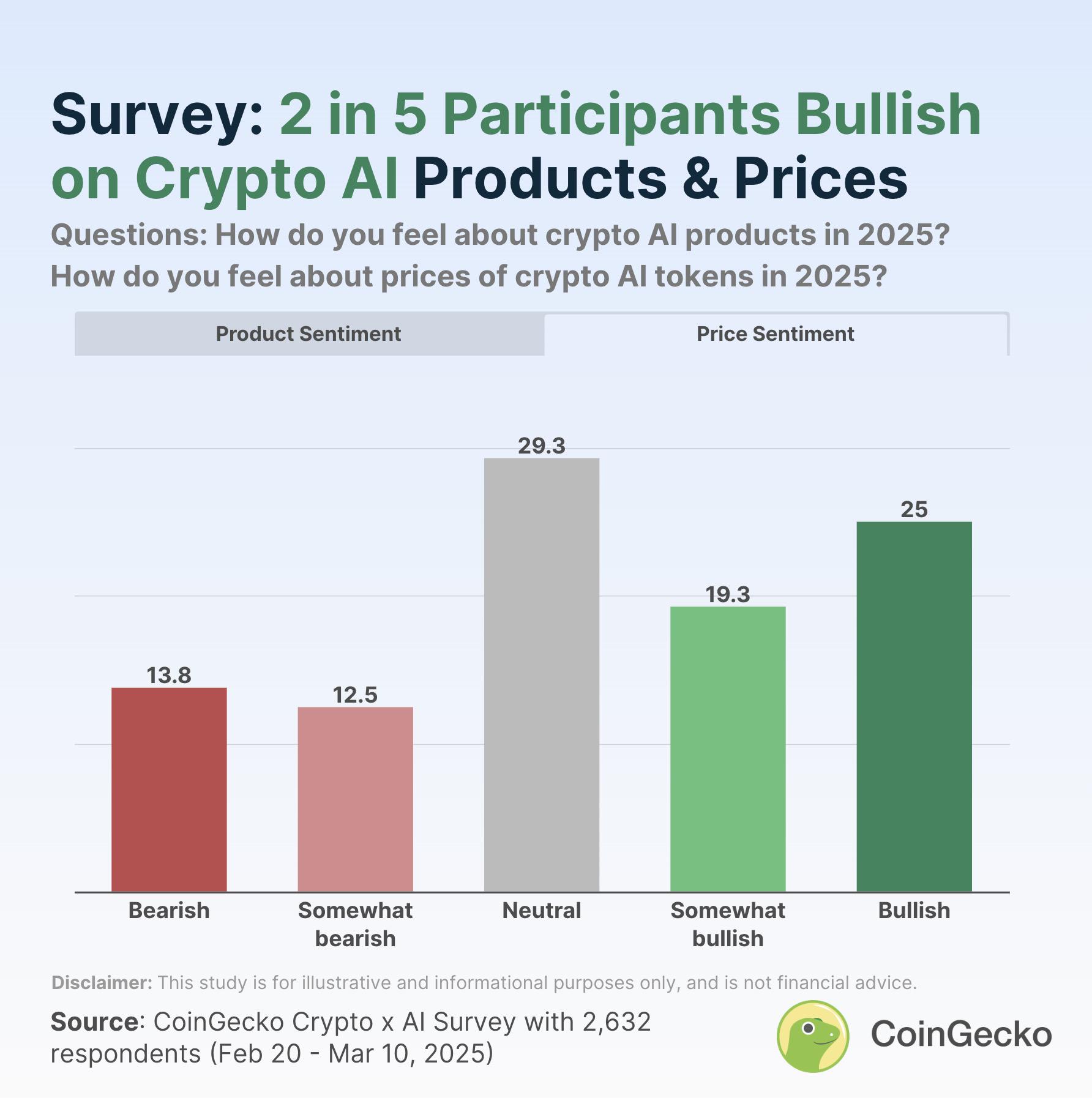

In a recent survey conducted by Coingecko, 46.9% of crypto users said they were bullish on crypto AI products in 2025. Of these, 19.9% of respondents said they were “somewhat bullish” and 27.0% were “completely bullish.” As the application scenarios combining crypto and AI continue to improve and gain wider adoption, market sentiment has shown some signs of recovery.

At the same time, 24.1% of crypto users are "somewhat bearish" or "completely bearish" on crypto AI products in 2025. In other words, about a quarter of the respondents are still cautious or skeptical about crypto AI technology and its application prospects, at least in the short term.

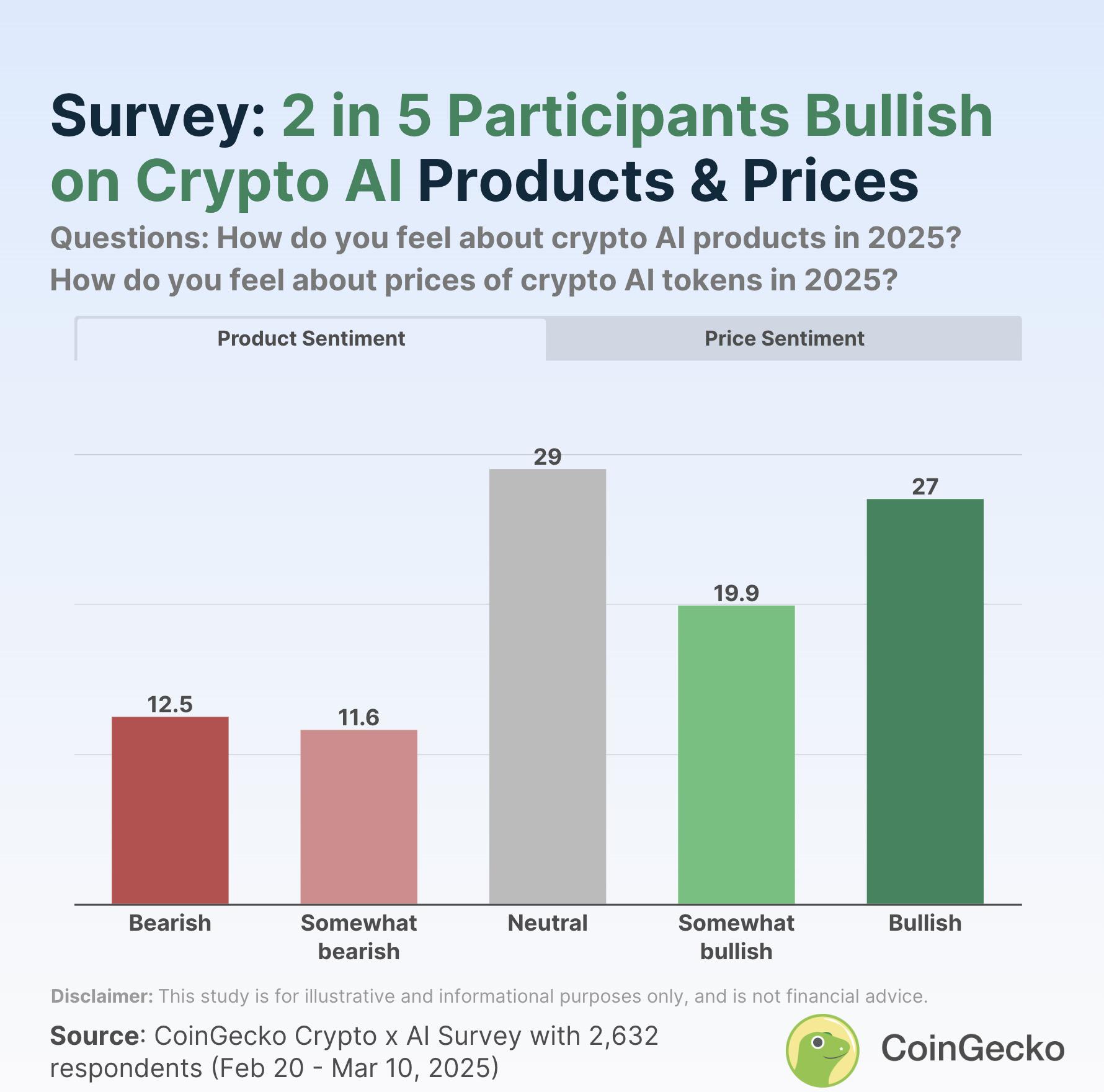

The crypto community has a similar attitude towards the price of crypto AI tokens. 44.3% of respondents are bullish and 26.4% are bearish. This may indicate that the market has not yet clearly distinguished the investment value, trading potential and technological development of crypto AI. This market sentiment reflects the market's expectation that crypto AI should move from the conceptual stage to maturity.

Nearly one-third of the respondents are neutral about the price of crypto AI products and tokens in 2025, accounting for 29.0% and 29.3% respectively. In fact, among all the options, "neutral" is the most selected by the respondents, while the proportions of "bearish", "somewhat bearish", "somewhat bullish" and "bullish" are lower. This shows that a considerable number of respondents have not yet formed a clear opinion on the crypto AI narrative, or are still waiting and watching.

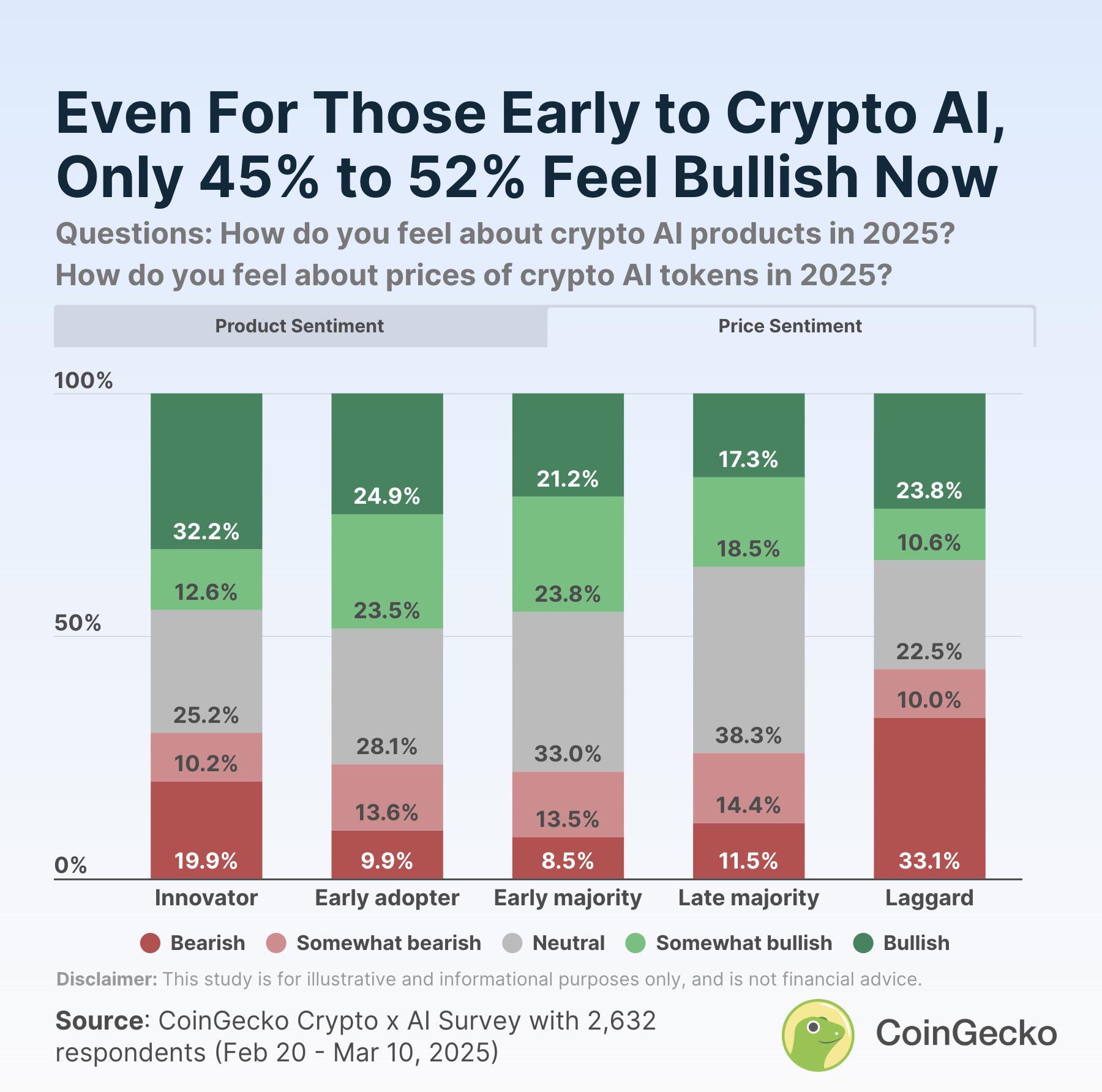

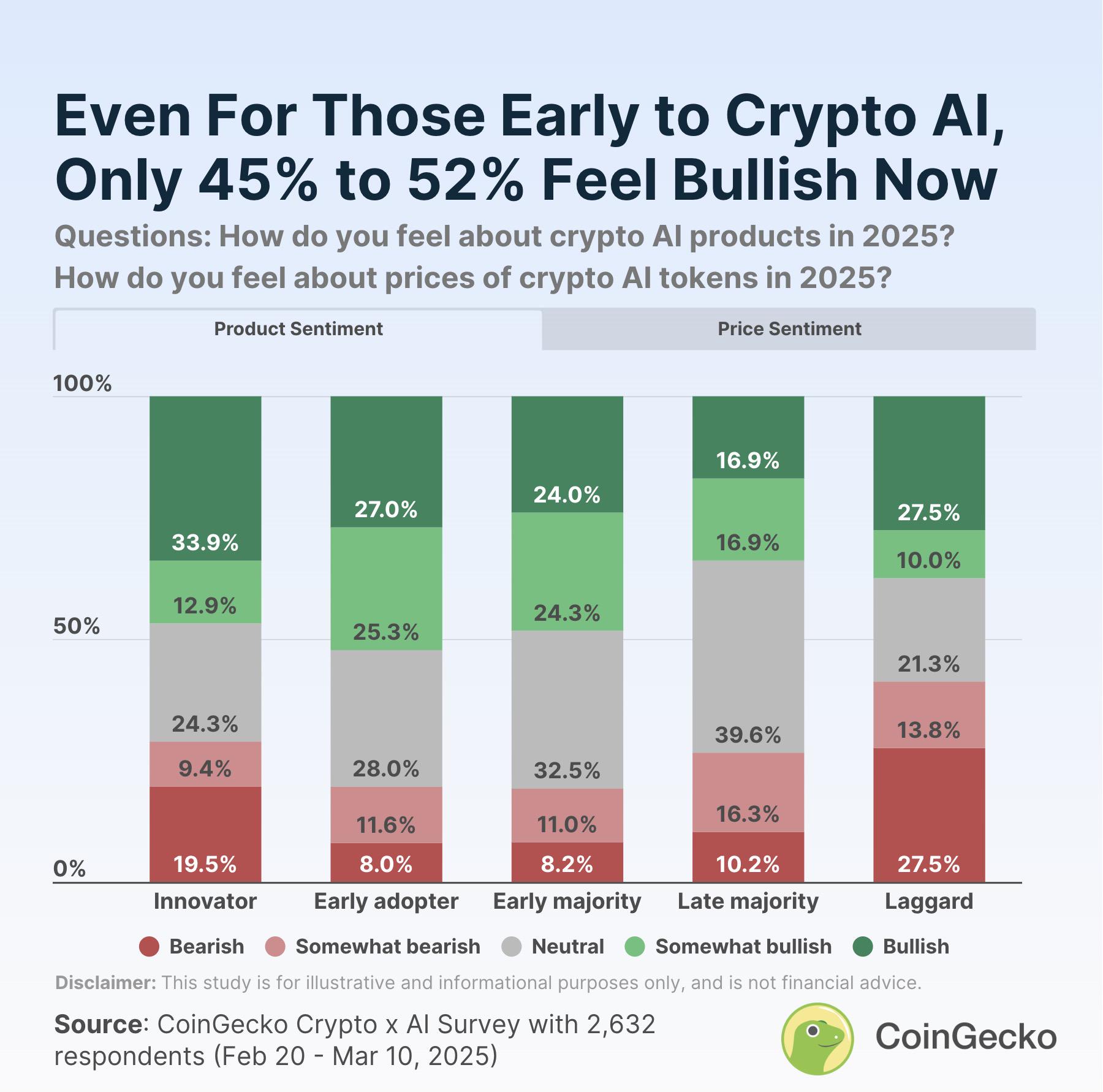

Early innovators and adopters are only 45% to 52% bullish

Among the group of “innovators” who call themselves driving the adoption of crypto AI, 46.8% of respondents are bullish on crypto AI products, while 28.9% are bearish. Similarly, only 44.8% of “innovators” are bullish on crypto AI token prices, while 30.0% are bearish.

“Innovators” are usually the first group to pay attention to the crypto AI narrative. However, in this survey, their bullish proportion on the field is relatively low, while the bearish proportion is higher, indicating that even early adopters remain cautious about the prospects of crypto AI.

In contrast, the sentiment distribution of the "early adopters", "early majority", "late majority" and "laggards" groups is more in line with market expectations. Among them, "early adopters" and "early majority" have the highest bullish sentiment towards crypto AI products and token prices, while the lowest bearish sentiment.

The “late majority” group is the most conservative about crypto AI products, with only 33.9% holding a positive attitude. The “laggards” group is the most pessimistic group overall, with 41.3% bearish on crypto AI products and 43.1% bearish on token prices. It is worth noting that the “laggards” group has the lowest proportion of neutral attitudes, indicating that although they paid attention to crypto AI later, their views are the most firm.

Methodology

This survey counted and analyzed responses from 2,632 crypto market participants in the Coingecko Anonymous Crypto x AI Survey, which was conducted from February 20 to March 10, 2025. The survey results are for reference only.

Among the respondents:

- 51% consider themselves to be long-term crypto investors;

- 26% consider themselves to be crypto traders who mainly trade on a short-term basis;

- 10% consider themselves builders in the field of crypto AI;

- 13% consider themselves to be bystanders who are on the sidelines.

Regarding respondents’ crypto experience:

- 53% are in their first crypto cycle (0-3 years in the industry);

- 34% are in their second crypto cycle (4-7 years in the industry);

- The remaining respondents were senior investors (8 years and above).

In terms of geographical distribution, 93% of respondents were from Europe, Asia, North America and Africa, with the remainder from Oceania or South America.

Note: This research is for reference only and does not constitute financial advice. Please do sufficient research and make careful decisions before investing in any crypto assets or financial assets.

You May Also Like

The Channel Factories We’ve Been Waiting For

Markets await Fed’s first 2025 cut, experts bet “this bull market is not even close to over”