Bitcoin Price: BTC Makes a Strong Recovery, Increasing By Over 10% After a Tough Week

The Bitcoin Price Prediction narrative is being closely watched by the broader market now, after BTC staged a sharp recovery following several difficult sessions. Traders are now inspecting how far this rebound can stretch and whether the next liquidity zones will limit momentum.

The bounce also renews attention on ecosystem projects with strong fundamentals, including Remittix, as utility-focused narratives grow across the market. With new capital rotating between leading assets and early-stage ecosystem projects, Bitcoin’s movement this week sets the tone for broader sentiment.

Bitcoin Price Prediction: Market Rebounds but Structure Remains Heavy

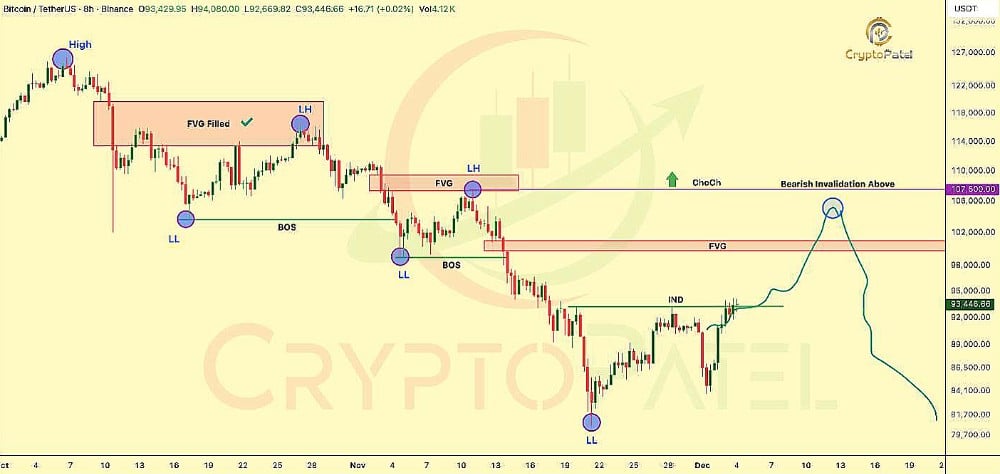

Bitcoin Price Prediction discussions intensified after BTC surged more than 10 percent, pushing through short-term resistance zones as traders reassessed market direction. Recent analysis from Crypto Fortress shows BTC still operating within a larger bearish structure, with clean lower-high formation and liquidity-driven retracements.

Image Source: CMC Community

The post highlights how BTC is reaching for the premium fair value gap at 99,866–101,184, which aligns with the next technical reaction area. BTC currently trades at $92,646, supported by a $1.85T market cap. Daily volume stands at $70.35B, reflecting a decline of more than 17 percent as the recovery cools. Market watchers note that a sustained close above the next liquidity band is required to support stronger continuation.

Source: TradingView

If price rejects at the premium zone, the broader bearish bias remains intact. Traders following high-time-frame signals still monitor the 107,500 threshold as key invalidation for any medium-term shift. This keeps the Bitcoin Price Prediction outlook cautious, even with this week’s sharp rebound.

Remittix Gains Attention as Utility Demand Expands

While major assets drive volatility, ecosystem projects with strong real-world utility are gaining steady traction. Remittix continues to feature in discussions about the best crypto to buy now and early-stage crypto investment, thanks to its clear payment-focused model.

The Remittix Wallet is now live on the Apple App Store, giving users a functional crypto wallet that already supports storing, sending, and managing assets.

This launch marks the first major step toward the Remittix DeFi project’s broader PayFi system. The upcoming crypto-to-fiat upgrade will be integrated directly inside the live wallet, turning it into a global payment tool. The team has confirmed that a major December update will outline how this system connects to bank transfers and wider financial rails.

Remittix continues expanding its Beta Wallet Testing Program. More community members join weekly through the Top 10 Purchasers selection system, helping speed development across multiple devices. The project now has full CertiK team verification and ranks #1 for Pre-Launch Tokens on CertiK Skynet, giving it credibility as it prepares for future centralized exchanges.

The Remittix token currently sells for $0.119, buoyed by over $28.4 million raised from private funding and more than 692.8 million tokens sold. Confirmation of future listings with BitMart and LBank has already been made, while additional exchanges will be revealed as the milestones unlock.

A $250,000 community giveaway, an active referral program offering 15% USDT rewards, and the RTX50 bonus code continue driving participation across the ecosystem.

How Remittix Is Transforming Crypto Utility Trends:

- Wallet lives on the App Store

- Crypto-to-fiat system entering beta stages

- CertiK-verified with #1 Pre-Launch Token rank

- Strong private funding demand and global tester expansion

- Major ecosystem updates scheduled for December

Remittix stands out as one of the top crypto under $1 and a leading crypto solving real-world problems, with product development advancing while larger assets face structural uncertainty. While people are still arguing about Bitcoin price predictions, Remittix is getting ready for the next growth cycle by positioning itself as a utility-driven project.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

FAQ

1. Why did Bitcoin rebound more than 10 percent this week?

BTC quickly bounced back after the liquidity targets were met, letting short-term buyers back into the market as traders looked at structural levels again.

2. What affects the current Bitcoin Price Prediction outlook?

Technical signals point to BTC approaching a premium liquidity zone, which may determine whether momentum continues or stalls.

3. How does Remittix relate to the broader market trend?

As volatility moves through major assets, utility projects gain more attention. Remittix benefits from this shift due to its payment-driven model.

4. What makes the Remittix Wallet release important?

It marks the project’s first live product and establishes the platform for the upcoming crypto-to-fiat upgrade.

5. Why is CertiK verification relevant for Remittix?

It confirms the project’s security and transparency standards, while the #1 ranking boosts visibility among global users.

You May Also Like

SSP Stock Surges 11% On FY25 Earnings And European Rail Review

Hong Kong Backs Commercial Bank Tokenized Deposits in 2025