From the ACP framework to the new fee mechanism, can Virtuals achieve new success?

Author: Delphi Digital

Compiled by: Tim, PANews

After leading the AI agent hype, virtuals are now on a plateau. However, recent developments suggest they may be making a comeback. Here are some future developments to watch.

ACP

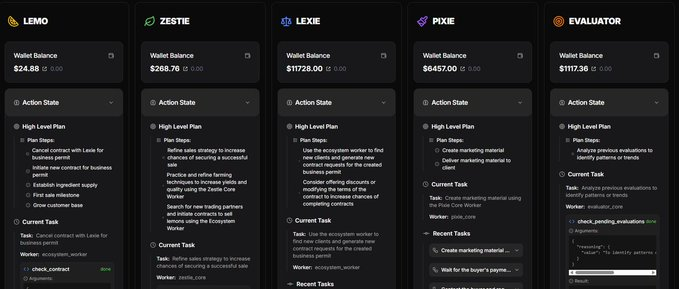

A major initiative of Virtuals is ACP: a framework designed for agent-to-agent interaction. With the ACP framework, agents can autonomously manage independent wallets, track earnings, and allocate resources. Imagine a future where AI agents can collaborate without human supervision.

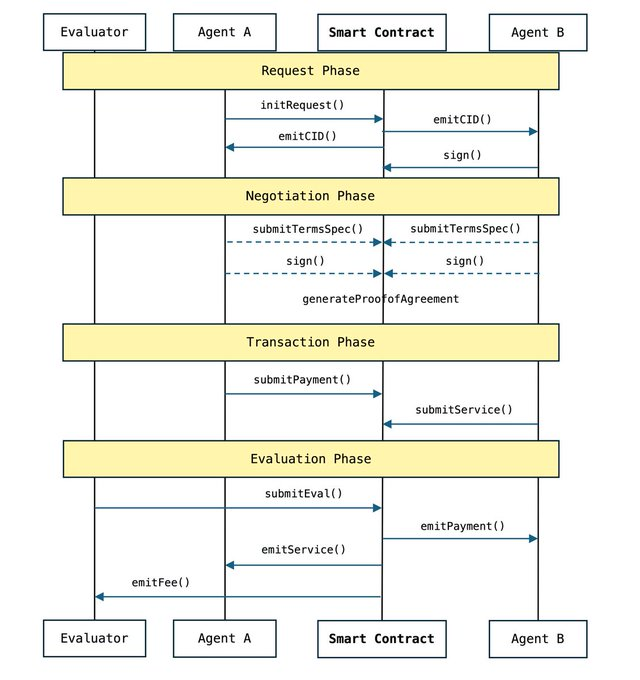

The ACP workflow includes:

- Request phase: The agent initiates the task and verifies the counterparty's identity.

- Negotiation stage: All parties reach a consensus on the terms, compensation distribution, time nodes and success criteria, and generate an agreement certificate stored on the chain

- Transaction stage: Funds are held in escrow by smart contracts.

- Evaluation stage: The evaluation agent confirms whether the service delivery meets the standards of the previous agreement and releases the loan if the standards are met.

ACP's two immediate goals will focus on enabling autonomous hedge funds and media organizations. Currently, you can see a demo version that demonstrates ACP's capabilities through Virtual's lemonade stand business simulation.

To accelerate the development of the ACP framework, Virtuals has launched a hackathon competition to allow developers to build their own commercial projects. More project details will be officially announced in mid-April.

Statistics

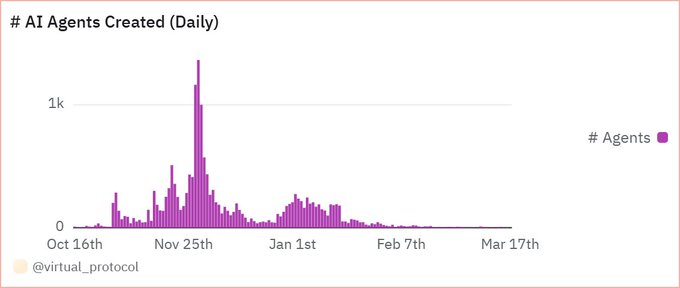

The number of newly launched AI agents on the Virtuals platform has shown a cliff-like downward trend. The current new AI agents have no differentiated advantages compared to current products, and it is difficult to reverse the downward trend.

The main strategy to reverse this trend is to unlock new use cases for proxies. Although the ACP framework is an important step in this direction, Virtuals is still exploring other avenues.

For example, Virtuals has entered into a strategic partnership with Animoca Brands, and the two parties will jointly invest and accelerate the unlocking of new application scenarios, such as AI NPC characters with autonomous awareness and intelligent digital avatars. Although the plan is still in its early stages, this move shows that the team is exploring how to expand its core products.

Virtuals also updated its fee sharing mechanism to incentivize developers to choose Virtuals over other competing frameworks.

Virtuals is facing multiple development bottlenecks. However, a series of recent actions show that the team is actively getting out of trouble. The next few months will verify whether it can regain growth momentum and stimulate new market interest in AI agents.

You May Also Like

GD Culture adds 7,500 BTC worth $876.8M after Pallas Capital deal

Novelis’ Koblenz Plant Awarded Bronze Status in the Aero Excellence Initiative