Bitmine Acquires $199M ETH as Top Traders Short ETH—What You Need to Know

Institutional Ethereum Purchases Signal Confidence Amid Market Slowdown

Despite a recent decline in overall corporate Ethereum acquisitions, BitMine Immersion Technologies, the world’s largest institutional holder of Ether, continues to expand its holdings aggressively. The company’s latest purchases highlight a firm conviction in Ethereum’s long-term prospects, even as broader market activity remains subdued.

Key Takeaways

- BitMine acquired approximately $199 million worth of Ether over two days, bringing its total holdings close to 3.08% of the circulating supply.

- The company’s current Ether holdings amount to around $11.3 billion, inching towards its 5% accumulation target.

- While overall digital asset treasury activity has slowed significantly, BitMine has maintained a dominant position, acquiring over 679,000 Ether last month.

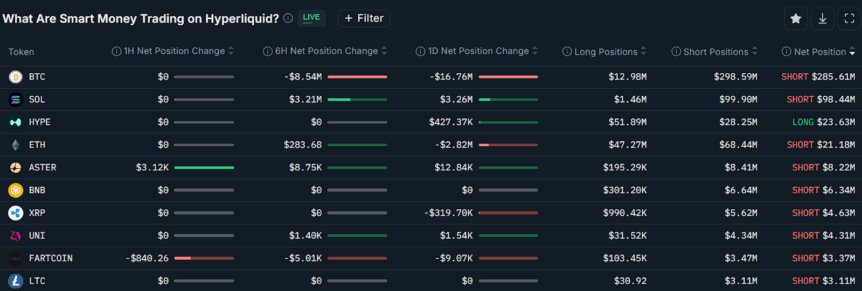

- Contrasting the bullish accumulation trend, short-term traders, identified as “smart money,” are betting on a decline in Ether’s price, reflecting potential market hesitations.

Tickers mentioned: Ether

Sentiment: Cautiously bullish long-term, with short-term bearish sentiment among traders

Price impact: Negative, as trader activity indicates short-term downward pressure despite large institutional holdings

Trading idea (Not Financial Advice): Hold, given the divergence between institutional accumulation and short-term trader sentiment

Market context: The broader crypto market faces a period of consolidation, with institutional buying contrasting with declining ETF flows and trader short positions

Continued Accumulation Amid Market Uncertainty

BitMine Immersion Technologies has escalated its Ethereum holdings despite the industry’s overall slowdown. Blockchain data from Lookonchain indicates the company purchased an additional $68 million worth on Saturday and another $130.7 million on Friday. These acquisitions bring BitMine’s total to approximately $11.3 billion, representing 3.08% of the total Ether supply, according to data from StrategicEthReserve. The firm’s substantial cash reserves, estimated at $882 million, could facilitate further accumulation opportunities.

Largest corporate Ether holders. Source: Strategicethreserve.xyzThe aggressive accumulation by institutional players occurs amid a sharp slowdown in digital asset treasury activity. Data shows Ethereum acquisitions have plummeted 81% over three months—from 1.97 million Ether in August to only 370,000 Ether in November. Nonetheless, BitMine acquired a significant 679,000 Ether in the past month alone, worth approximately $2.13 billion.

Meanwhile, market sentiment among sophisticated traders appears bearish in the short term. According to Nansen’s blockchain intelligence platform, some of the industry’s top-performing traders have added $2.8 million in short positions on Ether in the past 24 hours, bringing the overall short position to $21 million.

Smart money traders top perpetual futures positions on Hyperliquid. Source: Nansen

Smart money traders top perpetual futures positions on Hyperliquid. Source: Nansen

Adding to the cautious outlook, Ethereum exchange-traded fund (ETF) flows continue to reflect tepid demand. Data shows that spot ETH ETFs recorded nearly $75 million in net outflows on Friday, with monthly outflows reaching $1.4 billion in November, as per Farside Investors. This indicates a lack of immediate institutional interest despite large holdings, underscoring a nuanced market dynamic where long-term accumulation contrasts with short-term trader sentiment.

This article was originally published as Bitmine Acquires $199M ETH as Top Traders Short ETH—What You Need to Know on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

XRP Potential Double Bottom Strengthens Amid Ripple’s 250M Transfer

CME Group to Launch Solana and XRP Futures Options