BisonFi Debuts on Solana as Forward Industries Expands Digital Asset Infrastructure

- BisonFi strengthens Solana’s institutional liquidity stack alongside Forward Industries’ SOL treasury, validators, and staking products.

- Base’s Chainlink bridge and x402 payments growth show rising real-world and machine-to-machine demand on Solana.

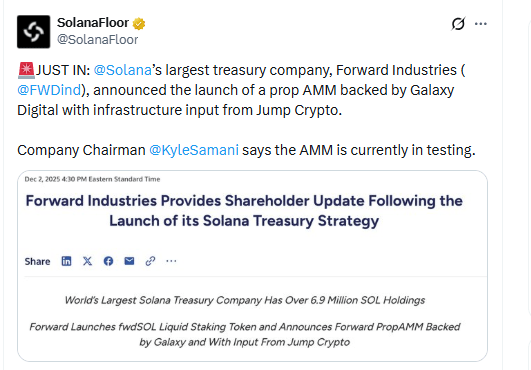

Forward Industries launches BisonFi — a proprietary automated market maker (AMM) built for the Solana blockchain. The firm behind it, Forward Industries, confirmed the launch via its chairman. BisonFi targets institutional-grade traders. It enables them to run custom trading strategies using the company’s own capital, marking a shift from consumer-oriented decentralized exchanges to a more tailored, institutional infrastructure.

Forward Industries Solana AMM Launch. Source: SolanaFloor

Forward Industries Solana AMM Launch. Source: SolanaFloor

The rollout of BisonFi follows a series of aggressive moves by Forward Industries: the company recently amassed over 6.9 million SOL tokens, invested nearly all of them into validator infrastructure, and launched staking and liquid-staking offerings.

The initiative positions Forward Industries not simply as a treasury holder but as a builder of core infrastructure for Solana — combining treasury management, staking, and now market-making on-chain.

Solana Draws More Users as Base Bridge and x402 Payments Grow

Meanwhile, Base has turned on a new bridge to Solana that uses Chainlink’s Cross-Chain Interoperability Protocol, as summarized in our earlier news story, letting users move SOL and other Solana tokens directly to the Ethereum layer-2 network. The system relies on independent validators run by Chainlink and Base, which monitor messages between the chains and help reduce the risk of tampering. As a result, developers can now plug Solana assets into apps on Base more easily, while Solana users gain another route to reach Ethereum-style DeFi.

Moreover, Solana has seen a major jump in real-world usage after its x402 payment protocol surpassed $600,000 in daily transactions, as highlighted in our previous article. The surge reflects rising demand from developers and AI agents using x402 for micropayments and automated services.

As a result, Solana now leads other networks in x402 volume, underscoring its suitability for fast and low-cost machine-to-machine payments.

]]>You May Also Like

‘Huge’ investor demand for apartment buildings

Trump has 'collapsed' with 'core voters' on 3 key issues